- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Will Disappointing Results and Guidance Cut Change Whirlpool’s (WHR) Long-Term Investment Narrative?

Reviewed by Simply Wall St

- In its latest quarterly update, Whirlpool reported a 5.5% year-over-year decrease in sales and a 44% decline in adjusted earnings per share, alongside lowered full-year free cash flow, adjusted EPS, and EBIT margin guidance.

- This combination of disappointing results and a cut in outlook has heightened investor focus on the company's ability to manage near-term challenges despite leadership stressing confidence in long-term domestic manufacturing and housing demand fundamentals.

- With Whirlpool lowering its annual outlook, we'll explore what this means for the company's investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Whirlpool Investment Narrative Recap

To be a Whirlpool shareholder today means believing the company can overcome persistent headwinds from sluggish demand, global competition, and margin pressure, particularly as near-term catalysts are tied to stabilization in consumer sentiment and housing activity. The latest sales and earnings miss, along with lowered guidance, directly clouds these short-term drivers and signals that margin recovery and product mix improvement remain the most urgent challenges for the business.

Among recent company actions, the reduction of Whirlpool's annual dividend back to pre-pandemic levels stands out, underscoring cautious cash flow management amid ongoing earnings and margin volatility. For current and prospective investors, this announcement is especially relevant as it aligns with the second quarter earnings update and highlights a more conservative stance on capital returns while operational and demand risks remain elevated.

But while new product launches and long-term housing demand trends are positives, investors should be especially mindful of how global competitive pressures could...

Read the full narrative on Whirlpool (it's free!)

Whirlpool's narrative projects $15.8 billion in revenue and $741.4 million in earnings by 2028. This requires a -0.6% annual revenue decline and an earnings increase of $887.4 million from the current earnings of -$146.0 million.

Uncover how Whirlpool's forecasts yield a $96.50 fair value, in line with its current price.

Exploring Other Perspectives

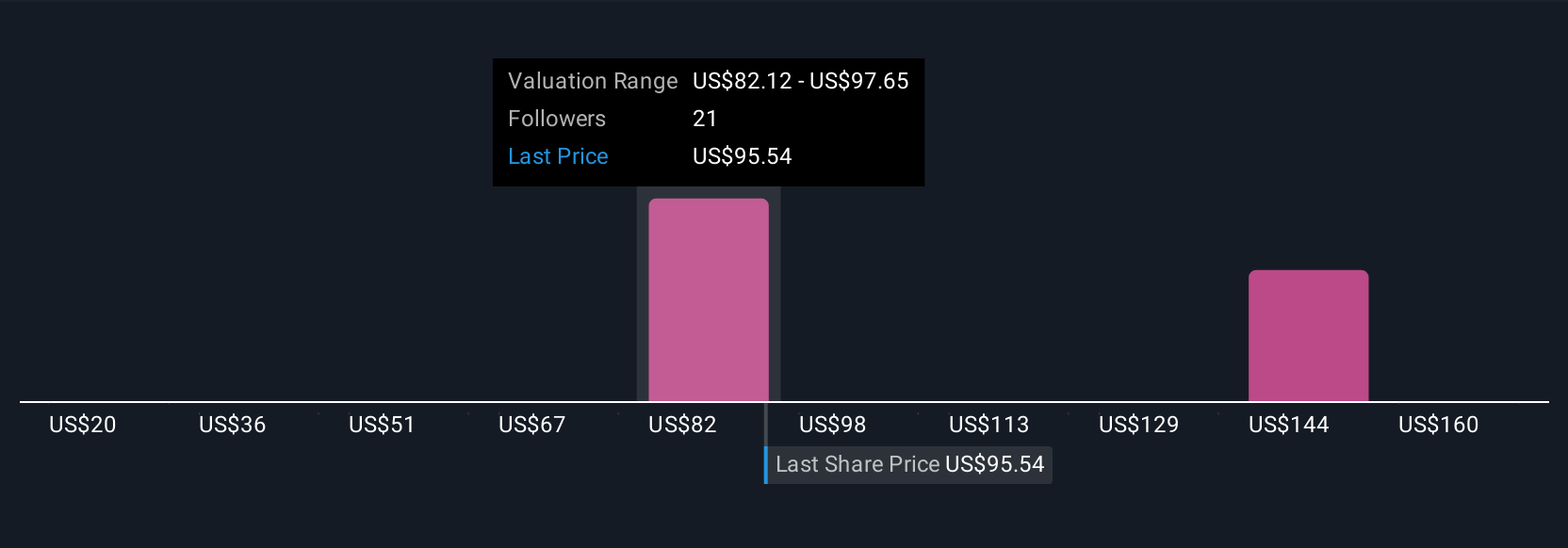

Four members of the Simply Wall St Community offered fair value estimates between US$20 and US$175.29 per share for Whirlpool. Many focus on the threat from low-cost Asian competitors, a risk which could weigh on margins and future recovery potential.

Explore 4 other fair value estimates on Whirlpool - why the stock might be worth less than half the current price!

Build Your Own Whirlpool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whirlpool research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Whirlpool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whirlpool's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives