- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

3 Reasons Why Buffett Keeps Increasing the Stake in The Kroger Co.(NYSE:KR)

After slumping over 50% since the peak back in 2015, The Kroeger Co.( NYSE: KR ) recently made a new all-time high. It was certainly a long recovery, although the 2020 decline was much shorter than what most of the market experienced.

In the wake of the latest news of Berkshire Hathaway ( NYSE: BRK.A ) boosting its stake in the stock , we will examine 3 possible reasons why it might have caught Warren Buffett's interest in the first place.

View our latest analysis for Kroger

1. Reliable Dividend

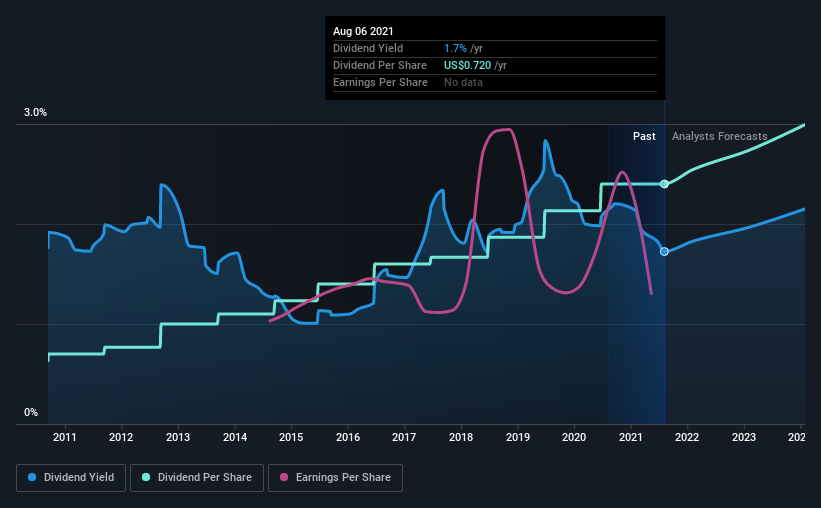

The current dividend payment is US$0.21 per share, working out to an FY yield of approx. 1.85%. While not in the market top, this is above the industry's average, which yields 1.5%.

Furthermore, the company pays just 37% of the earnings, and payments take only 30% of the free cash flow generated. This is a very comfortable ratio where the company can afford to keep the dividend growing and maintain sufficient protection in case of any turmoils.

Additionally, over the last 10 years, dividends have been growing by an average of 14%.

2. Superior ROE

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. Simply put, it is used to assess a company's profitability concerning its equity capital.

View our latest analysis for Kroger

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kroger is:

16% = US$1.5b ÷ US$9.2b (Based on the trailing twelve months to May 2021).

The 'return' is the profit over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.16.

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. Pleasingly, Kroger has a superior ROE than the average (12%) in the Consumer Retailing industry.

Kroger does use a high amount of debt to increase returns. It has a debt-to-equity ratio of 1.38. Undoubtedly, its ROE is decent, but the high debt the company carries is not too exciting to see. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

3. 10x Pretax Earnings Rule

Those following Warren Buffett might have noticed that pretax returns are one of the metrics that he favors when evaluating a business.

The most obvious reason is that taxes can vary for reasons that do not influence the fundamental business. Thus, the post-tax returns can skew the outlook. Furthermore, pretax earnings are easier to benchmark, as an investment at 10x of the pretax earnings is similar to owning an equity bond at a 10% yield.

Quite a few of his investments followed these guidelines, from Coca-Cola ( NYSE: KO ) to Walmart ( NYSE: WMT ) and even Apple ( NASDAQ: AAPL ).

At a reasonable valuation, being still below the pre-pandemic peak, and most importantly – being a business that Buffett understands, it is no surprise he keeps boosting his position. S o you might want to check this FREE visualization of analyst forecasts for the company .

If you are interested in Kroger, you may wish to see this free collection of other companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:KR

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026