- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

How New Distribution Centers and Margin Pressures Could Reshape Dollar Tree's (DLTR) Investment Story

Reviewed by Sasha Jovanovic

- Dollar Tree recently acquired a 1.25-million-square-foot distribution center near Phoenix, Arizona, and broke ground on a new 1-million-square-foot center in Marietta, Oklahoma, aiming to strengthen its supply chain and support over 700 stores across the West and Southwest following the loss of its Marietta facility to a tornado in 2024.

- Recent analyst downgrades have highlighted mounting operational complexity and margin concerns as Dollar Tree adapts to multi-tier pricing and contends with ongoing cost pressures, intensifying scrutiny of its business outlook.

- We'll assess how the margin pressures flagged by analysts influence Dollar Tree's investment narrative after these recent supply chain expansions.

Find companies with promising cash flow potential yet trading below their fair value.

Dollar Tree Investment Narrative Recap

To own Dollar Tree, you need confidence in its ability to leverage value-focused retailing, aggressively expand its store footprint, and use supply chain efficiencies to support traffic and sales growth amid a shifting consumer environment. The newly announced distribution centers in Arizona and Oklahoma aim to boost operational resilience and support regional expansion, but they do not materially shift the current short-term focus on managing margin pressures stemming from tariffs, inflation, and rising labor costs.

Among recent company announcements, the sale of Family Dollar stands out as most relevant. This move streamlines operations around the Dollar Tree brand, positioning the company to concentrate resources on its core formats and potentially enhance the impact of its distribution expansion. Focusing the business could support execution on gross margin improvement, a key catalyst as management navigates cost pressures and operational complexity.

Yet, in contrast with the expansion narrative, investors should be aware of how persistent tariff threats may undermine these efficiency gains and ...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's narrative projects $22.1 billion revenue and $1.4 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.3 billion increase in earnings from $1.1 billion today.

Uncover how Dollar Tree's forecasts yield a $109.91 fair value, a 25% upside to its current price.

Exploring Other Perspectives

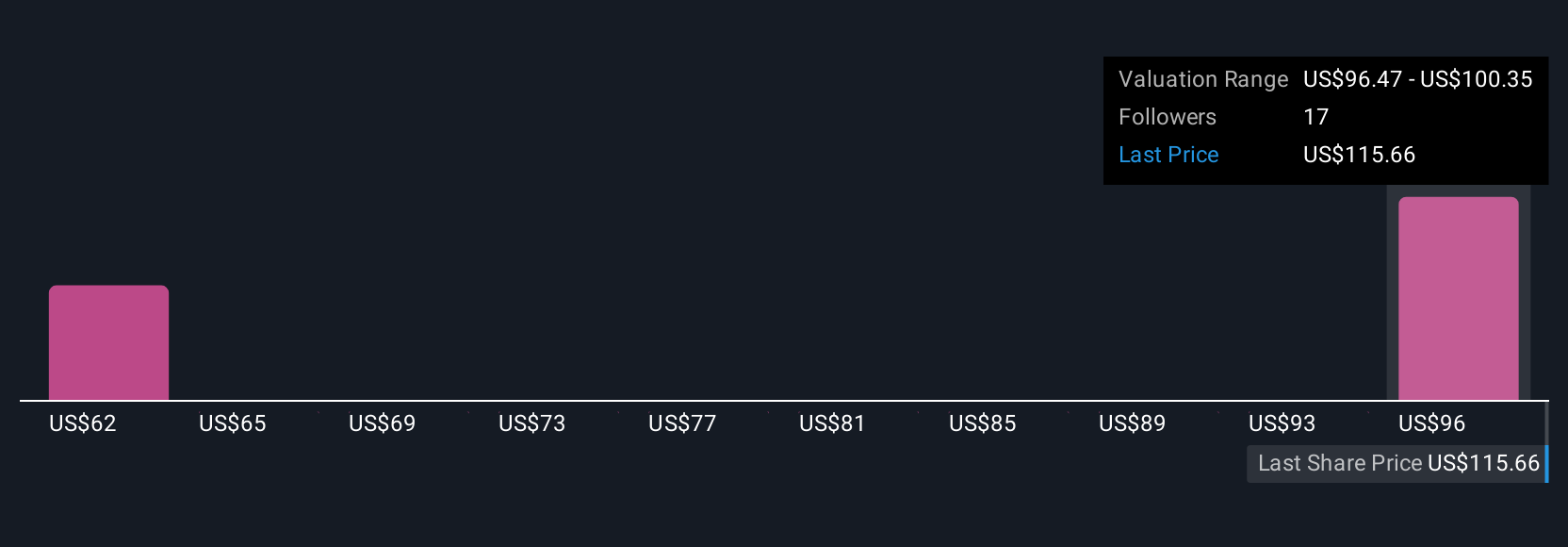

Within the Simply Wall St Community, three user-generated fair value estimates for Dollar Tree range from US$56.90 to US$109.91 per share. While investors disagree on valuation, persistent margin pressures flagged by analysts could shape company performance in the quarters ahead.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth as much as 25% more than the current price!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

No Opportunity In Dollar Tree?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives