- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:WILC

G. Willi-Food International (NASDAQ:WILC) Has Rewarded Shareholders With An Exceptional 596% Total Return On Their Investment

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the G. Willi-Food International Ltd. (NASDAQ:WILC) share price has soared 553% over five years. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 27% in about a quarter. But this could be related to the strong market, which is up 16% in the last three months.

It really delights us to see such great share price performance for investors.

See our latest analysis for G. Willi-Food International

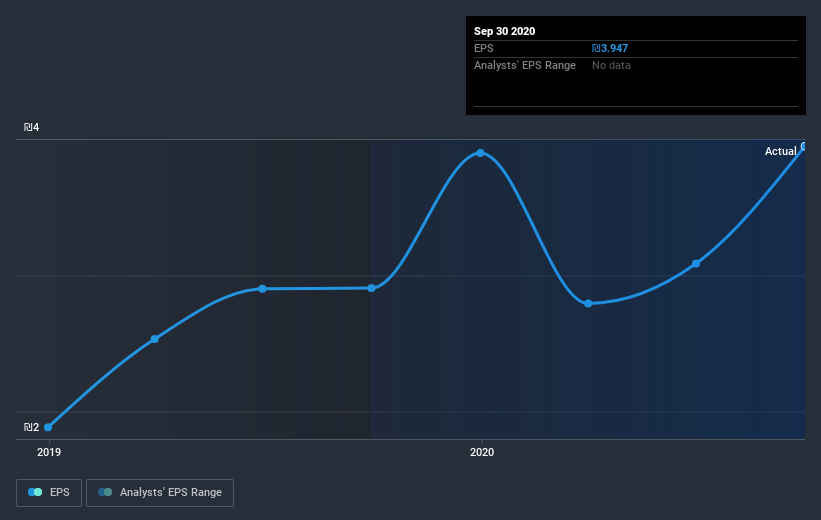

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, G. Willi-Food International managed to grow its earnings per share at 34% a year. This EPS growth is slower than the share price growth of 46% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on G. Willi-Food International's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between G. Willi-Food International's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that G. Willi-Food International's TSR of 596% over the last 5 years is better than the share price return.

A Different Perspective

It's good to see that G. Willi-Food International has rewarded shareholders with a total shareholder return of 89% in the last twelve months. That gain is better than the annual TSR over five years, which is 47%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with G. Willi-Food International , and understanding them should be part of your investment process.

We will like G. Willi-Food International better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade G. Willi-Food International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:WILC

G. Willi-Food International

Designs, imports, markets, and distributes food products worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives