- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:ANDE

Could Andersons’ (ANDE) Ethanol Bet Offset Softer Earnings and Shape Its Long-Term Trajectory?

Reviewed by Simply Wall St

- The Andersons, Inc. recently reported its second quarter and first half 2025 earnings, revealing higher sales of US$3.14 billion for the quarter and US$5.79 billion for the half, but significantly lower net income compared to the same periods last year.

- Alongside the earnings, the company highlighted its completed acquisition of full ownership in four ethanol plants and progress on the Port of Houston expansion, both of which are expected to support future growth and efficiency gains.

- We’ll now examine how the ethanol plant acquisitions could reshape Andersons’ long-term prospects amid softer recent earnings results.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Andersons Investment Narrative Recap

To be a shareholder in Andersons, you need confidence in the company's ability to transform short-term earnings challenges, like recent sharp declines in net income, into longer-term gains through control of assets such as ethanol plants and infrastructure expansion. While the acquisition of full ownership in four ethanol plants is seen as a catalyst for improving margins and capturing renewables-related benefits, this shift has not materially changed the core short-term risk: persistent pressure on net margins and free cash flow due to high capital expenditures and variable commodity markets.

The company’s completed ethanol plant acquisitions, announced alongside its latest earnings release, directly address Andersons’ efforts to participate more fully in the high-potential renewables segment. This move positions Andersons to benefit more directly from regulatory incentives like 45Z tax credits and anticipated improvements in plant efficiency, both of which remain highly relevant as management looks to offset lower profits amid increased industry competition and volatile grain markets.

However, investors should also be mindful that if renewed regulatory support or efficiency gains in the renewables business don’t pan out as anticipated, the upside from these capital-intensive investments could...

Read the full narrative on Andersons (it's free!)

Andersons' outlook projects $13.3 billion in revenue and $186.7 million in earnings by 2028. This implies a 4.8% annual revenue growth rate and an increase of $106.1 million in earnings from the current $80.6 million.

Uncover how Andersons' forecasts yield a $46.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

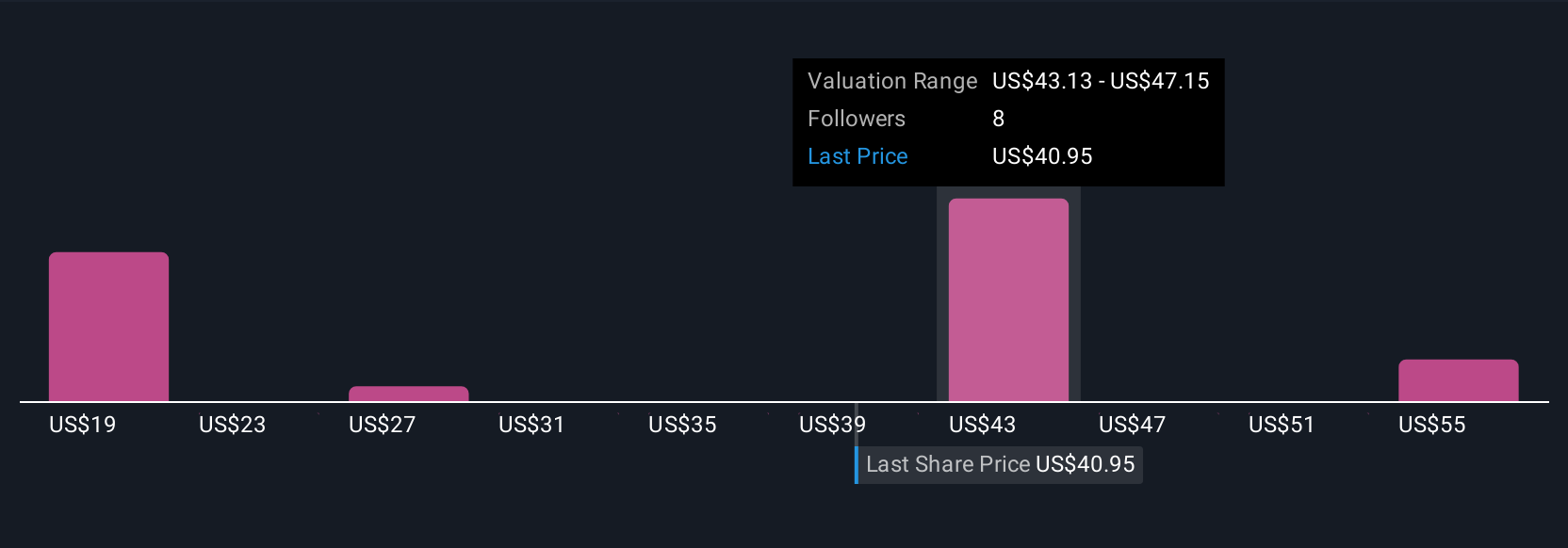

Community fair value estimates for Andersons, Inc. range widely from US$18.78 to US$59.24 across five Simply Wall St Community contributors. While many participants focus on the earnings potential from renewables, some see near-term risks from high capital spending, encouraging you to explore a variety of viewpoints before making a decision.

Explore 5 other fair value estimates on Andersons - why the stock might be worth as much as 48% more than the current price!

Build Your Own Andersons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andersons research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Andersons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andersons' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANDE

Andersons

Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives