- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:GO

Grocery Outlet (GO): Examining Valuation Potential After Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 1.9% Undervalued

The most widely followed narrative positions Grocery Outlet Holding as slightly undervalued, suggesting that the current share price does not fully reflect its long-term growth potential and margin expansion.

Analysts are assuming Grocery Outlet Holding's revenue will grow by 8.3% annually over the next 3 years. Analysts assume that profit margins will increase from 0.2% today to 1.5% in 3 years time.

Think you know what’s powering this call? The fair value depends on projections that could influence both sales and profit. Will Grocery Outlet actually deliver on these big expectations? Explore the full narrative to see the bold quantitative targets and the aggressive future margins being considered.

Result: Fair Value of $16.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition and shifting consumer habits could quickly challenge this outlook. This may make future growth less certain than current forecasts suggest.

Find out about the key risks to this Grocery Outlet Holding narrative.Another View: SWS DCF Model Says Shares Are Overvalued

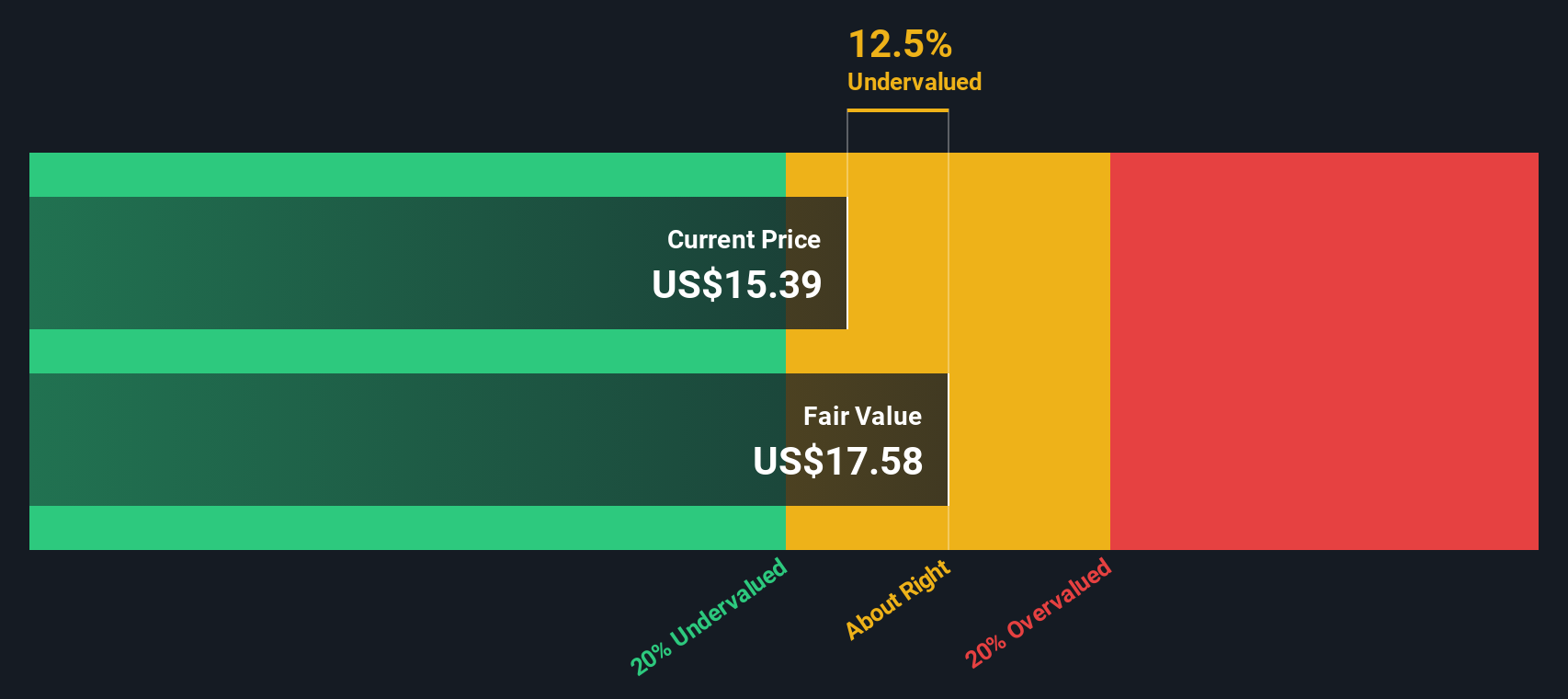

While the popular narrative suggests Grocery Outlet Holding is undervalued, our DCF model comes to the opposite conclusion and signals that the current share price is actually above fair value. Which method do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Grocery Outlet Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Grocery Outlet Holding Narrative

If you have a different take, or simply want to use your own data-driven approach, you can craft your own analysis in just a few minutes. Do it your way.

A great starting point for your Grocery Outlet Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t leave your next big opportunity on the table. With the right tools, you can spot hidden winners and shape your portfolio for the trends ahead.

- Spot under-the-radar bargains by unlocking potential with undervalued stocks based on cash flows. This is perfect for those seeking strong value before the crowd catches on.

- Boost your income stream by tapping into reliable picks through dividend stocks with yields > 3%, focusing on companies with yields that can enhance your returns.

- Ride the future of healthcare innovation and see which stocks are shaping tomorrow’s breakthroughs with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GO

Grocery Outlet Holding

Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives