- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Chefs' Warehouse (CHEF): Valuation Insights Following Raised 2025 Outlook and Strong Earnings Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Chefs' Warehouse.

Chefs' Warehouse’s steady progress in the high-end hospitality space seems to be gaining recognition, as reflected in its 13.4% share price gain so far in 2025 and an impressive total shareholder return of 43% over the past year. Recent results have drawn new attention, and momentum is building as investors look past a choppy short-term environment and focus on sustained growth potential.

If the premium hospitality rebound interests you, it might be time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares soaring and management raising future guidance, the question now is whether Chefs' Warehouse remains undervalued by the market or if all its potential is already reflected in the price. This makes a fresh buying opportunity uncertain.

Most Popular Narrative: 26.5% Undervalued

Chefs' Warehouse's most watched narrative sees fair value at $76.62, well above the last close of $56.33, with future earnings growth in focus. Analyst consensus has sharpened around new expansion plans and a higher quality sales mix, potentially setting the stage for price gains.

Continued expansion and integration of the Texas (Hardie's) operations, with an explicit focus on shifting away from low-margin commodity offerings and cross-selling premium categories, suggests substantial future improvement in both gross margins and EBITDA as the business mix evolves. The company is leveraging the trend of urbanization and demand for high-quality, artisanal food in new metropolitan markets.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $76.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost inflation and integration challenges from new acquisitions could hinder margin improvements and disrupt the positive growth story for Chefs' Warehouse.

Find out about the key risks to this Chefs' Warehouse narrative.

Another View: Market Ratios Signal Caution

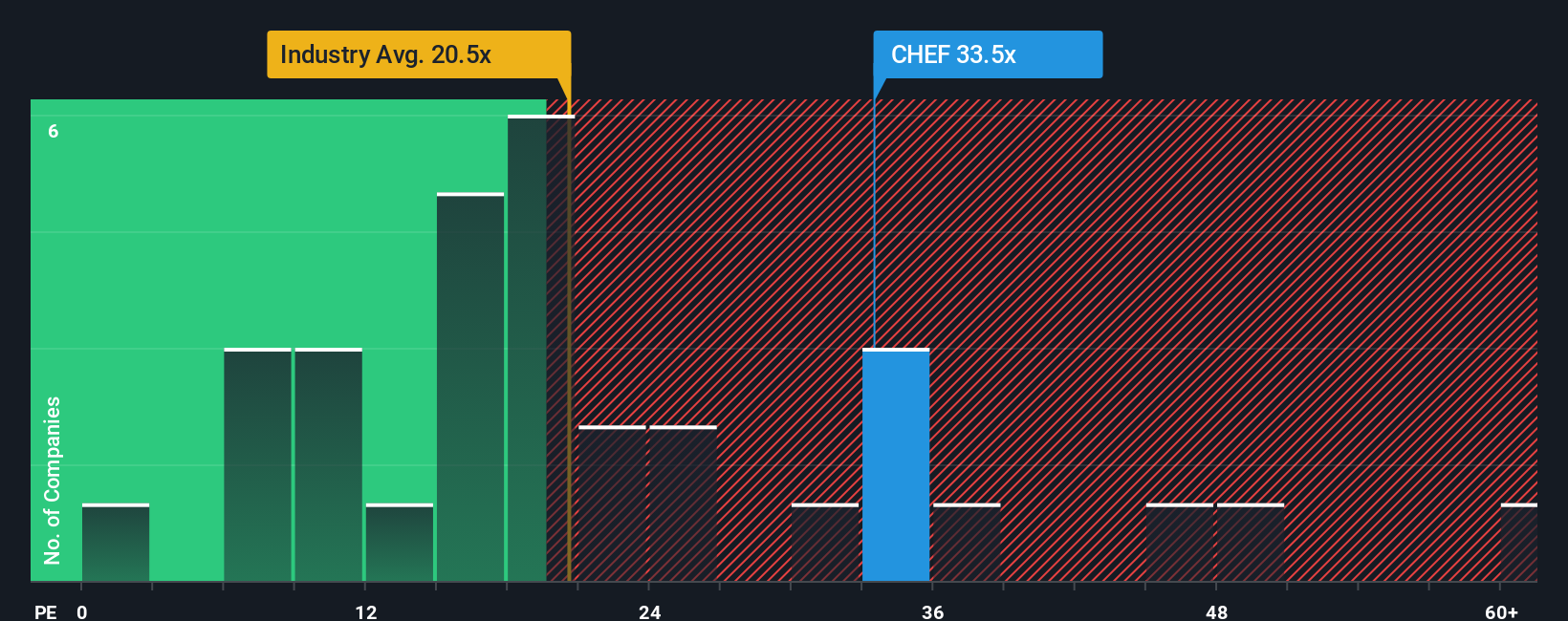

While our earlier approach suggested Chefs' Warehouse might be undervalued, a look at its price-to-earnings ratio tells a different story. The company trades at 33x earnings, which is much higher than both the US Consumer Retailing industry average (20.6x) and its peer group (26.2x), and is well above the fair ratio of 19.9x. This premium suggests that investors are pricing in strong growth ahead of what is typical for the sector. Does this point to a hidden risk, or is the market simply anticipating significant developments?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chefs' Warehouse Narrative

Feel free to dig into the numbers yourself and chart your own story about Chefs' Warehouse's outlook. It takes just a few minutes to analyze the facts and see what conclusions you reach. Do it your way

A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Take charge and find your next winner with hand-picked lists tailored for unique strategies and market trends.

- Unlock high-yield potential and maximize your income by checking out these 19 dividend stocks with yields > 3%, which consistently pay attractive dividends above 3%.

- Surf the wave of innovation and spot future leaders among these 25 AI penny stocks, as these are disrupting markets with artificial intelligence breakthroughs and rapid adoption.

- Catch early growth before the crowd by evaluating these 888 undervalued stocks based on cash flows, which are trading below their cash flow value and may offer compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives