- United States

- /

- Luxury

- /

- NYSE:VFC

V.F Corporation (VFC): Assessing Valuation After New Class Action Lawsuits and Ongoing Investor Scrutiny

Reviewed by Kshitija Bhandaru

V.F (NYSE:VFC) is now facing a series of class action lawsuits from multiple law firms. The lawsuits allege the company made false and misleading statements on key financial topics, including revenue outlook and performance of its Vans brand.

See our latest analysis for V.F.

V.F’s share price has seen some volatility this year, with a recent 3.06% daily gain offset by a longer-term decline and an impressive 22.5% jump over the past 90 days. That momentum, however, comes after tough headlines. The one-year total shareholder return is still down 24%, and five-year returns have slipped by more than 75%, reflecting persistent market skepticism about the turnaround story.

If you’re weighing the big picture or hunting for your next opportunity, now’s the perfect moment to broaden your outlook and explore fast growing stocks with high insider ownership.

With these legal headwinds and a deeply negative five-year return, the question now is whether V.F’s current share price reflects all the risks and opportunities, or if there could be a genuine buying opportunity for value-focused investors.

Most Popular Narrative: 6.5% Undervalued

Compared to the recent close at $14.48, the consensus narrative suggests V.F's fair value should be higher at $15.49. This difference, while not massive, signals room for upside if narrative projections hold true.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement, expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Want to know why analysts are betting on digital and premium categories for V.F? The narrative's valuation hinges on a sharp profit turnaround and growth projections that defy recent history. Curious what's fueling this optimism on margins, earnings, and future multiples? Read on, the full story reveals some surprising numbers behind that fair value.

Result: Fair Value of $15.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines at Vans or renewed tariff pressures could undermine the optimism around V.F's turnaround and could weigh further on its recovery story.

Find out about the key risks to this V.F narrative.

Another View: Valuation Through Earnings Multiples

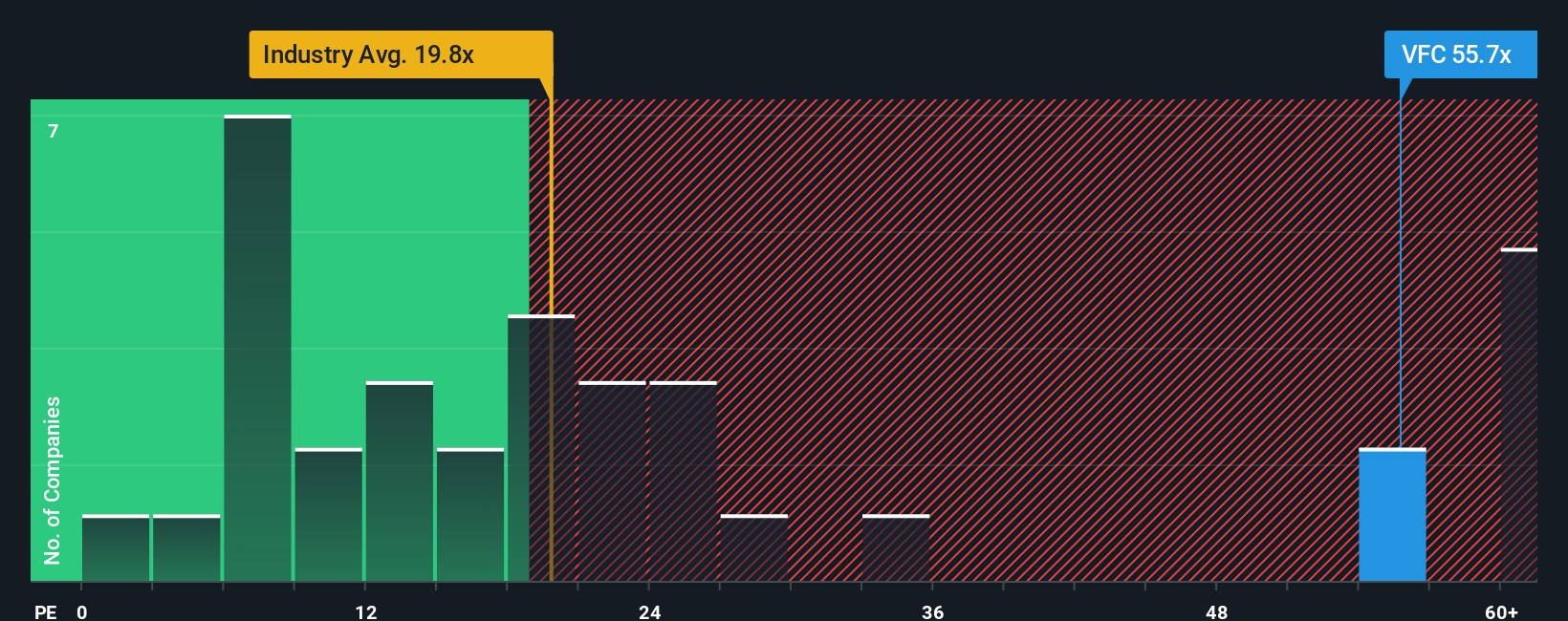

Looking at V.F's valuation through its price-to-earnings ratio, some red flags emerge. The company trades at 53.9x earnings, which is much higher than its US Luxury industry peers at 19.4x and even above its own fair ratio of 29.3x. This signals a valuation risk. When a stock trades so far above its sector and even its fundamental benchmarks, it raises real questions about the level of optimism already baked into the price. Could the market be overestimating V.F's turnaround story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own V.F Narrative

If you see things differently or prefer diving into the data firsthand, you can build your own V.F narrative in just a few minutes: Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by checking out stocks with powerful trends and compelling opportunities. Don’t let another breakthrough pass you by. Use the screener to target what matters now.

- Accelerate your potential for long-term income by reviewing these 18 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Stay ahead of market shifts by scouting these 881 undervalued stocks based on cash flows currently trading below their intrinsic value based on robust cash flow analysis.

- Ride the frontlines of technology by browsing these 25 AI penny stocks as artificial intelligence reshapes entire industries from the ground up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives