- United States

- /

- Consumer Durables

- /

- NYSE:WHR

Prolonged US Government Shutdown Could Be a Game Changer for Whirlpool (WHR)

Reviewed by Sasha Jovanovic

- In the past week, Whirlpool shares have reacted to growing investor concerns as the U.S. government shutdown extended into its seventh day, creating economic uncertainty and affecting multiple sectors. Delays in releasing key economic data and operational challenges, such as Federal Aviation Administration staffing issues, are fueling broader market anxiety that is impacting consumer durables companies.

- Analysts note that in this environment, Whirlpool's risk profile is intensified by underwhelming sales trends and weakening returns on capital, making external shocks like the government shutdown even more significant for investors considering the company's future outlook.

- We'll examine how the heightened economic uncertainty from the U.S. government shutdown could reshape Whirlpool's investment narrative and growth prospects.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Whirlpool Investment Narrative Recap

Owning shares of Whirlpool means believing in the long-term potential of its core appliance brands, global expansion, and ability to innovate, even in mature markets. The current U.S. government shutdown is adding to short-term uncertainty and could make underwhelming sales trends and compressed profit margins more challenging, but the impact on immediate catalysts such as ongoing cost-cutting initiatives appears limited for now.

One recent announcement that stands out against this economic backdrop is Whirlpool’s decision in July to reduce its annual dividend to US$3.60 per share from the previous higher payout, a move reflecting cautious management as earnings and free cash flow remain pressured. This action provides context for assessing whether the company’s efforts to preserve flexibility will be enough to offset muted sales momentum and subdued forecasts.

Yet, in contrast to Whirlpool's historical reputation for steady returns, investors should be aware of...

Read the full narrative on Whirlpool (it's free!)

Whirlpool is projected to reach $15.8 billion in revenue and $741.4 million in earnings by 2028. This outlook assumes a 0.6% annual revenue decline and an earnings increase of $887.4 million from the current earnings of -$146.0 million.

Uncover how Whirlpool's forecasts yield a $96.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

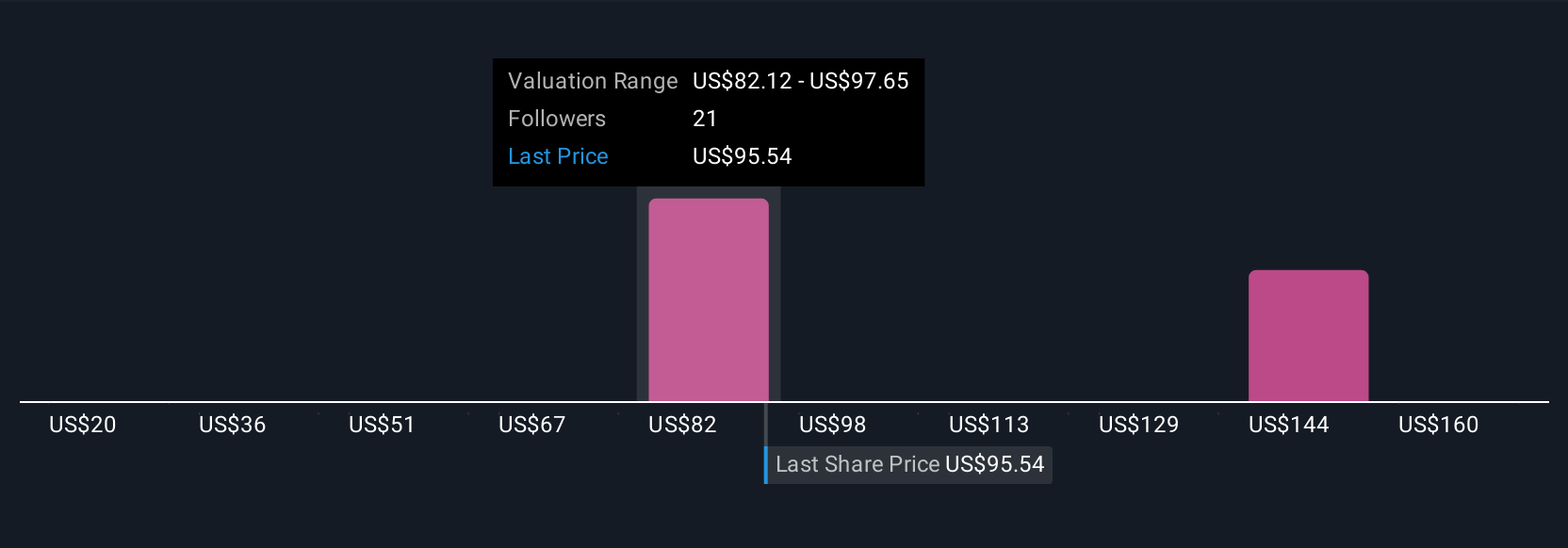

Members of the Simply Wall St Community submitted five fair value estimates for Whirlpool stock, ranging from US$20 to US$175.29. With sales trends weakening and key markets showing signs of recession, these varied opinions show just how much future industry pressures could shape your own outlook.

Explore 5 other fair value estimates on Whirlpool - why the stock might be worth over 2x more than the current price!

Build Your Own Whirlpool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whirlpool research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Whirlpool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whirlpool's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHR

Whirlpool

Manufactures and markets home appliances and related products and services in the North America, Latin America, Asia, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives