- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:SFM

Sprouts Farmers Market (NasdaqGS:SFM) Reports US$7.7 Billion Sales with 10% Projected Growth in 2025

Reviewed by Simply Wall St

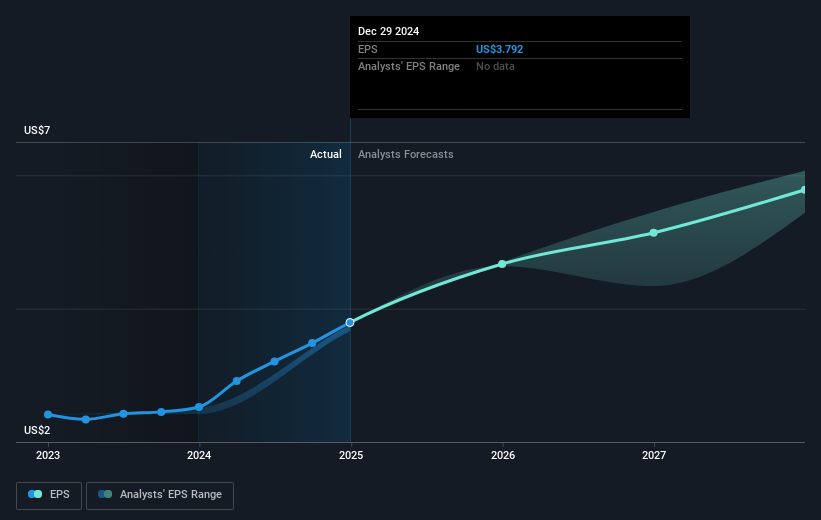

Sprouts Farmers Market (NasdaqGS:SFM) recently reported substantial growth in both its fourth-quarter and full-year 2024 results, with sales rising to $1,996 million and $7,719 million, respectively. The company's strong performance contributed to a 15% share price increase over the past month. It also issued positive guidance for 2025, projecting significant growth in comparable store sales and overall net sales, further boosting investor confidence. During a period when major stock indices like the Dow and Nasdaq were experiencing declines, Sprouts Farmers Market's robust financials and promising outlook stood out against a backdrop of mixed market conditions. While the broader market faced pressures from declines in major companies like UnitedHealth due to investigations, and fluctuations in tech stocks, Sprouts' positive earnings and growth projections provided a solid base for its share price momentum, distinguishing it within a challenging environment.

Click here to discover the nuances of Sprouts Farmers Market with our detailed analytical report.

Over the past five years, Sprouts Farmers Market's shares have delivered an exceptionally high total return, exceeding 900%. This remarkable performance can be attributed to consistent quarterly earnings growth and strategic corporate actions. The company's earnings have grown at an average of 9.5% per year, a testament to its solid operational foundation. In October 2024, Sprouts announced a successful share buyback program, repurchasing over 957,000 shares for US$60 million, indicating strong confidence from the management in the company's prospects.

Furthermore, Sprouts outperformed both the US market and the Consumer Retailing industry over the last year, highlighting its competitive edge in a challenging marketplace. Another key aspect of its robust returns is the profit growth acceleration observed when earnings surged 38.2% year-over-year, much faster than the industry average of 9.8%. Significant client partnerships formed throughout 2024 also supported its expansion and investor appeal, reinforcing its position within the retail sector.

- Analyze Sprouts Farmers Market's fair value against its market price in our detailed valuation report—access it here.

- Uncover the uncertainties that could impact Sprouts Farmers Market's future growth—read our risk evaluation here.

- Already own Sprouts Farmers Market? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFM

Sprouts Farmers Market

Engages in the retailing of fresh, natural, and organic food products under the Sprouts brand in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives