- United States

- /

- Banks

- /

- NasdaqGS:FNLC

Discover First Bancorp And 2 Other Top US Dividend Stocks

Reviewed by Simply Wall St

As U.S. markets reach record highs following the recent presidential election, investors are keenly observing sectors that stand to benefit from potential policy shifts and economic changes. Amidst this backdrop, dividend stocks remain a focal point for those seeking steady income and long-term growth potential. In this article, we explore First Bancorp alongside two other prominent U.S. dividend stocks that exemplify resilience and reliability in today's dynamic market environment.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.97% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 4.92% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.54% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.27% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.62% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Heritage Commerce (NasdaqGS:HTBK) | 4.74% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.46% | ★★★★★★ |

| Carter's (NYSE:CRI) | 6.08% | ★★★★★☆ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

First Bancorp (NasdaqGS:FNLC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The First Bancorp, Inc., with a market cap of $296.54 million, operates as the holding company for First National Bank, offering a variety of banking products and services to individuals and businesses.

Operations: The First Bancorp, Inc. generates revenue of $80.58 million from its banking operations segment.

Dividend Yield: 4.6%

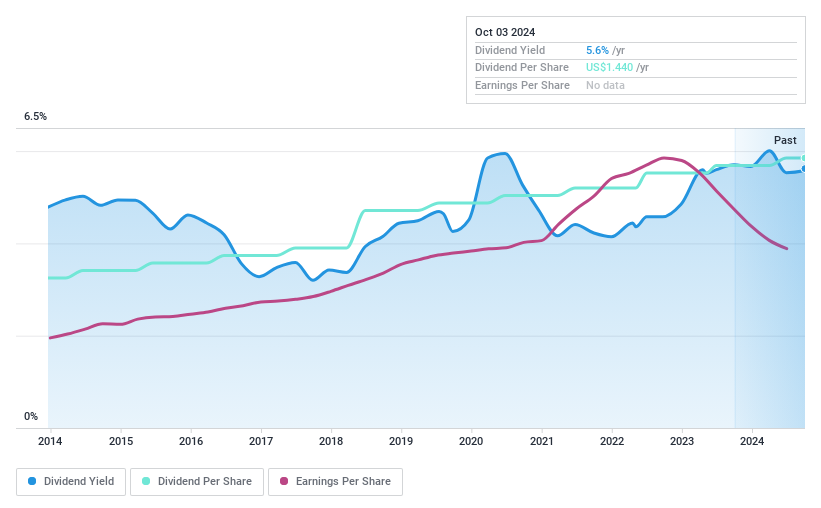

First Bancorp pays a high and reliable dividend yield of 4.64%, which is within the top 25% of US dividend payers. The payout ratio of 59.3% suggests dividends are covered by earnings, and payments have been stable and growing over the past decade. However, recent earnings showed a decline in net interest income to US$46.36 million for Q3 2024 from US$49.35 million last year, potentially impacting future dividend sustainability assessments.

- Dive into the specifics of First Bancorp here with our thorough dividend report.

- Upon reviewing our latest valuation report, First Bancorp's share price might be too pessimistic.

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $369.40 million.

Operations: Northrim BanCorp's revenue is primarily derived from its Community Banking segment, which contributes $112.55 million, and its Home Mortgage Lending segment, which adds $29.04 million.

Dividend Yield: 3.2%

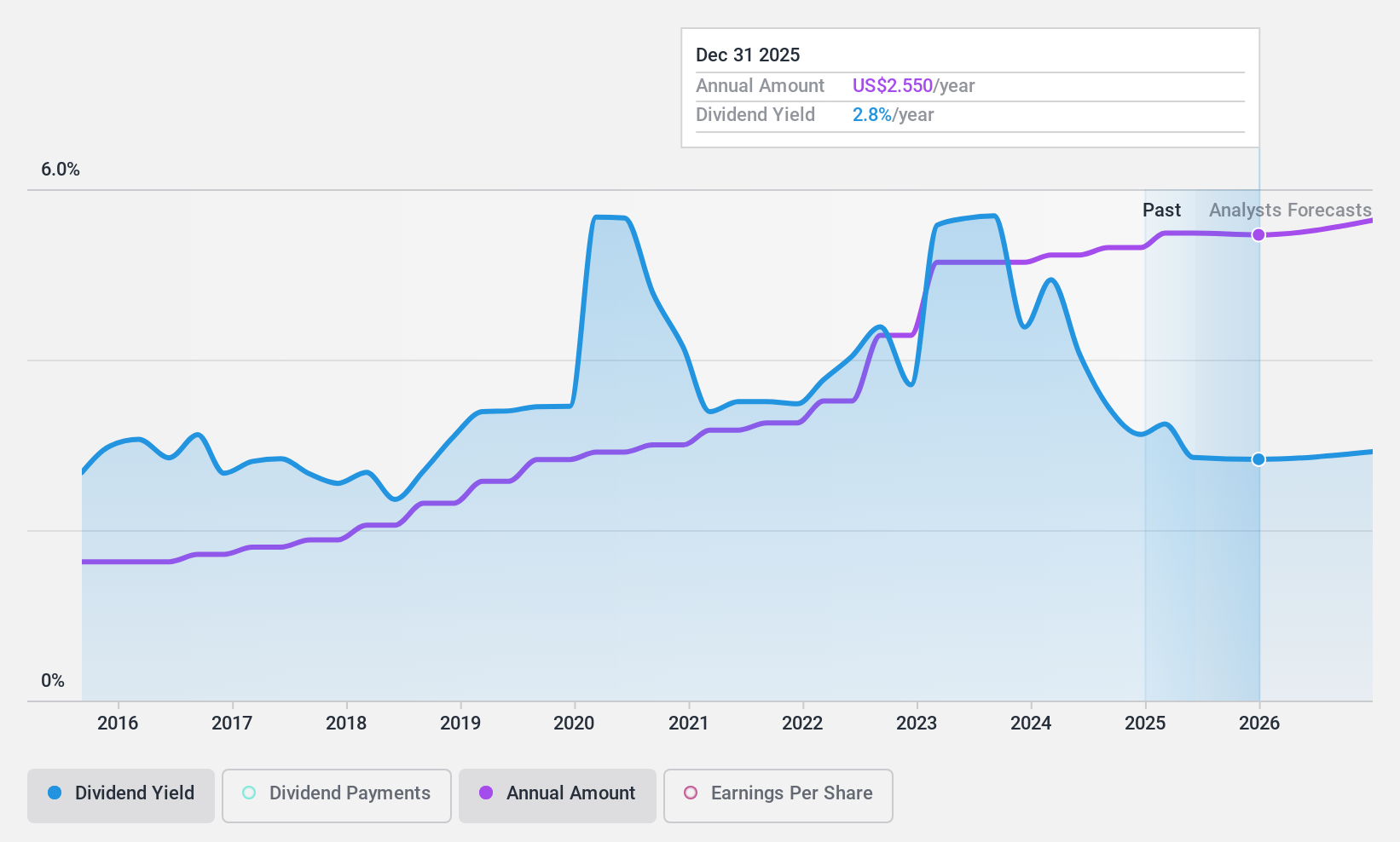

Northrim BanCorp's dividend payments have been stable and growing over the past decade, with a current yield of 3.19%, though below the top US payers. The payout ratio of 41.5% indicates dividends are well covered by earnings, supported by recent earnings growth, including net income rising to US$26.04 million for nine months in 2024 from US$18.78 million previously. The acquisition of Sallyport Commercial Finance may influence future financial dynamics but hasn't impacted recent buyback activities.

- Navigate through the intricacies of Northrim BanCorp with our comprehensive dividend report here.

- According our valuation report, there's an indication that Northrim BanCorp's share price might be on the expensive side.

Village Super Market (NasdaqGS:VLGE.A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Village Super Market, Inc. operates a chain of supermarkets in the United States and has a market cap of $435.10 million.

Operations: Village Super Market, Inc.'s revenue is primarily derived from the retail sale of food and nonfood products, totaling $2.24 billion.

Dividend Yield: 3%

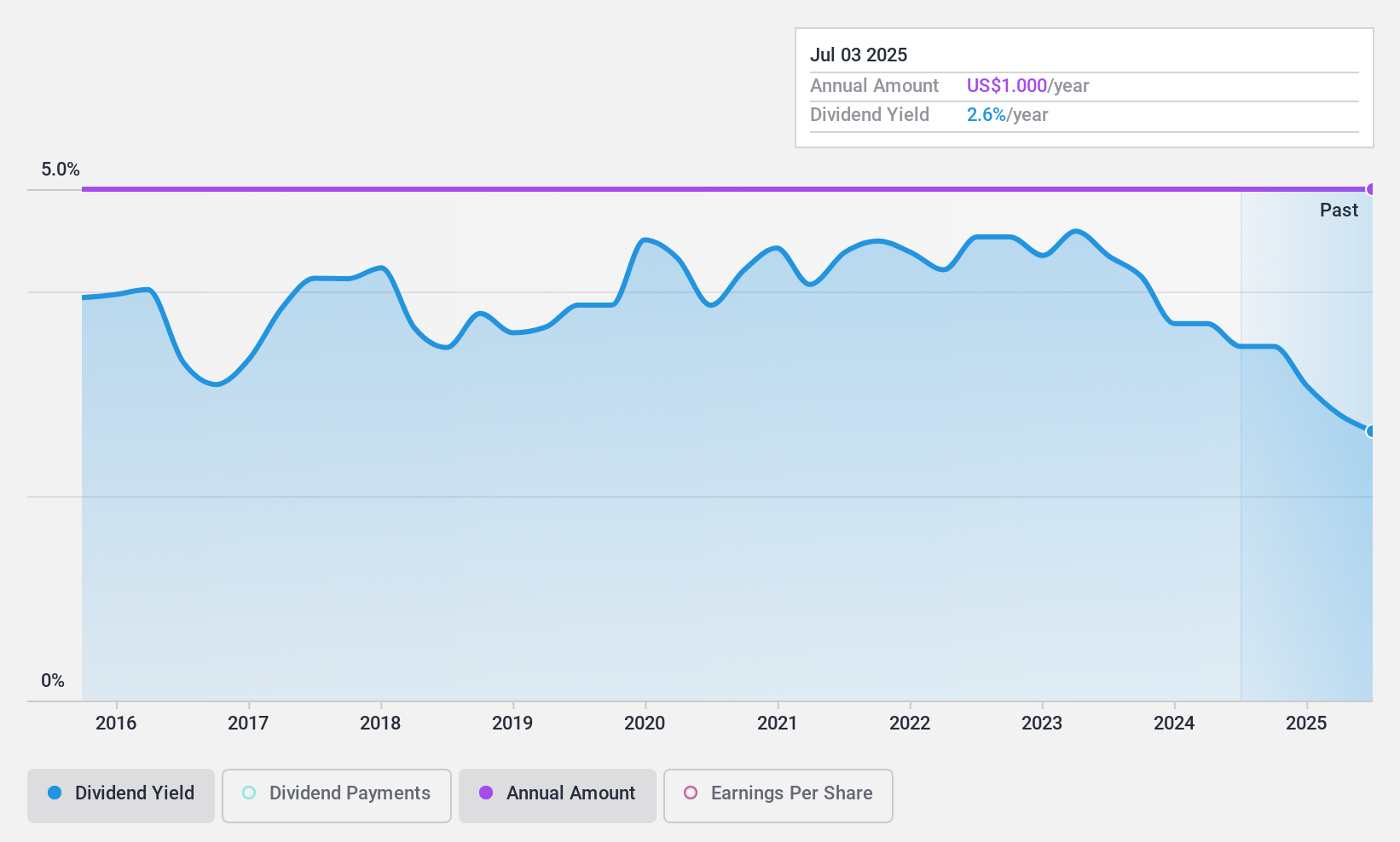

Village Super Market's dividends are stable, with a current yield of 3.01%, though not among the highest in the US market. The payout ratio is sustainable, covered by earnings at 29.5% and cash flows at 83.8%. Recent earnings show modest growth, with Q4 sales reaching US$578.24 million and net income of US$15.43 million, slightly up from last year. Dividend payments remain consistent but have not increased over the past decade despite reliable payouts.

- Click to explore a detailed breakdown of our findings in Village Super Market's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Village Super Market shares in the market.

Make It Happen

- Reveal the 135 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FNLC

First Bancorp

Operates as the holding company for First National Bank that provides a range of banking products and services to individuals and businesses.

Flawless balance sheet established dividend payer.