- United States

- /

- Personal Products

- /

- NYSE:EL

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average showing significant gains entering the Thanksgiving holiday, investors are increasingly attentive to opportunities that may be trading below their estimated value. In such a buoyant environment, identifying stocks that are potentially undervalued can provide investors with strategic entry points to capitalize on broader market optimism while maintaining a focus on intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WEBTOON Entertainment (WBTN) | $14.55 | $28.24 | 48.5% |

| Sotera Health (SHC) | $17.37 | $33.57 | 48.3% |

| Old National Bancorp (ONB) | $21.89 | $41.49 | 47.2% |

| Nicolet Bankshares (NIC) | $126.76 | $242.17 | 47.7% |

| Li Auto (LI) | $18.32 | $34.93 | 47.6% |

| Huntington Bancshares (HBAN) | $16.18 | $31.33 | 48.4% |

| Freshworks (FRSH) | $12.35 | $24.01 | 48.6% |

| Fifth Third Bancorp (FITB) | $43.28 | $83.54 | 48.2% |

| Elastic (ESTC) | $69.53 | $135.76 | 48.8% |

| Advanced Micro Devices (AMD) | $206.13 | $397.53 | 48.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Estée Lauder Companies (EL)

Overview: The Estée Lauder Companies Inc. manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide with a market cap of approximately $33.65 billion.

Operations: The company's revenue is primarily derived from skin care ($7.01 billion), makeup ($4.20 billion), fragrance ($2.58 billion), and hair care products ($555 million).

Estimated Discount To Fair Value: 12.1%

Estée Lauder Companies, trading at US$91.94, is undervalued based on its discounted cash flow valuation with an estimated fair value of US$104.64. Although burdened by high debt, the company is expected to achieve profitability in three years with earnings growth forecasted at 49.17% annually, surpassing market growth expectations. Recent strategic initiatives include a partnership with Shopify and a follow-on equity offering of US$1 billion to bolster its digital infrastructure and consumer engagement strategies.

- Insights from our recent growth report point to a promising forecast for Estée Lauder Companies' business outlook.

- Click here to discover the nuances of Estée Lauder Companies with our detailed financial health report.

Fidelity National Information Services (FIS)

Overview: Fidelity National Information Services, Inc. (FIS) operates as a global provider of technology solutions for merchants, banks, and capital markets firms with a market cap of approximately $33.35 billion.

Operations: The company's revenue is primarily derived from its Banking Solutions segment at $7.14 billion and Capital Market Solutions at $3.13 billion, with an additional contribution from Corporate and Other amounting to $192 million.

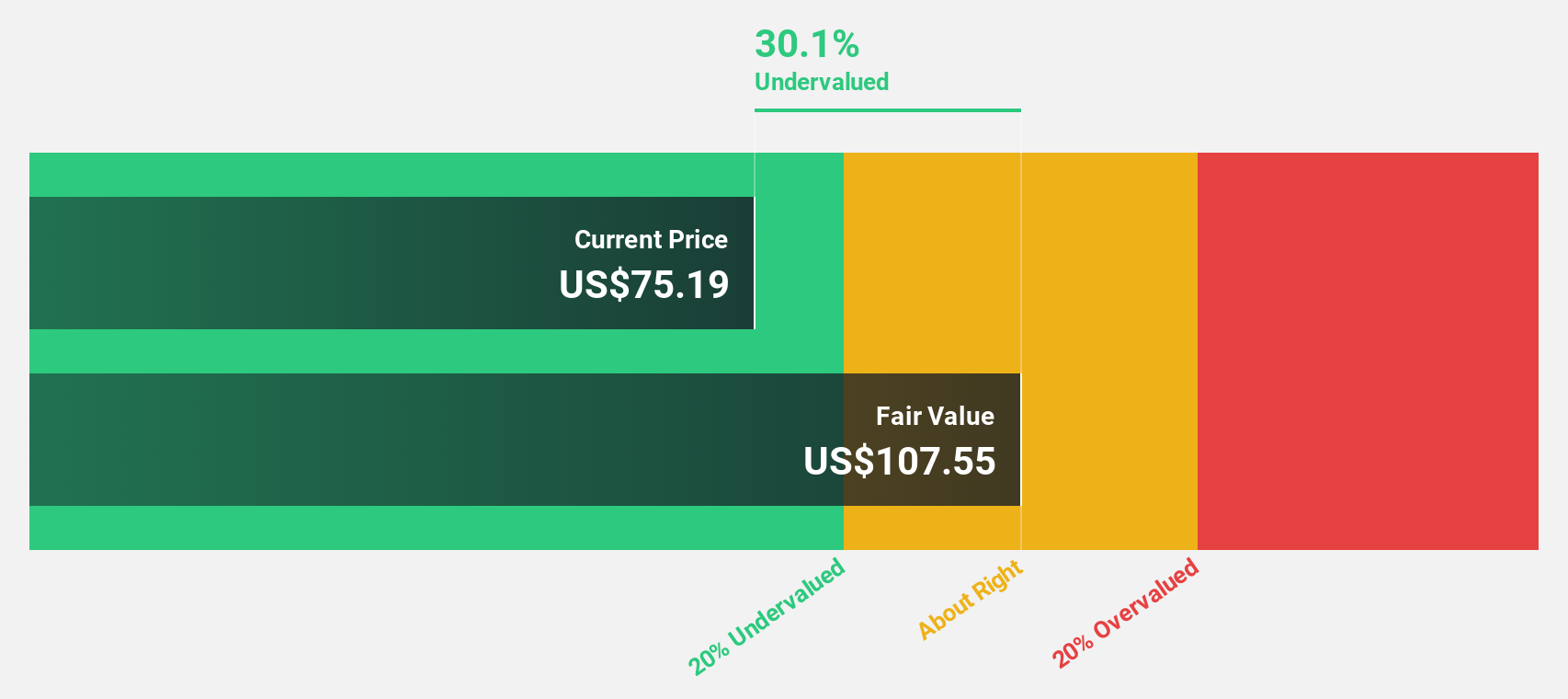

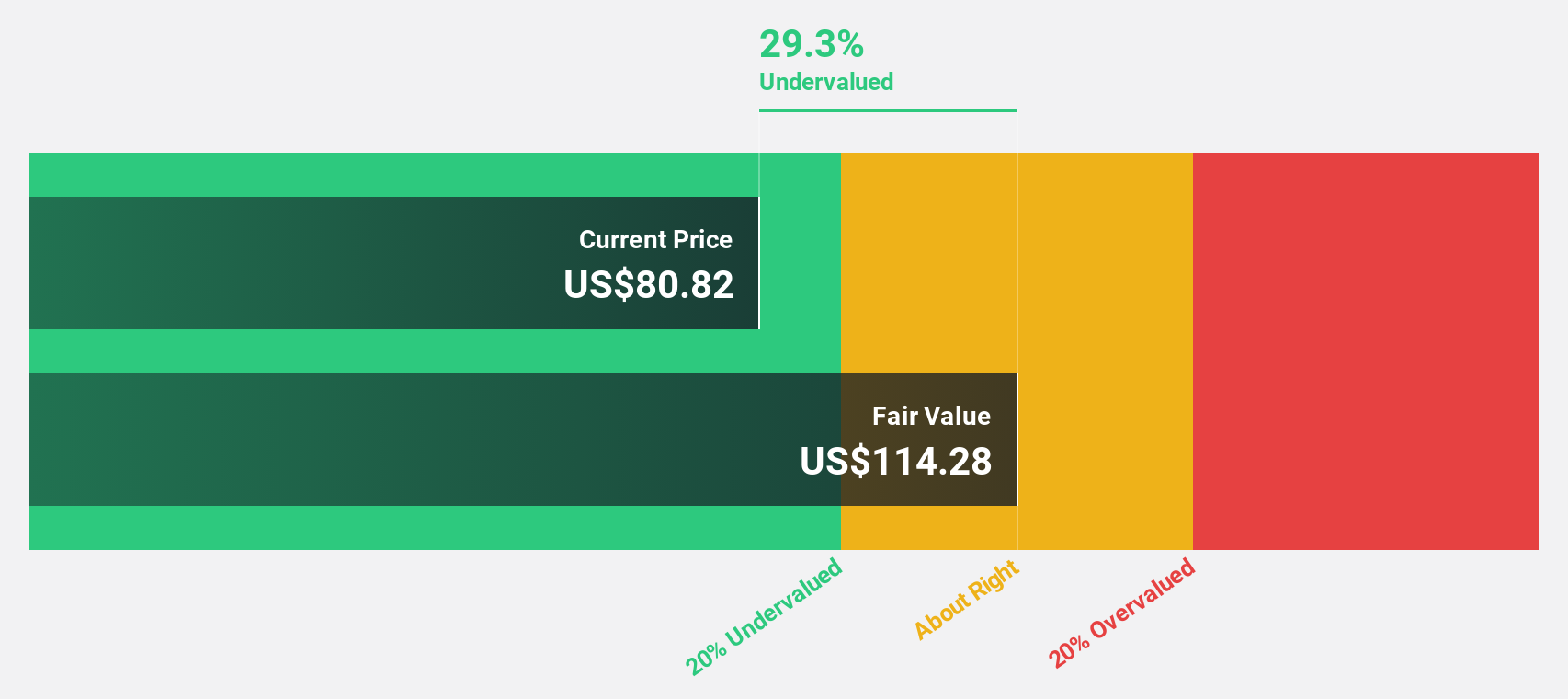

Estimated Discount To Fair Value: 42.5%

Fidelity National Information Services (FIS), trading at US$65.65, is significantly undervalued with a fair value estimate of US$114.21 based on discounted cash flow analysis. Despite high debt levels and a current net profit margin of 1.7%, FIS's earnings are projected to grow substantially at 49.1% annually over the next three years, outpacing the broader market growth rate of 15.9%. Recent initiatives include enhancing cloud-based solutions and expanding digital finance capabilities, supporting operational efficiency and potential revenue growth opportunities in the financial services sector.

- Our expertly prepared growth report on Fidelity National Information Services implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Fidelity National Information Services.

V.F (VFC)

Overview: V.F. Corporation, along with its subsidiaries, provides branded apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific region with a market capitalization of approximately $6.74 billion.

Operations: The company's revenue segments include Active at $2.95 billion and Outdoor at $5.73 billion.

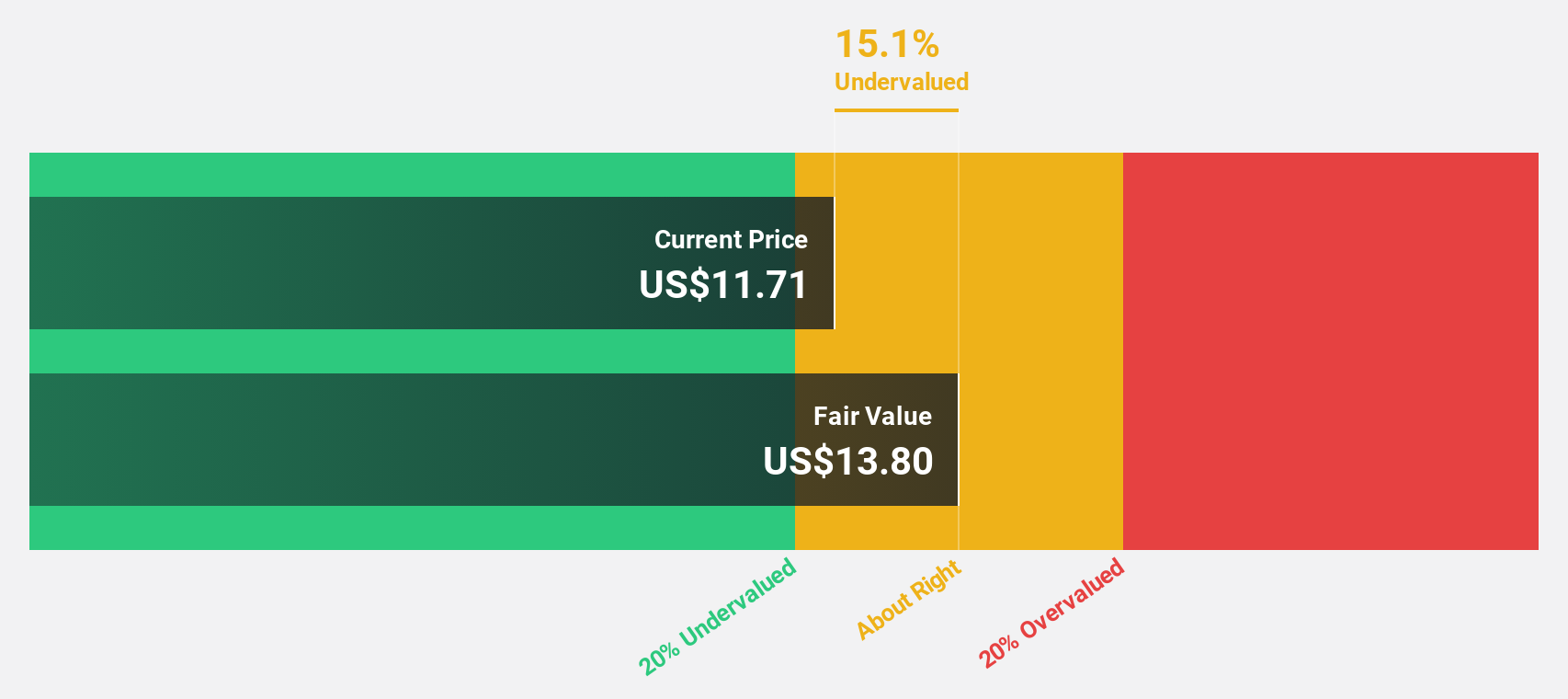

Estimated Discount To Fair Value: 14.1%

V.F. Corporation, with a trading price of US$17.24, is undervalued relative to its fair value estimate of US$20.08 based on discounted cash flow analysis. Recent earnings show a significant improvement in net income from the previous year, yet the dividend yield of 2.09% lacks coverage by current earnings. The company's debt levels are concerning as they are not well-supported by operating cash flow, despite forecasts indicating substantial annual earnings growth of 33.73%.

- Upon reviewing our latest growth report, V.F's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of V.F stock in this financial health report.

Taking Advantage

- Delve into our full catalog of 208 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success