- United States

- /

- Leisure

- /

- NYSE:YETI

YETI Holdings (NYSE:YETI) Eyes Acquisitions and Reports Strong Q3 Earnings Growth

Reviewed by Simply Wall St

Navigate through the intricacies of YETI Holdings with our comprehensive report here.

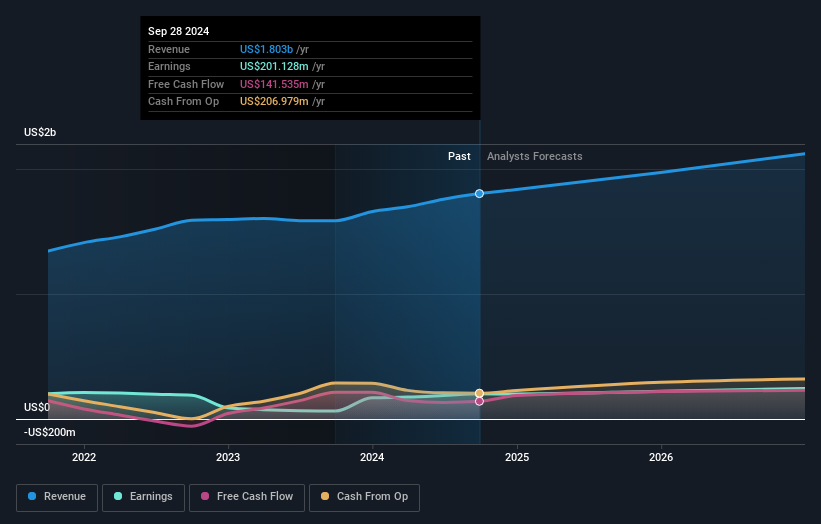

Competitive Advantages That Elevate YETI Holdings

YETI Holdings has demonstrated impressive financial health, with earnings growing at an average of 10.4% annually over the past five years. This growth is bolstered by a significant net profit margin increase to 11.2% from 4% last year, reflecting enhanced operational efficiency. The company's return on equity stands at a strong 26.1%, indicating effective use of shareholder funds. YETI's strategic focus on product innovation, as highlighted by CFO Maria Lycouris, has resulted in a 10% uplift in margins, showcasing its ability to meet customer demands and drive profitability. Furthermore, its trading price of $38.66, well below the SWS fair ratio of $102.73, suggests potential for market appreciation.

Challenges Constraining YETI Holdings's Potential

YETI faces challenges with its earnings growth forecasted at 8.4%, trailing the broader US market's 15.4%. Revenue growth projections of 6.8% also fall short of the target 20%, indicating potential market saturation or competitive pressures. CEO Matthew Reintjes acknowledged supply chain inefficiencies impacting overall efficiency, a critical area needing improvement to sustain growth. Rising raw material costs, as noted by Maria Lycouris, further pressure margins, necessitating strategic cost management to maintain profitability.

Growth Avenues Awaiting YETI Holdings

Opportunities abound for YETI, particularly in international markets like Europe and Asia, where it plans to expand its footprint. This expansion aligns with its strategic acquisitions and share repurchase plans, as stated by CEO Matt Reintjes, leveraging a strong cash position. Additionally, investing in digital capabilities to enhance online presence and customer engagement is a priority, aligning with market trends and potentially boosting sales. Analysts agree on a potential stock price rise exceeding 20%, reflecting confidence in YETI's growth trajectory.

External Factors Threatening YETI Holdings

Economic headwinds pose a risk, with potential downturns affecting consumer spending, as highlighted by Matthew Reintjes. Supply chain disruptions remain a concern, with ongoing efforts to mitigate these risks, as emphasized by Maria Lycouris. Additionally, navigating complex regulatory challenges requires vigilance to ensure compliance and avoid penalties, as noted by Thomas Shaw. These external factors could impact YETI's operations and market share if not effectively managed.

To learn about how YETI Holdings's valuation metrics are shaping its market position, check out our detailed analysis of YETI Holdings's Valuation.Explore the current health of YETI Holdings and how it reflects on its financial stability and growth potential.Conclusion

YETI Holdings has shown strong financial health with impressive earnings growth and a significant increase in net profit margins, reflecting its operational efficiency and effective use of shareholder funds. The company's earnings and revenue growth projections are below market averages, highlighting challenges such as supply chain inefficiencies and rising raw material costs that need strategic management to sustain profitability. However, YETI's planned international expansion and investments in digital capabilities present significant growth opportunities, potentially boosting sales and market presence. With its current trading price of $38.66, significantly below the estimated fair value of $102.73, there is a substantial opportunity for market appreciation, suggesting that the company's strategic initiatives could enhance future performance and investor confidence.

Key Takeaways

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YETI

YETI Holdings

Designs, retails, and distributes outdoor products under the YETI brand name.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives