- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

The Earnings Beat Shows that Costco (NASDAQ:COST) Has Resilience Under Economic Pressures - There May Still be Opportunity in the Stock

Key takeaways:

- Costco managed to grow and beat analyst estimates.

- Analysts are expecting more growth in the future in both earnings and revenue.

- The company may be some 32% undervalued according to our general DCF model.

In a time when everyone is concerned about an economic decline, Costco Wholesale Corporation (NASDAQ:COST) managed to retain their client base and delivered on earnings. Today, we will review the company's performance and analyze what investors can expect in the future.

See our latest analysis for Costco Wholesale

Costco Wholesale released earnings last week, and the stock recovered some 7% to US$470. Here are the highlights:

- Quarterly revenue US$52.596b vs US$45.277b a year ago - 12% beat on estimates.

- Quarterly net income US$1.353b vs US$1.22b a year ago.

- Diluted EPS US$8.94 vs US$7.51 a year ago - 2% beat on estimates.

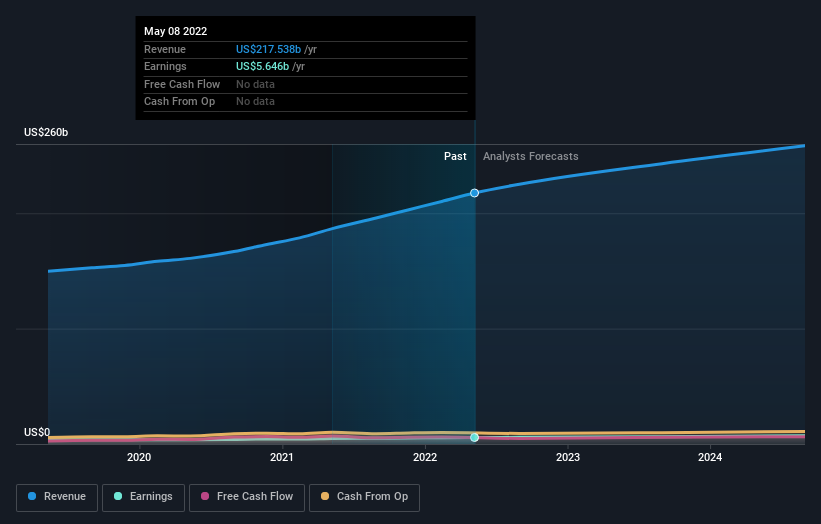

We can also look at what analysts are forecasting for Costco in the future and get a better picture of what to expect:

Costco's 27 analysts forecast revenues of US$225.1b in 2022, which would reflect a satisfactory 3.5% improvement in sales compared to the last 12 months. Per-share earnings are expected to accumulate 2.2% to US$13.03.

While being a large scale retailer, Costco is still expected to grow and maintain profit levels. Revenue growth in companies can be artificially boosted by inflation, but it is the bottom line that is at risk in economic downturns. This is why it is impressive to see analysts predicting a retention and possibly growth in the EPS of the company.

Costco is known to provide customers with minimal markup in products while making money on their membership cards. This approach can stimulate shoppers to trust the company to provide them with affordable goods, which they may stockpile in the anticipation of further economic decline.

Costco's Value

For investors, every metric serves to inform us about the final value of a company. This is then used as a basis in creating investing strategies.

One way to assess the value of a company is to use the traditional discounted cash flow valuation. We use this approach, along with analyst's estimates for the future and some key assumptions, in order to arrive at an intrinsic value for Costco.

Using our DCF model, we can see that analysts still expect the company to grow free cash flows in the future, and working from that, we estimate an intrinsic value of the company at US$308.5b or about US$696 per share.

This implies that Costco is some 32% undervalued.

Of course, COST needs to keep performing in order to realize this value, but it seems that the company has a bright future in the US market.

Conclusion

Costco showed resilience in the market by managing to retain shopper loyalty while providing affordable goods in an inflationary environment. The company exceeded expectations, showing that their business model can be sustained even under economic pressure.

Analysts are bullish on the future of the company, and our valuation model indicates that there is potential upside for investors.

A note on risk. The future is difficult to predict, and should the economy deteriorate into a recession, then retailers like Costco will also be affected. In order to reduce this risk, investors may look into the benefits of planned and continuous investment across a longer horizon vs bulk investment. This article attempts to analyze the company and does not make assumptions on what should investors do with the information.

We also analyze fundamental risks, for example - Costco Wholesale has 2 warning signs we think you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives