- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Farmers Market (SFM): Unpacking Valuation After RBC Capital Upgrade Spurs Investor Optimism

Reviewed by Kshitija Bhandaru

Shares of Sprouts Farmers Market (SFM) rallied after RBC Capital upgraded the stock to “Outperform.” The move reflects fresh optimism around the grocer’s prospects and a belief that recent marketing concerns are overstated.

See our latest analysis for Sprouts Farmers Market.

This latest upgrade came after a volatile stretch for Sprouts, with the stock rebounding 4.3% in a single session but still down more than 33% over the last 90 days. While momentum in the share price has cooled after a strong run, long-term shareholders have seen a staggering 421% total return over five years. This demonstrates that the grocer’s story rewards patience even when sentiment is shifting in the short term.

If today’s food retail moves pique your curiosity, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

So after recent turbulence and a wave of analyst optimism, is Sprouts Farmers Market trading at a genuine discount, or has the market already priced in every aspect of its future growth potential?

Most Popular Narrative: 38.4% Undervalued

Compared to the last close at $111.13, the narrative's fair value points to major upside. The numbers behind this outlook signal just how big the gap may be.

Strong consumer momentum for healthy, organic, and fresh foods continues to drive sales growth at Sprouts, as evidenced by 17% total sales growth and 10.2% comp sales. Management attributes the top-line gains to ongoing shifts in food preferences and wellness-focused choices. This sets the stage for sustained revenue growth.

Curious about what’s fueling this target? The secret lies in how the narrative weighs aggressive growth, expanding margins, and optimism about long-term consumer demand. The quantitative assumptions here are anything but bland. Get ready for ambitious projections and bold financial targets that could catch even experienced investors off guard.

Result: Fair Value of $180.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and supply chain cost pressures could still challenge Sprouts’ optimistic growth narrative and put pressure on future profitability.

Find out about the key risks to this Sprouts Farmers Market narrative.

Another View: What Do the Multiples Say?

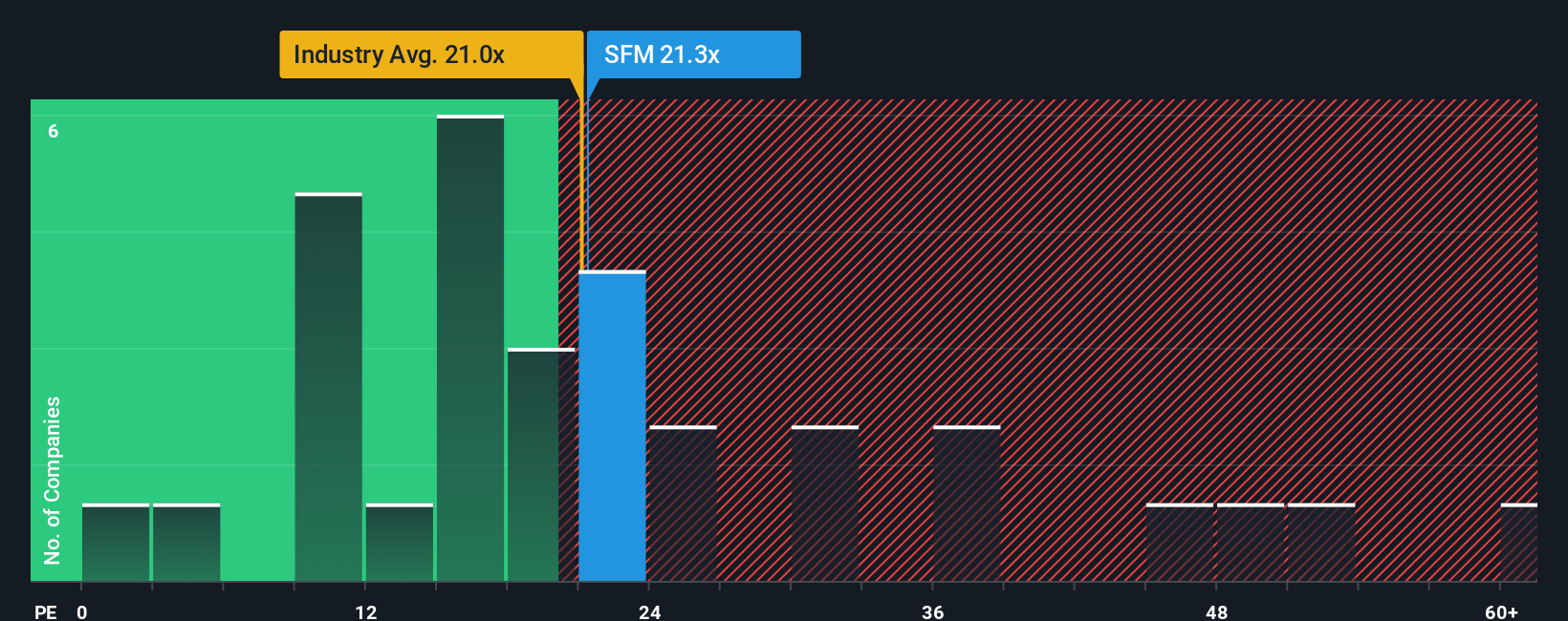

Looking beyond growth assumptions, investors often turn to price-to-earnings ratios as a grounding point. For Sprouts, the current price-to-earnings ratio is 22.4x, which stands higher than both the US Consumer Retailing industry average of 21.2x and the peer average of 21.4x. This suggests the stock carries a premium versus its closest comparables. It also sits above its estimated fair ratio of 20.8x. These differences hint at valuation risk if the company cannot continue to outperform. Does this premium reflect justified optimism, or could it leave less room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sprouts Farmers Market Narrative

If this outlook does not match your perspective or you want to test your own insights, you can dig into the data and shape your personal view in just a few minutes with Do it your way.

A great starting point for your Sprouts Farmers Market research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and get ahead of market trends. Uncover stocks that match your strategy and never let another smart idea slip by.

- Tap into the highest yielding opportunities and secure potential long-term income by checking out these 18 dividend stocks with yields > 3%.

- Spot tomorrow’s biggest themes and leap into innovation with these 26 quantum computing stocks, which is shaping the frontier of computing.

- Strengthen your watchlist by targeting value with these 877 undervalued stocks based on cash flows, filtering for strong fundamentals and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives