- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Analysts Just Made A Notable Upgrade To Their The Chefs' Warehouse, Inc. (NASDAQ:CHEF) Forecasts

The Chefs' Warehouse, Inc. (NASDAQ:CHEF) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Chefs' Warehouse has also found favour with investors, with the stock up a remarkable 10% to US$29.31 over the past week. Could this upgrade be enough to drive the stock even higher?

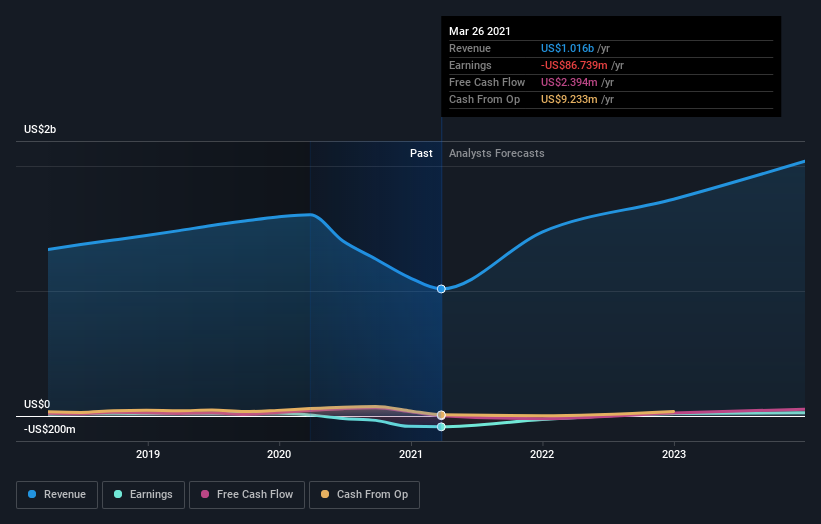

After this upgrade, Chefs' Warehouse's four analysts are now forecasting revenues of US$1.6b in 2021. This would be a major 32% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 90% to US$0.19. However, before this estimates update, the consensus had been expecting revenues of US$1.5b and US$0.73 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

See our latest analysis for Chefs' Warehouse

There was no major change to the consensus price target of US$38.80, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Chefs' Warehouse, with the most bullish analyst valuing it at US$40.00 and the most bearish at US$34.00 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting Chefs' Warehouse's growth to accelerate, with the forecast 74% annualised growth to the end of 2021 ranking favourably alongside historical growth of 1.7% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 5.1% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Chefs' Warehouse to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Chefs' Warehouse is moving incrementally towards profitability. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Chefs' Warehouse could be a good candidate for more research.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Chefs' Warehouse going out to 2023, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Chefs' Warehouse, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.