- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

A Fresh Look at Sysco (SYY) Valuation Following Portland Teamsters Strike Authorization

Reviewed by Kshitija Bhandaru

Sysco (NYSE:SYY) faces possible disruption this month after Teamsters at its Portland division voted to authorize a strike by an overwhelming margin. This development puts new pressure on ongoing contract discussions.

See our latest analysis for Sysco.

Sysco’s year has seen a steady climb in total shareholder returns, up 12% over the past twelve months, even as the share price currently sits at $82.15. While the recent strike authorization adds some near-term uncertainty, momentum overall has been quietly building due to solid long-term performance, recent technology partnerships, and increased community engagement.

If this kind of behind-the-scenes business shift has you curious, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares hovering near their price target and the company trading at a substantial discount to intrinsic value, investors now face a classic dilemma: Is this an undervalued opportunity amid short-term uncertainty, or has the market already accounted for Sysco’s future growth?

Most Popular Narrative: 4% Undervalued

Sysco last closed at $82.15, just shy of the most popular narrative’s fair value of $85.60. This proximity signals cautious optimism and sets the stage for what is driving analyst conviction.

Sysco is focused on improving its sales consultant workforce, with new hires becoming more productive and a strategic shift in compensation model, which is expected to enhance revenue and earnings starting in fiscal 2026. The company is expanding its fulfillment capacity with new facilities in Florida and internationally in Sweden and Ireland, boosting its storage and distribution ability to capture profitable revenue growth in key markets.

Want to uncover what is fueling the valuation? There is one key transformation in their workforce and market reach that could defy expectations, and it is all baked into the financial projections. Find out exactly what assumptions analysts are making to justify that higher price.

Result: Fair Value of $85.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining consumer confidence and ongoing sales consultant turnover could challenge Sysco’s optimistic outlook if these trends persist or worsen in the coming quarters.

Find out about the key risks to this Sysco narrative.

Another View: Multiples Tell a Different Story

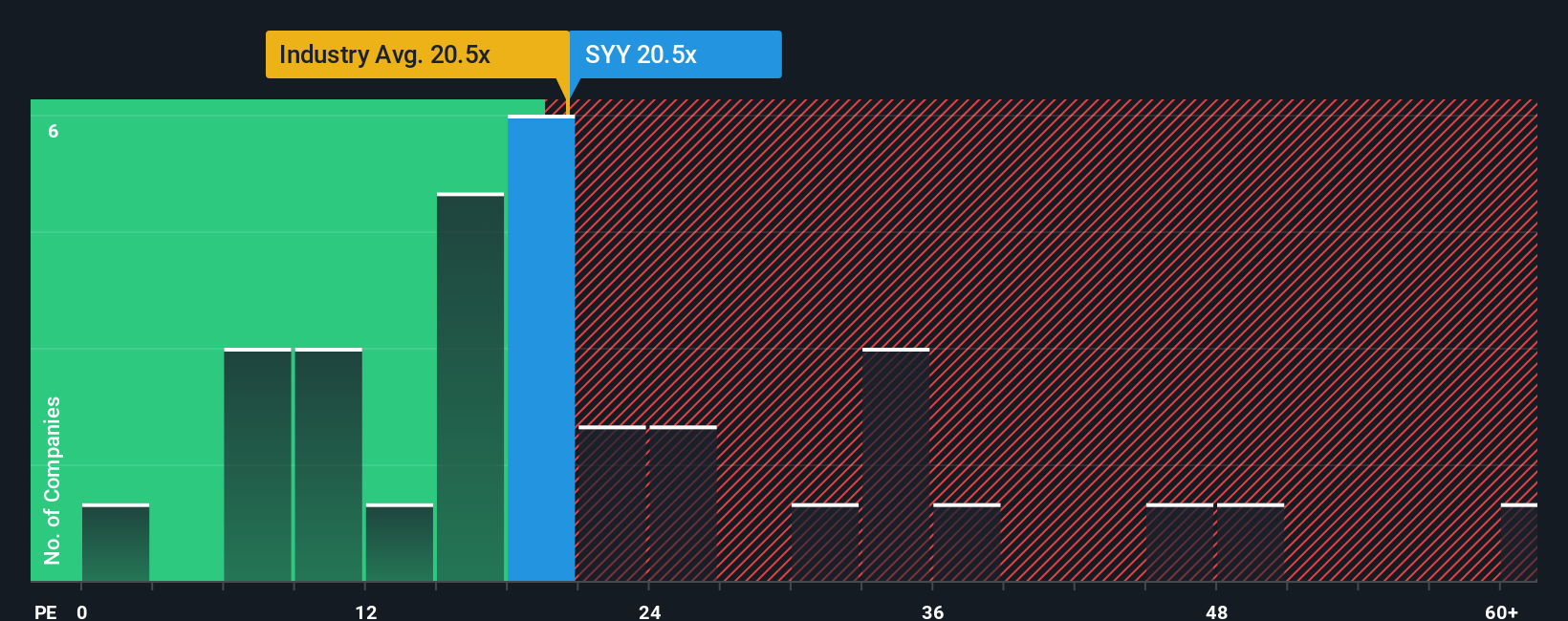

Looking through the lens of valuation multiples, Sysco trades at a price-to-earnings ratio of 21.5x. Compared to the peer average of 30.3x, Sysco looks relatively cheap. However, it still sits above the US Consumer Retailing sector’s 20.9x average. The fair ratio is estimated at 22.8x, suggesting the market could shift. Does this gap indicate hidden upside, or does it highlight possible risks lurking beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sysco Narrative

If you see things differently or are keen to dig into the numbers on your own terms, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Sysco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize opportunities that others overlook. Expand your horizons beyond Sysco and unlock potential in other areas. These handpicked stock ideas bring fresh angles to your portfolio.

- Boost your income with market leaders by reviewing these 19 dividend stocks with yields > 3% that consistently deliver strong yields above 3%. These stocks reward shareholders no matter the market moves.

- Ride the AI wave and see which companies are capitalizing on artificial intelligence breakthroughs by starting your search with these 24 AI penny stocks.

- Tap into growth potential before the crowd by scanning these 896 undervalued stocks based on cash flows and find hidden gems trading below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives