- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Target (NYSE:TGT) Expands Floral Lineup With Launch Of Good Little Garden From US$6

Reviewed by Simply Wall St

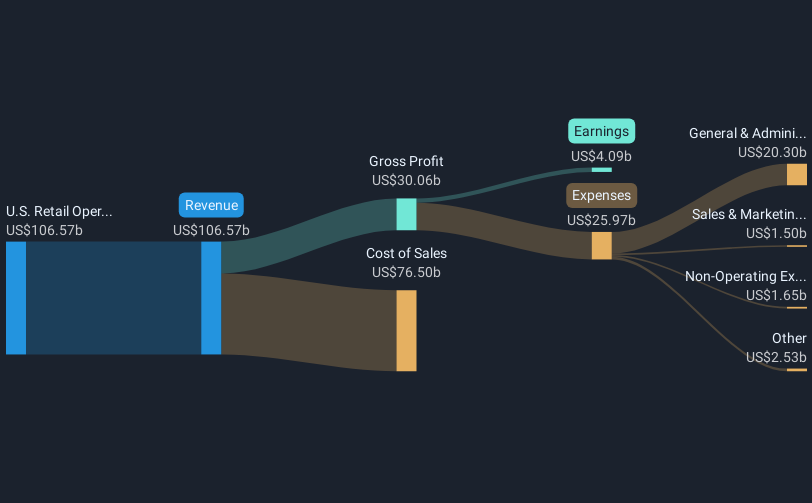

Target (NYSE:TGT) recently launched "Good Little Garden," a standalone floral brand, expanding its offerings with over 60 floral and plant options. This expansion positions Target as a comprehensive floral destination. However, the broader market saw a 1.1% decline last week amid tariff concerns and economic instability fears. Target's 1.6% price decline aligns with the market trend. The launch of new products likely added some positive sentiment to its stock but did not significantly counteract the broader market downturn. The ongoing trade uncertainties and economic concerns appeared to overshadow the company's latest product introduction.

Every company has risks, and we've spotted 2 possible red flags for Target you should know about.

The introduction of "Good Little Garden" by Target has the potential to enhance the company's product diversity and attract a broader customer base, which could be reflected in future revenue growth. While the immediate positive sentiment from this launch didn't fully counteract the broader market decline, the expansion could contribute positively to the company's long-term strategy of enhancing customer experiences and expanding digital marketplaces. However, Target's shares have experienced a gradual decline in total returns over the past five years, with a 4.60% decline, indicating challenges in maintaining momentum compared to market dynamics.

Over the past year, Target's underperformance relative to the US Consumer Retailing industry, which returned 33.7%, highlights the pressures the company faces amidst economic uncertainty and discretionary spending volatility. Although the recent floral brand launch may not yet significantly alter revenue or earnings projections, it aligns with the company's broader initiative to grow by $15 billion in five years through various enhancements. The current share price of US$90.46, when juxtaposed with the analyst price target of around US$129.94, portrays a potential upside of over 30%, suggesting room for future growth as market conditions stabilize and strategic initiatives bear fruit.

Assess Target's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Target, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives