- United States

- /

- Consumer Durables

- /

- OTCPK:QEPC

Q.E.P (QEPC): Margin Expansion Challenges Skepticism, But Earnings Quality Draws Investor Scrutiny

Reviewed by Simply Wall St

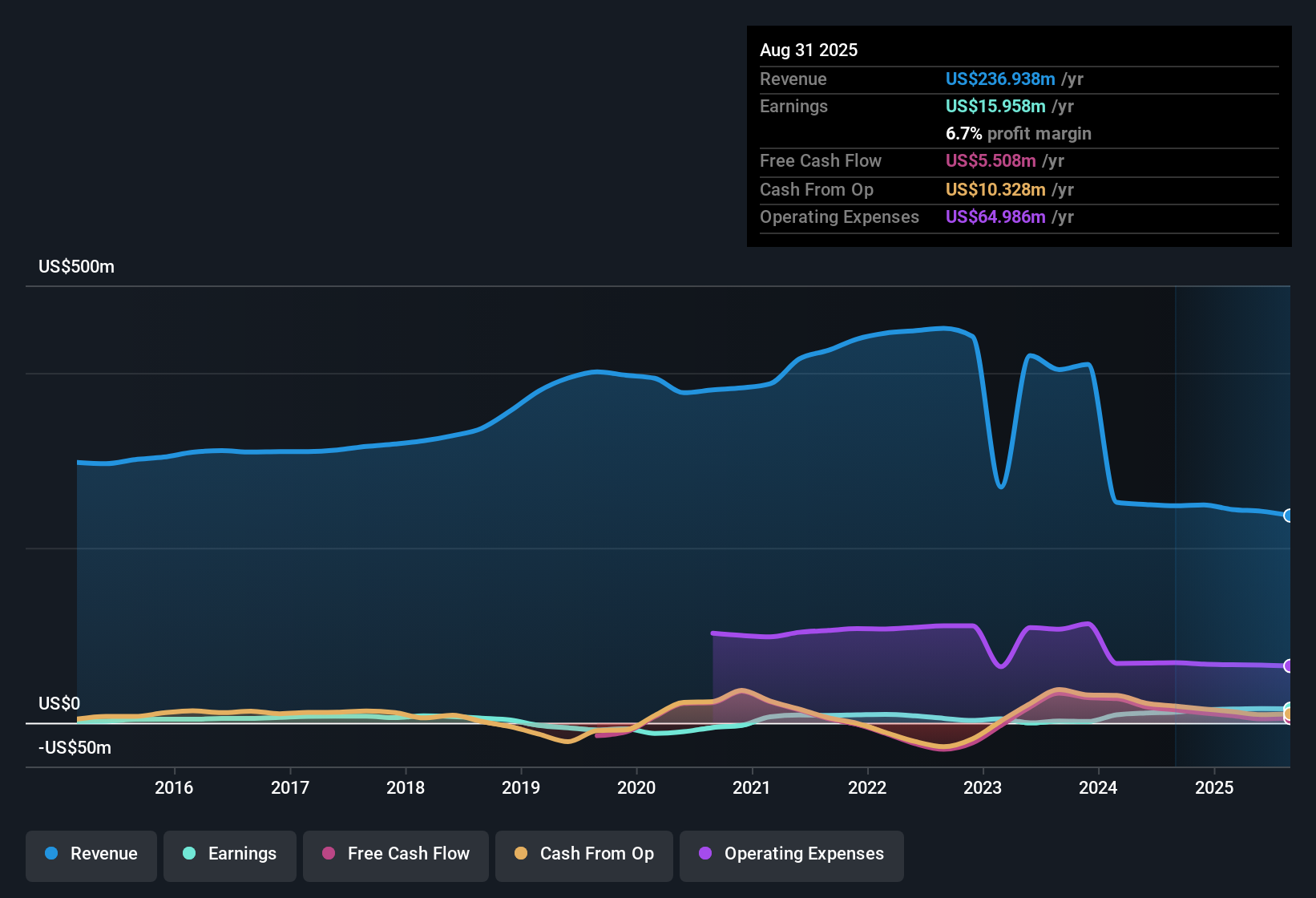

Q.E.P (QEPC) posted a net profit margin of 6.7%, up from 4.9% in the previous year. Earnings have grown at an impressive 32.1% annually over the past five years. The company’s Price-to-Earnings Ratio sits at 7.7x, noticeably lower than both the peer group average of 12.5x and the US Consumer Durables industry average of 10.7x. This frames Q.E.P as particularly attractive on a value basis right now. While these strong numbers point to greater operational efficiency and historically solid profitability, investors may want to keep an eye on the quality of recent earnings due to a notable presence of non-cash items.

See our full analysis for Q.E.P.Next up, we’ll see how these headline earnings figures measure up against the market’s current narratives and expectations. We will also consider whether the story supports or challenges the consensus view.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Signals Pricing Power

- Net profit margin has reached 6.7%, climbing from 4.9% in the prior year. This marks a notable improvement in Q.E.P’s operational efficiency relative to both historical performance and sector norms.

- What stands out, based on recent market analysis, is that this margin expansion supports the view that Q.E.P may be finding a sustainable competitive footing, with investors pointing to:

- Repeated annual earnings growth of 32.1% suggests efficiency gains are not a short-term anomaly but part of a multi-year uptrend.

- With profit margins now exceeding Q.E.P’s own historical averages, some investors see these results as further evidence that the company is better absorbing costs or managing pricing, potentially offsetting concerns about industry-wide cost pressure.

Low Multiple Creates Value Case

- Q.E.P’s Price-to-Earnings Ratio of 7.7x sits well below the peer group at 12.5x and the US Consumer Durables industry average of 10.7x, creating a valuation discount of over 25% against its direct competitors.

- From a prevailing market view, this significant valuation gap lends support to the case that shares may offer value:

- If profit margins remain at current levels or improve further, the company could see its multiple move closer to peer averages, a trend that long-term investors may find encouraging.

- However, some note that the discount is warranted only if there are lingering doubts about sustainability, so investors should track next year’s trends closely to assess the situation.

Non-Cash Earnings Raises Earnings Quality Flags

- While headline profitability is strong, Q.E.P’s latest results reveal a notable presence of non-cash items, making earnings quality an important factor in evaluating past growth and future durability.

- Prevailing investor analysis identifies concerns here, as this factor complicates a purely positive outlook:

- Critics highlight that high non-cash earnings may distort operational performance, so underlying profitability could be overstated compared to cash flow reality.

- For cautious investors, this means analyst and investor attention is likely to focus on the next set of disclosures to gauge whether this effect will persist or diminish.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Q.E.P's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Q.E.P’s rising non-cash earnings and questions about underlying profitability mean its recent growth may not fully reflect sustainable, cash-backed performance.

If you want clearer signals and stronger earnings quality, check out stable growth stocks screener (2096 results) to focus on businesses with consistently reliable financial progress year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Q.E.P might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:QEPC

Q.E.P

Designs, manufactures, and distributes flooring installation solutions for commercial and home improvement projects in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)