- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

Sysco (SYY) Expands Houston Presence With New 'Sysco To Go' Retail Store

Reviewed by Simply Wall St

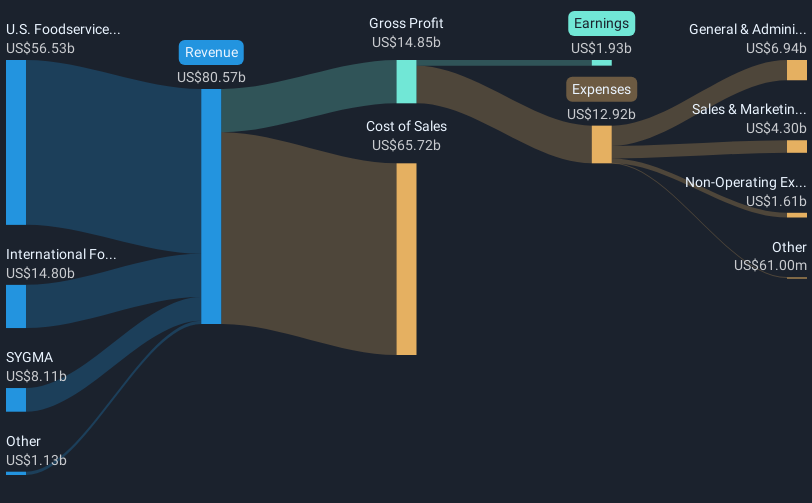

Sysco (SYY) recently celebrated the grand opening of its second Sysco To Go retail store in Houston, enhancing its presence in key markets and likely contributing to its 10% share price increase over the last quarter. The company's expanded retail footprint and its role as the official food distributor for the Michelin Guide California Ceremony could strengthen its brand visibility. These developments, along with market trends such as the S&P 500's rise to record highs, potentially bolstered investor confidence in Sysco, aligning its performance with broader market optimism despite mixed quarterly earnings results.

Every company has risks, and we've spotted 1 warning sign for Sysco you should know about.

Sysco's recent moves, including the grand opening of its second Sysco To Go retail store and its involvement with the Michelin Guide California Ceremony, could play a significant role in shaping its narrative of growth and market expansion. These initiatives might enhance its revenue potential and bolster earnings by capturing new market segments. In terms of historical performance, Sysco's total shareholder return, including share price and dividends, rose 70.60% over the past five years, indicating strong overall growth. However, when examined against the recent year, the company's shares underperformed compared to the US Consumer Retailing industry, which returned 21.9%.

Despite these new developments, Sysco continues to face potential challenges in improving its revenue and earnings forecasts. The strategic expansion could help mitigate these challenges, yet adverse factors such as macroeconomic conditions and sales consultant turnover might still influence revenue growth negatively. Currently, with a share price of US$80.20, Sysco's shares are nearly aligned with the analyst consensus price target of approximately US$80.78. This indicates limited potential upside from the share price perspective in the near term, signifying close alignment with market expectations.

Evaluate Sysco's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives