- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

Sysco (SYY) Valuation in Focus as West Coast Worker Strike Threatens Supply Chain Stability

Reviewed by Kshitija Bhandaru

Sysco (SYY) finds itself in the spotlight as nearly 800 West Coast workers have authorized strikes in San Francisco and Portland, pushing for improved pay, benefits, and working conditions. With labor negotiations underway, investors are closely watching for potential supply chain and operational effects. These developments could influence Sysco’s near-term outlook.

See our latest analysis for Sysco.

This labor standoff lands just as Sysco’s 1-year total shareholder return reaches 8.3%, a reflection of the company’s solid long-term progress. Even as short-term price momentum has lost steam, recent operational changes and industry growth drivers are in play. The stock’s story remains one of resilience and measured optimism rather than runaway momentum.

If you’re weighing fresh opportunities while labor news shakes up the sector, it might be the perfect time to discover fast growing stocks with high insider ownership

With looming labor unrest and steady but unspectacular returns, is Sysco flying under the radar as a value buy, or is the market already factoring in the company’s long-term growth?

Most Popular Narrative: 8.4% Undervalued

At a last close price of $78.45 versus a fair value estimate of $85.6, the narrative paints Sysco as modestly undervalued. This perspective focuses on catalysts like new market entries and improved workforce productivity that could drive future growth.

Sysco is focused on improving its sales consultant workforce, with new hires becoming more productive and a strategic shift in compensation model. This approach is expected to enhance revenue and earnings starting in fiscal 2026.

Curious what’s fueling analyst optimism? The real secret behind this price target lies in bold projections around earnings growth and profit margins. Unlock the narrative to see which financial levers could make all the difference.

Result: Fair Value of $85.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, wild swings in consumer confidence and adverse weather could quickly dampen Sysco’s growth outlook. These factors serve as key risks to this optimistic view.

Find out about the key risks to this Sysco narrative.

Another View: What Do Profit Multiples Say?

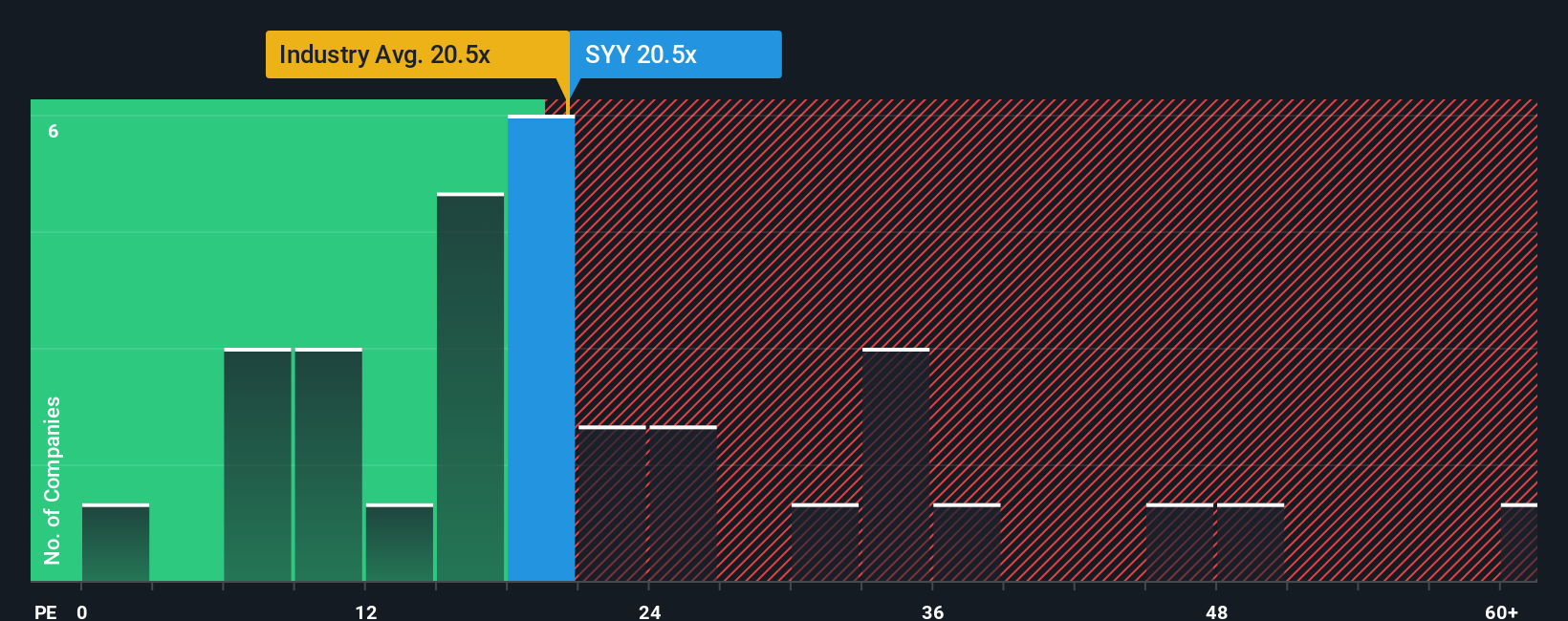

Looking from another angle, Sysco’s price-to-earnings ratio sits at 20.5x, nearly matching the industry average and well below the peer average of 31.8x. Interestingly, this is also below its fair ratio of 22.6x, hinting at possible value. However, what happens if the market starts to shift its expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sysco Narrative

If you see things differently or want to dig deeper, try building your own story from the numbers in just a couple of minutes. Do it your way

A great starting point for your Sysco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Break out of the ordinary and spot opportunities others might miss. Act now to uncover unique stocks powering tomorrow’s growth before anyone else catches on.

- Tap into innovative healthcare breakthroughs and see which companies are leading the charge with these 33 healthcare AI stocks.

- Uncover strong cash flow potential by browsing these 893 undervalued stocks based on cash flows as market conditions shift and set to outperform.

- Maximize income from your portfolio with these 19 dividend stocks with yields > 3% which offers reliable yields above 3% for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives