- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

Does the Recent Uptrend Signal Further Room for Growth in BJ’s Wholesale Club in 2025?

Reviewed by Bailey Pemberton

Contemplating what to do with BJ's Wholesale Club Holdings stock? You're definitely not alone. Whether you’re a long-term holder weighing your next move or a potential investor keeping an eye on strong retail names, it’s worth taking a closer look at how this club giant has been performing and what the numbers really say about its valuation.

Let’s start with how BJ’s stock has behaved recently. Over the past week, shares have climbed 3.1%, suggesting some renewed optimism among investors. Yet, zoom out a bit and you’ll notice a 5.7% dip in the past month, a tug-of-war that’s not unusual in today’s market landscape. Looking longer term, those numbers become even more compelling: the stock is up 5.3% year-to-date, 8.8% over the last year, and 127.3% over five years. There is a strong growth story here, fueled in part by shoppers’ resilient demand for value and a steady market for warehouse clubs.

But what does all this mean if you’re trying to figure out if BJ’s stock is undervalued or overvalued right now? When we run the numbers through six key valuation checks, BJ’s scores a 1, undervalued on only one front out of six. That is worth pausing over, especially after such impressive multiyear gains. Coming up, we’ll break down how each valuation method paints its picture, but keep reading because there is an even better way to assess what BJ’s is really worth that we’ll explore at the end.

BJ's Wholesale Club Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BJ's Wholesale Club Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting future cash flows and discounting them back to present value. This approach helps investors judge whether a stock is trading above or below its calculated worth by examining how much cash the business can generate over time.

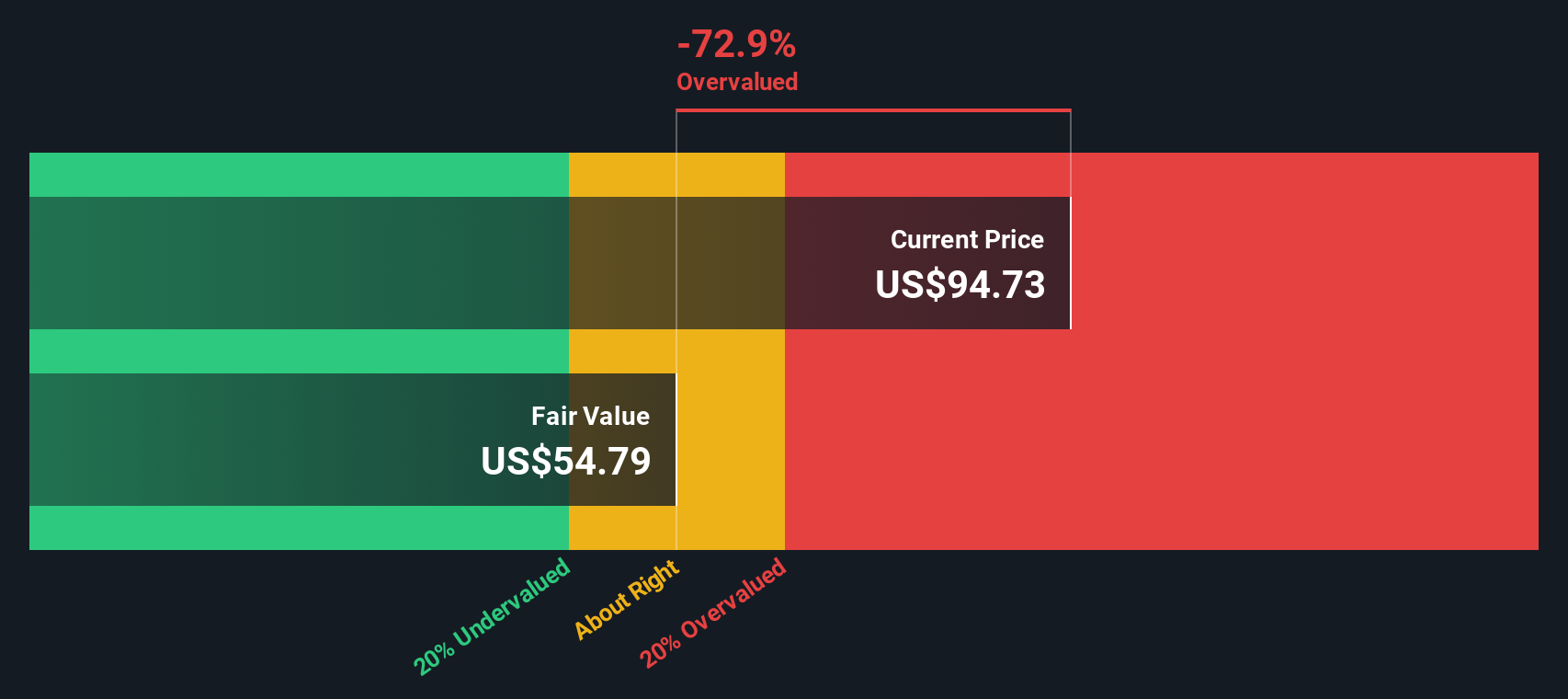

BJ's Wholesale Club Holdings currently reports Free Cash Flow of $396 million. Analyst projections extend out five years, after which Simply Wall St extrapolates further. The forecasted Free Cash Flow for 2028 is $354.7 million, and looking 10 years ahead, estimates rise to about $381 million. All amounts are in US dollars. These projections are based on a 2 Stage Free Cash Flow to Equity model, which factors in changes in growth rates over different periods.

After working through these cash flows and discounting them appropriately, the model arrives at an intrinsic value of $54.63 per share. Compared to BJ’s current market price, this DCF valuation suggests the stock is about 70% overvalued at today’s levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BJ's Wholesale Club Holdings may be overvalued by 70.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BJ's Wholesale Club Holdings Price vs Earnings

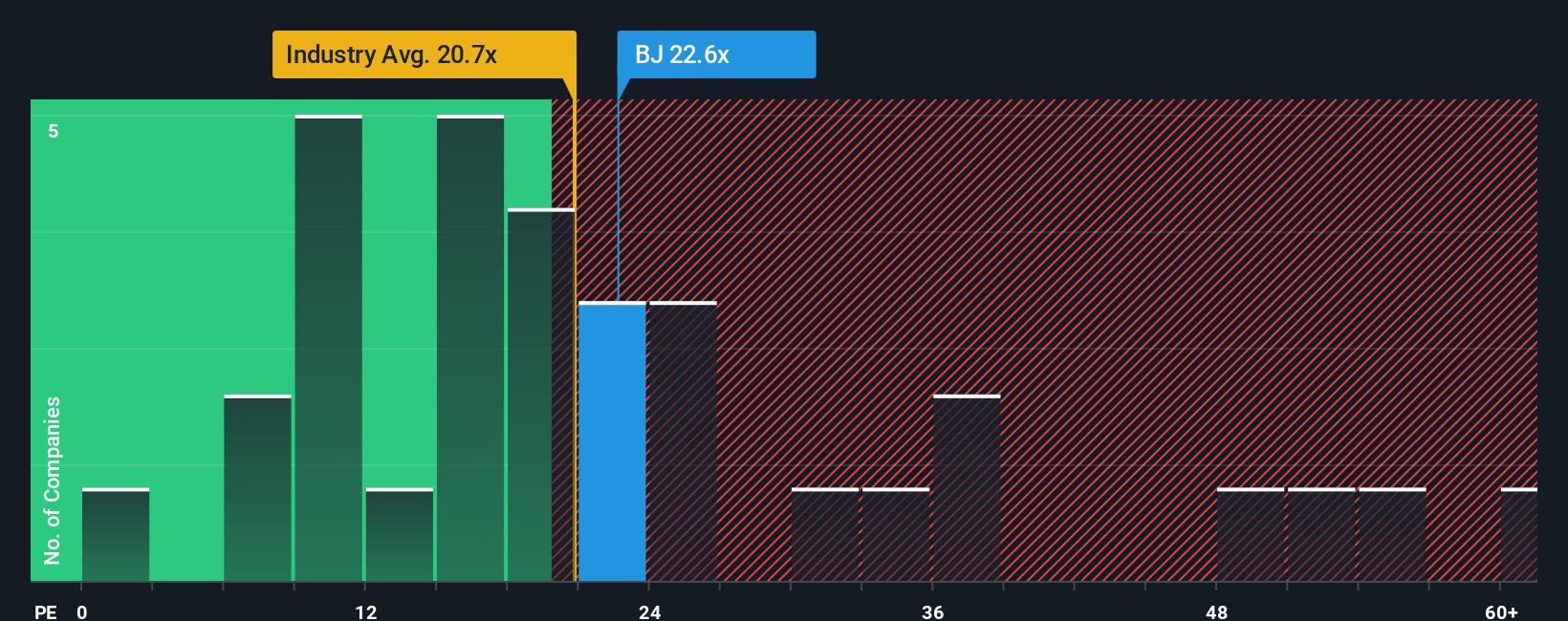

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like BJ’s Wholesale Club Holdings because it tells you how much investors are paying for each dollar of earnings. For companies generating steady profits, the PE ratio is a straightforward way to gauge if shares are expensive or offer good value, especially when compared to rivals or the broader sector.

Growth expectations and perceived risks significantly influence what counts as a “fair” PE ratio. If a company has faster growth ahead or carries less risk, investors are usually willing to pay more for its earnings, resulting in a higher PE. On the other hand, slower growth or higher uncertainty tend to keep that multiple lower.

Currently, BJ’s trades at a PE ratio of 21.1x, putting it just above the Consumer Retailing industry average of 20.8x and its peer group average of 18.0x. Rather than relying solely on those benchmarks, Simply Wall St calculates a proprietary “Fair Ratio” for each company. For BJ’s, the Fair Ratio stands at 19.1x, factoring in variables like earnings growth, profit margin, industry, risk profile, and market cap to produce a more relevant benchmark than basic peer or industry averages. By using the Fair Ratio, investors get a clearer idea of valuation that is tailored specifically to BJ’s business realities, not just what its competitors are doing.

Comparing BJ’s current 21.1x PE with its Fair Ratio of 19.1x suggests the stock is priced a bit above what its fundamentals support and may be slightly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BJ's Wholesale Club Holdings Narrative

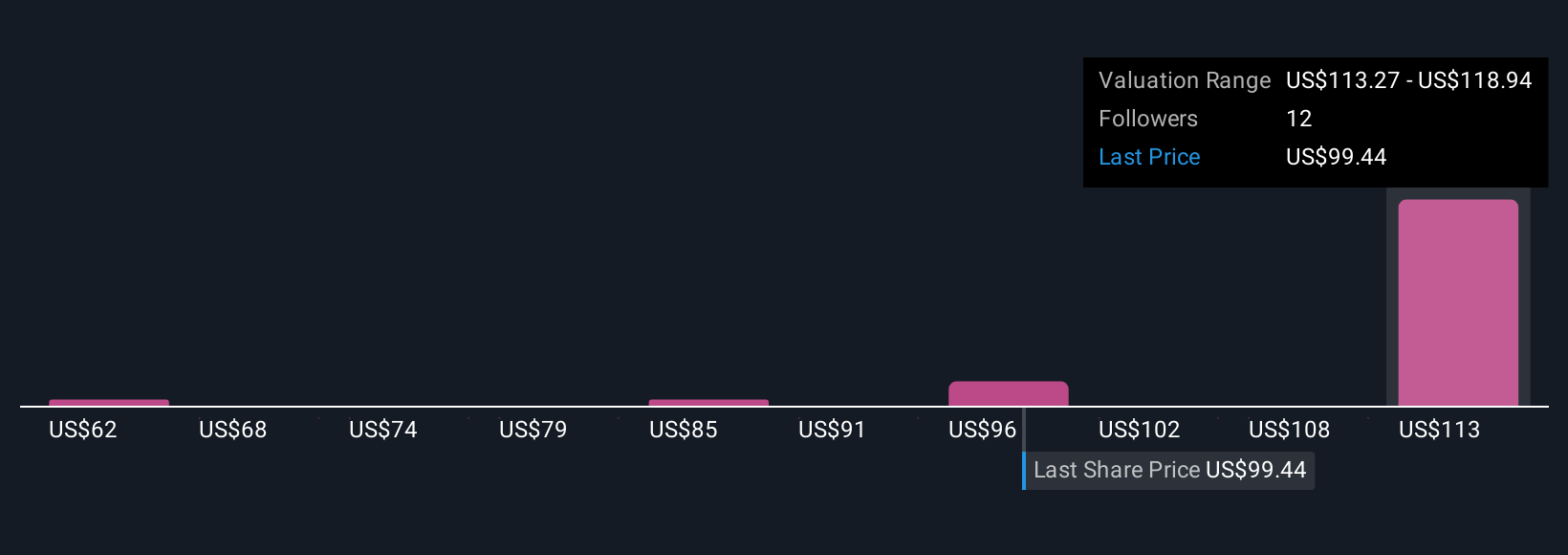

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is more than just a set of numbers; it’s the story you believe about a company’s future, connected to your own assumptions about fair value, estimated growth, and what really matters for the business. Narratives allow investors to capture their personal perspective, outlining how BJ’s might perform over the next several years and then linking that story directly to their financial forecast and fair value calculation.

On Simply Wall St’s Community page, millions of investors can easily create, customize, and share these Narratives. This tool helps you see at a glance whether the current share price fits with your outlook, so you know if you’re looking at a potential buy, hold, or sell. As company news, earnings, or new data emerge, Narratives automatically update, keeping your insights relevant and responsive to change.

For example, some investors are bullish on BJ’s, expecting membership and club expansion will drive recurring revenue and margins, supporting a fair value of around $130 per share; others are more cautious, citing demographic headwinds and margin pressures with a fair value closer to $70. No matter your view, Narratives make it easy to turn your outlook into actionable decisions that adapt as the facts change.

Do you think there's more to the story for BJ's Wholesale Club Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives