- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Dollar Tree (NASDAQ:DLTR) investors are sitting on a loss of 36% if they invested a year ago

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Dollar Tree, Inc. (NASDAQ:DLTR) share price is down 36% in the last year. That's disappointing when you consider the market returned 19%. At least the damage isn't so bad if you look at the last three years, since the stock is down 8.2% in that time. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

View our latest analysis for Dollar Tree

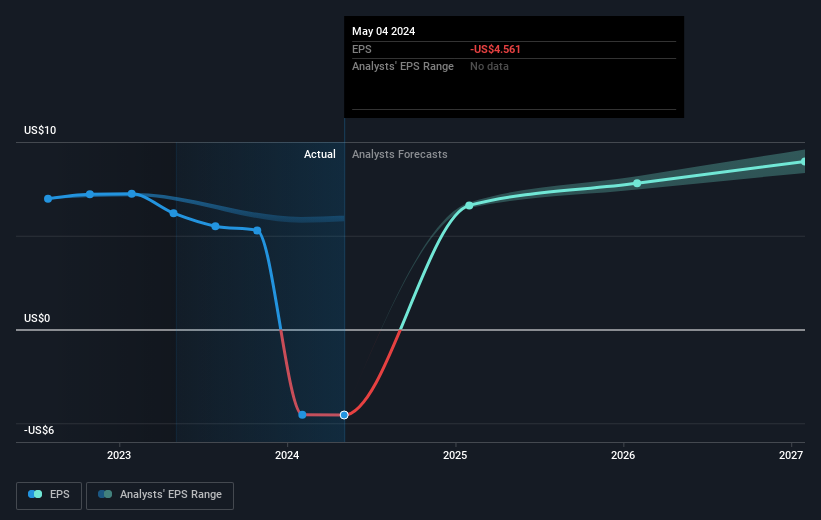

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Dollar Tree saw its earnings per share drop below zero. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. However, there may be an opportunity for investors if the company can recover.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Dollar Tree's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 19% in the last year, Dollar Tree shareholders lost 36%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Dollar Tree by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives