- United States

- /

- Luxury

- /

- NYSE:UAA

Is Under Armour’s 40% Drop in 2025 an Opportunity for Investors?

Reviewed by Bailey Pemberton

Thinking about what to do with your Under Armour shares right now? You're not alone. The stock has caught the eye of a lot of investors lately, and for good reason. Under Armour's share price has been under serious pressure this year, sliding 40.1% year to date and clocking a tough 62.2% decline over the last five years. Even just in the last 30 days, it's down 5.6%. That's not the kind of return any of us are after. So, what's driving this negative streak? Is it a warning sign, or could it actually spell opportunity?

Part of what's weighing on Under Armour has been shifting sentiment all across the athletic apparel sector, not to mention changing consumer habits and intense competition. Some market watchers speculate that adjusting strategies from industry giants is putting extra pressure on smaller brands. But even with recent headlines swirling and all that red on the performance charts, the story isn't finished for this company.

Looking at valuation specifically, Under Armour's current value score is 2 out of 6 possible checks on undervaluation. That means it's ticking the boxes for two of the standard value metrics analysts like to see, but there are some gaps. Of course, as most savvy investors know, valuation models are just the starting point. Let’s break down those valuation methods next and stick around, because at the end, we’ll talk about an even better way to see what the market might be missing.

Under Armour scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Under Armour Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. For Under Armour, the DCF method looks ahead to see what the company's potential free cash flow (FCF) could be, helping investors judge whether the stock price fairly reflects those expectations.

According to the latest figures, Under Armour's most recent annual free cash flow stands at -$310.7 million, meaning the company is currently burning cash. Analyst projections suggest the business will return to positive cash flow over the next several years, with free cash flow estimated to reach $75 million by 2030. Initially, estimates are generated by analysts for the next five years. Forecasts beyond that are extrapolated by data providers, offering a longer-term view of possible performance.

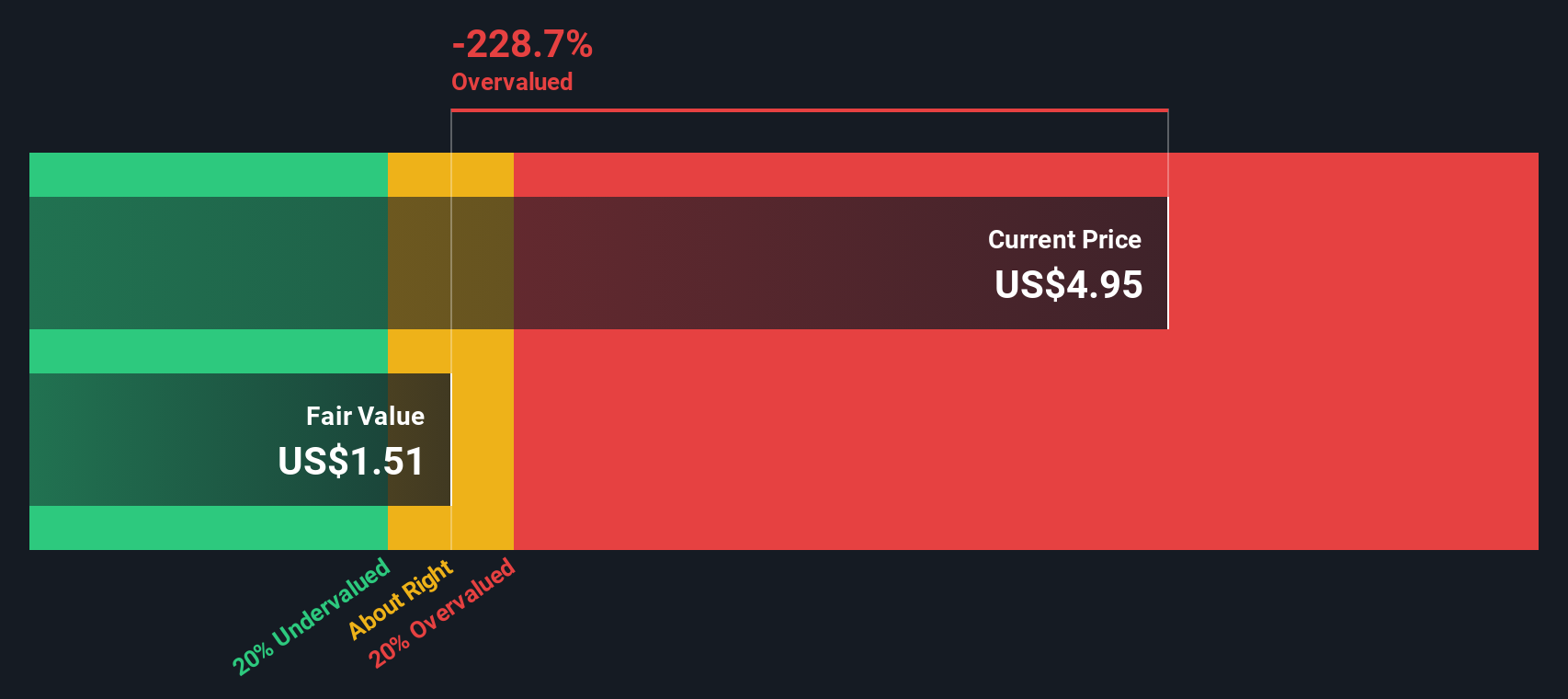

After crunching the numbers, the DCF model assigns Under Armour an intrinsic value of about $1.52 per share. However, when compared to the current market price, the DCF calculation implies the stock is around 219.8% overvalued based on today's cash flow outlook. That is a significant gap and suggests the share price is running well ahead of what is expected from future business performance.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Under Armour may be overvalued by 219.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Under Armour Price vs Earnings

The price-to-earnings (PE) ratio is a popular way to value profitable companies like Under Armour. Since it compares the company's share price to its earnings, it gives investors a sense of how much they are paying for each dollar of profit. Generally, higher PE ratios can be justified for faster-growing companies or those perceived as less risky. Slower growth or higher risk usually leads to lower PE ratios.

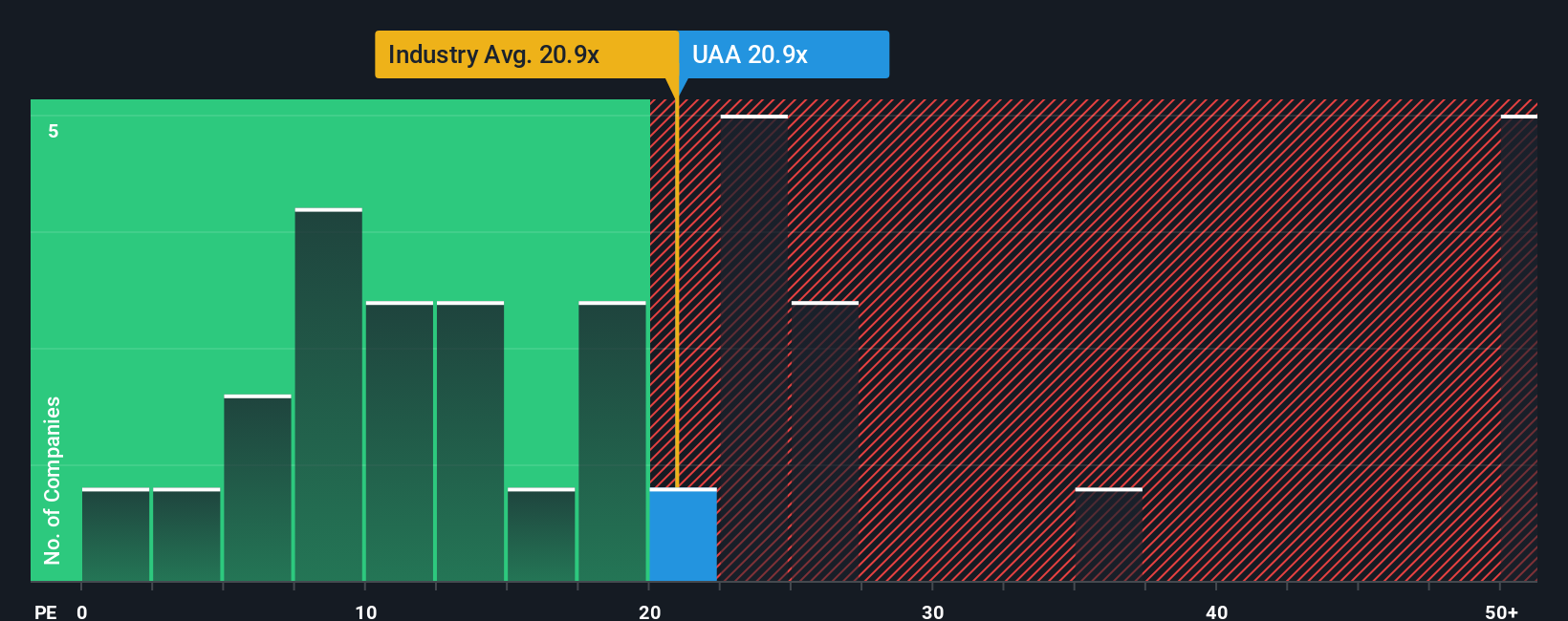

Currently, Under Armour trades at a PE ratio of 20.5x. This lines up closely with the broader luxury sector’s average PE of 20.5x and is a bit above the peer group average of 14.7x. On the surface, this suggests investors are willing to pay a slight premium for Under Armour compared to some direct competitors.

However, there is more nuance to finding a “fair” valuation than simply matching industry or peer multiples. That is where Simply Wall St's proprietary Fair Ratio comes in. The Fair Ratio for Under Armour is 25.6x, a figure that factors in the company's expected earnings growth, profit margins, industry trends, market capitalization, and unique business risks. Unlike the blunt tool of comparing raw PE ratios, this approach provides a fuller picture of what is reasonable for Under Armour right now.

Comparing these numbers, Under Armour’s actual PE (20.5x) is below its Fair Ratio (25.6x), indicating the stock is undervalued according to this tailored benchmark.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Under Armour Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story: the way you connect what is happening at Under Armour to your own expectations for its future revenue, earnings, margins, and ultimately its fair value. Narratives take you beyond the standard valuation ratios by anchoring your perspective in numbers and real company drivers, turning forecasts into actionable insights. On Simply Wall St's Community page, millions of investors use Narratives as an easy tool to map out their reasoning, compare with others, and update their view as fresh news or earnings come in automatically.

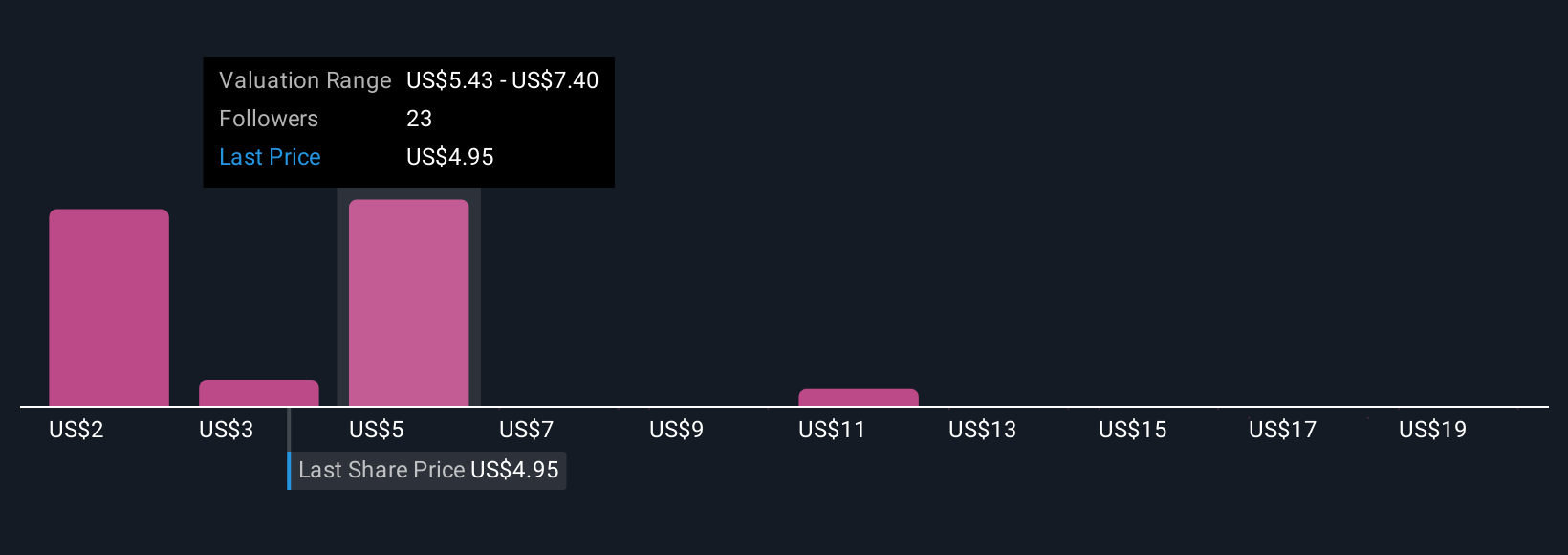

With Narratives, you can test your decision by seeing how your fair value stacks up against the current market price and get notified when new information changes the outlook. For example, one Narrative for Under Armour assumes strong global brand expansion and higher margins, leading to a fair value as high as $13.80. Another Narrative takes a more cautious view on earnings risks and sets a fair value at just $4.00, highlighting the range of perspectives that are powering smarter, timely decisions on the platform.

Do you think there's more to the story for Under Armour? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives