- United States

- /

- Luxury

- /

- NYSE:VFC

Steer Clear Of {avoid_company} With {hold_companies_count} Stronger Dividend Stock Alternative

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide a steady income stream. However, caution is warranted when a company's payout ratio becomes excessively high, as this could indicate that its dividends are not sustainable over the long term. In this article, we will explore two dividend stocks: one that presents an attractive investment opportunity and another that may pose risks due to its high payout ratio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.09% | ★★★★★★ |

| Globeride (TSE:7990) | 3.77% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.42% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

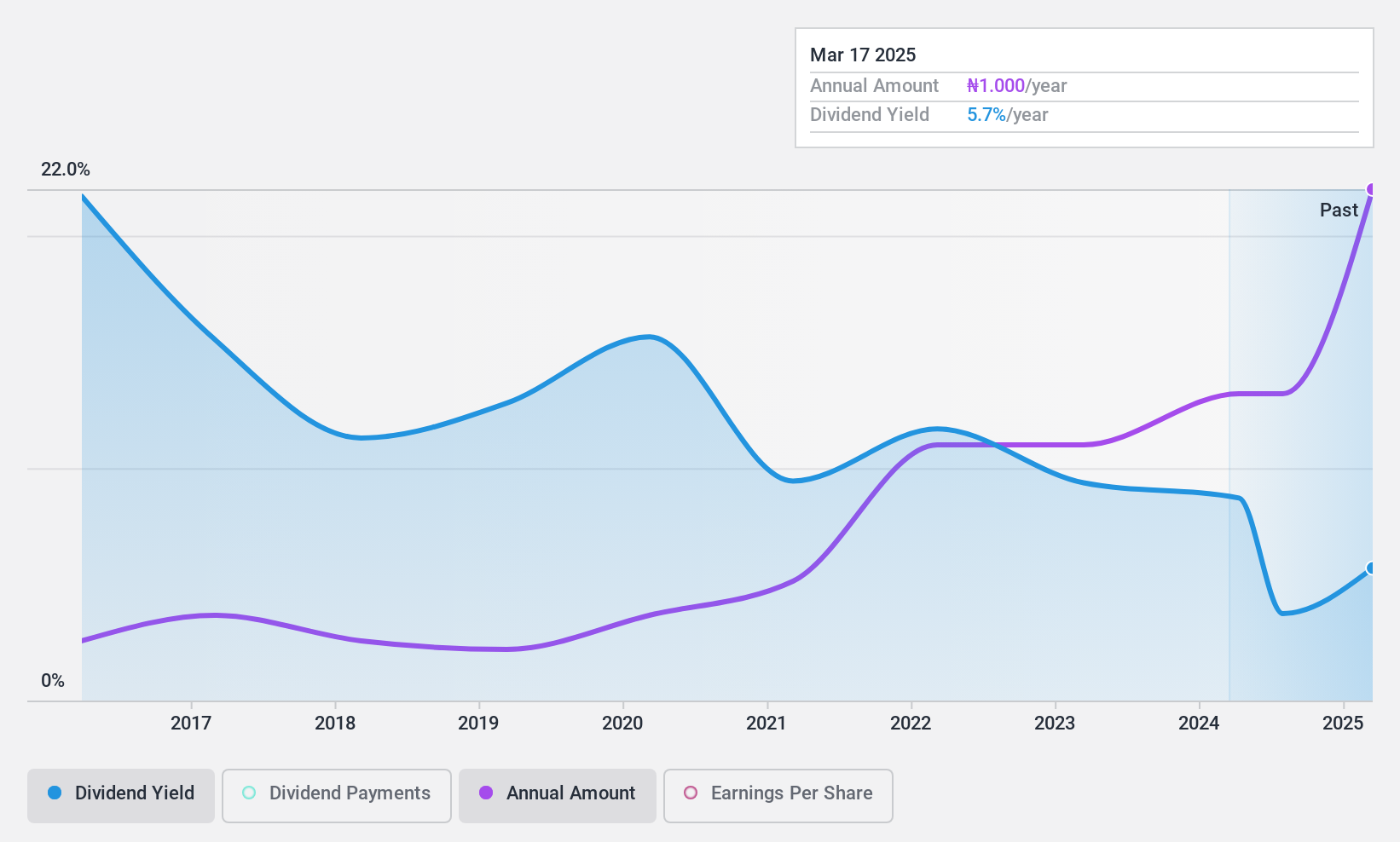

United Capital (NGSE:UCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Capital Plc operates in Nigeria, offering investment banking, portfolio management, securities trading, and trusteeship services with a market capitalization of approximately NGN 169.80 billion.

Operations: The company generates revenue primarily through brokerage services, totaling ₦20.62 billion.

Dividend Yield: 6.4%

United Capital Plc demonstrated robust financial performance with a notable increase in revenue to NGN 6.14 billion and net income to NGN 3.59 billion in Q1 2024, reflecting year-over-year growth. Despite a history of unstable and unreliable dividends over the past decade, UCAP maintains a sustainable dividend policy with an earnings payout ratio of 86% and a cash payout ratio at just 21.4%, significantly lower than companies facing risks from high payout ratios.

- Unlock comprehensive insights into our analysis of United Capital stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of United Capital shares in the market.

One To Reconsider

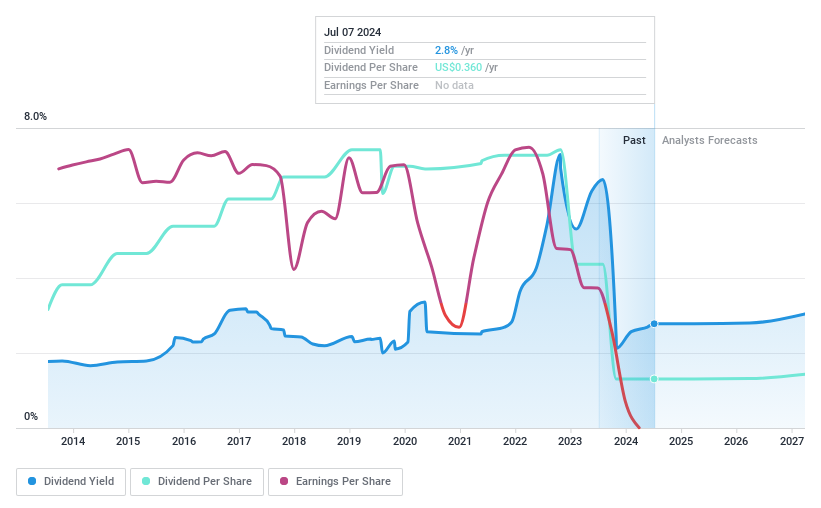

V.F (NYSE:VFC)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: V.F. Corporation operates in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories globally with a market cap of approximately $5.25 billion.

Operations: The company's revenue is segmented into Work ($0.89 billion), Active ($4.06 billion), and Outdoor ($5.50 billion).

Dividend Yield: 2.8%

V.F. Corporation's recent executive and board changes, including the appointment of Caroline Brown as Global Brand President of The North Face, indicate leadership restructuring but do not address underlying financial concerns. The company's high dividend payout ratio suggests that its dividends are not well-covered by earnings, posing risks to sustainability. Despite a low cash payout ratio indicating sufficient free cash flow coverage, the overall unprofitability and recent net losses highlight potential instability in maintaining dividend payments.

Make It Happen

- Embark on your investment journey to our 1964 Top Dividend Stocks selection here.

- Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives