- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:ANDE

A Look at Andersons (ANDE) Valuation After Full Acquisition of Ethanol Venture

Reviewed by Kshitija Bhandaru

Andersons (ANDE) just completed a significant step in its ongoing transformation by acquiring full ownership of TAMH and rebranding the venture as The Andersons Renewables, LLC. For investors, this move feels like more than just a business update; it marks a notable push into the ethanol market, an area with growing relevance as the energy and agriculture industries reshape themselves. With this strategic expansion, the company signals it is leaning into new revenue streams beyond its traditional grain and farm operations, aiming for a more diversified future.

This latest acquisition comes after a year of ups and downs for Andersons. While shares are up over the past three months, the longer view tells a different story, with the stock sliding nearly 22% over the past year. Still, the company’s track record over five years remains impressive, bolstered by its willingness to pursue meaningful growth initiatives. Annual revenue is climbing at around 4%, and net income has grown at an even faster pace, hinting at operational improvements even amid industry pressures like lower commodity prices and higher costs.

Given the recent price action and the move into renewable energy, is Andersons now trading at a discount compared to its future potential, or is the market already factoring in these growth plans?

Most Popular Narrative: 17.3% Undervalued

The prevailing narrative suggests Andersons is trading below its fair value, with analysts seeing meaningful upside based on future profits and expanding margins.

Recent acquisition of 100% ownership of ethanol plants positions Andersons to fully capture cash flow, tax credits, and margin upside from regulatory support for renewable fuels and low-carbon intensity ethanol. This directly supports future increases in earnings and net margins.

Curious about the hidden engine powering this bullish outlook? The heart of the narrative is a set of bold assumptions about accelerating profits and a transformation in where those earnings will come from. The secret sauce behind the fair value calculation? You'll need to explore the details yourself to uncover what could fuel Andersons' next chapter.

Result: Fair Value of $46.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing volatility in commodity markets and increased debt from recent expansions could challenge Andersons’ ability to achieve these bold growth expectations.

Find out about the key risks to this Andersons narrative.Another View: What Does Our DCF Model Say?

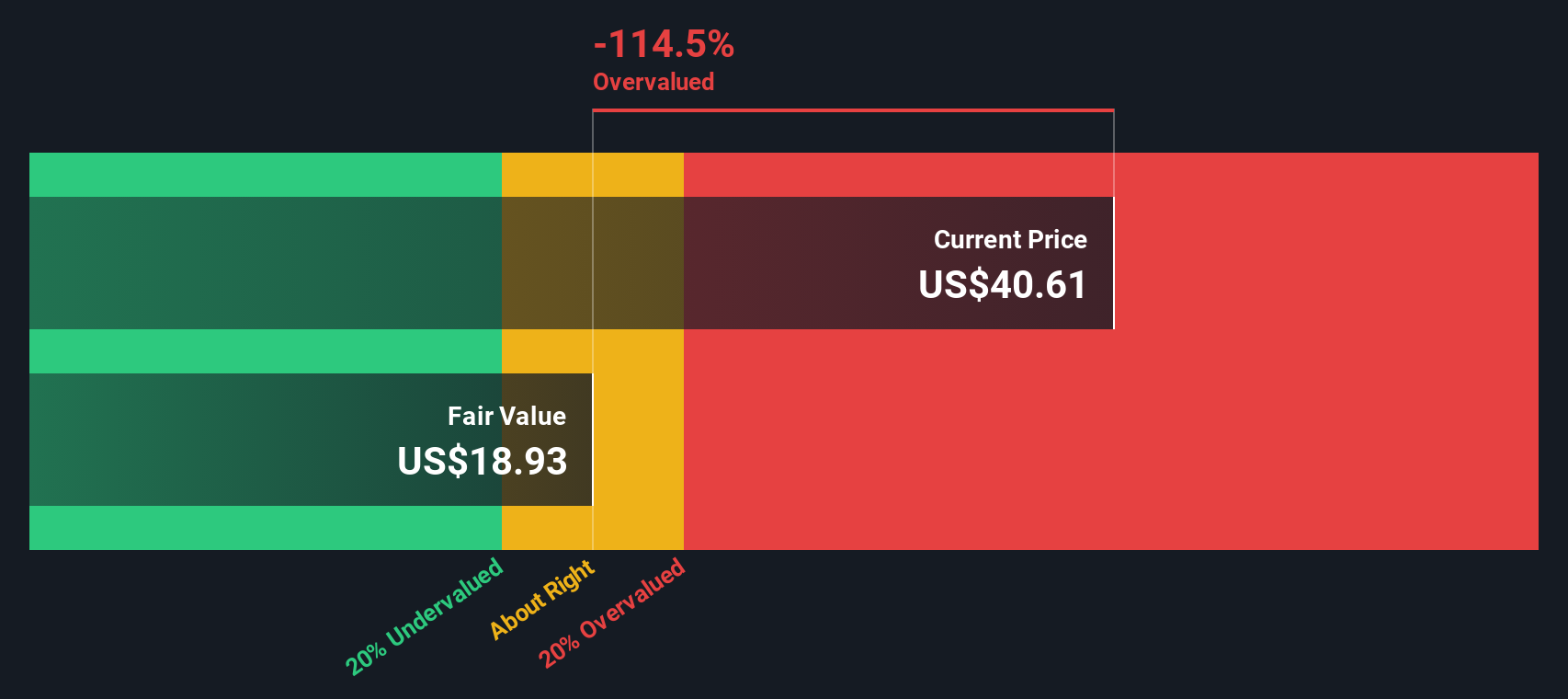

Looking at Andersons through the lens of our DCF model presents a very different picture, suggesting that the stock could be trading well above its intrinsic value. Is the optimism around future growth overstated, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Andersons for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Andersons Narrative

If you see the numbers differently or want to dig deeper, you can build your own view of Andersons in just a few minutes. Do it your way.

A great starting point for your Andersons research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. There’s a world of compelling stocks you likely haven’t considered, each one hand-picked for different growth, value, or income potential.

- Kickstart your hunt for hidden value by spotting tomorrow’s leaders among undervalued stocks based on cash flows before the rest of the market catches on.

- Catch the momentum in the tech revolution with a lineup of innovative companies in AI penny stocks that are harnessing artificial intelligence for real-world breakthroughs.

- Lock in reliable income streams and defend against market swings by checking out top picks for dividend stocks with yields > 3% and see which businesses deliver consistently strong dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANDE

Andersons

Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives