- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

Dollar General (DG) Q2: Margin Compression to 2.9% Reinforces Bearish Profitability Narrative

Reviewed by Simply Wall St

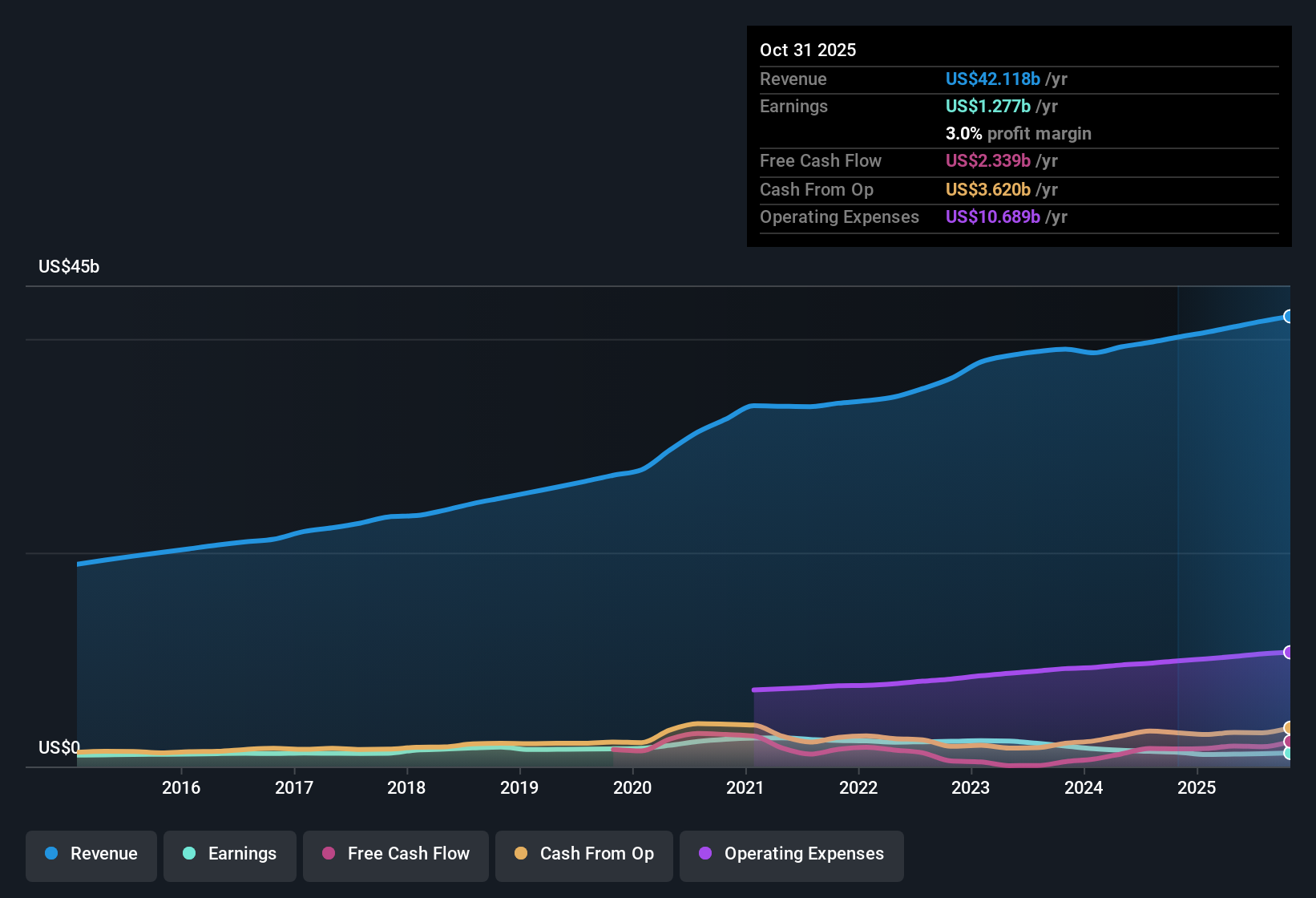

Dollar General (DG) just posted Q2 2026 results with revenue of about $10.7 billion, basic EPS of $1.87, and net income of roughly $411 million, setting a clear snapshot of its latest quarter. The company has seen quarterly revenue move from about $10.2 billion in Q2 2025 to $10.7 billion in Q2 2026, while basic EPS stepped up from $1.70 to $1.87 over the same period. This gives investors a cleaner view of how the top and bottom lines are tracking heading into the back half of the year as margins remain a key watchpoint.

See our full analysis for Dollar General.With the headline numbers on the table, the next step is to see how this earnings print lines up against the dominant narratives around Dollar General, and where the data might be starting to challenge them.

See what the community is saying about Dollar General

Same-store sales creep up to 2.8 percent

- Comparable sales growth improved from 0.5 percent in Q2 2025 to 2.8 percent in Q2 2026, alongside quarterly revenue rising from about 10.2 billion dollars to roughly 10.7 billion dollars over the same period.

- Analysts' consensus view expects steady store productivity gains, and the recent lift in same store sales aligns with that by:

- Pointing to value focused shopping behavior that has supported same store sales growth between 2.4 percent and 2.8 percent in the last two quarters.

- Fitting with the narrative that remodels and expanded private label offerings can help sustain revenue growth even when overall revenue is only forecast to grow about 4 percent per year.

Margins under pressure at 2.9 percent

- Trailing net profit margin sits at 2.9 percent versus 3.6 percent a year earlier, while trailing twelve month net income is about 1.2 billion dollars on 41.7 billion dollars of revenue.

- Bears argue rising costs and heavy rural exposure threaten profitability, and the margin trend gives that view some support because:

- The five year earnings trend shows reported earnings declining about 15.6 percent per year, which lines up with concerns about cost pressures and competitive intensity from other discount retailers.

- Management is still dealing with increasing labor and other operating costs, which matches the narrative that higher wages and expenses can weigh on margins if productivity gains do not keep pace.

Premium 23.2x P/E with DCF upside

- The stock trades on a price to earnings multiple of 23.2 times, above the US consumer retailing industry at 20.7 times and peers at 19.7 times, yet sits below a DCF fair value of about 161.11 dollars per share with the current price at 125.29 dollars.

- Supportive investors highlight a rewards mix of growth and income, and the numbers partly back that bullish stance through:

- Forecast earnings growth of about 10.6 percent per year, which is faster than the roughly 4 percent forecast for revenue and offers scope for earnings to grow ahead of sales if margins stabilize.

- A 1.88 percent dividend yield combined with the DCF fair value pointing to potential upside from 125.29 dollars, even though the higher than peer P E shows the market already prices in some optimism.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dollar General on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light? Turn that view into your own narrative in just a few minutes with Do it your way.

A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Dollar General's compressed margins, slower revenue growth, and premium valuation suggest limited room for error if costs rise further or sales momentum fades.

If those pressures make you uneasy, use our stable growth stocks screener (2081 results) to quickly focus on businesses delivering steadier revenue and earnings trends that could offer more predictable compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026