- United States

- /

- Consumer Durables

- /

- NYSE:TPX

65% Of This Tempur Sealy International Insider's Holdings Were Sold

Looking at Tempur Sealy International, Inc.'s (NYSE:TPX ) insider transactions over the last year, we can see that insiders were net sellers. That is, there were more number of shares sold by insiders than there were purchased.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

Check out our latest analysis for Tempur Sealy International

The Last 12 Months Of Insider Transactions At Tempur Sealy International

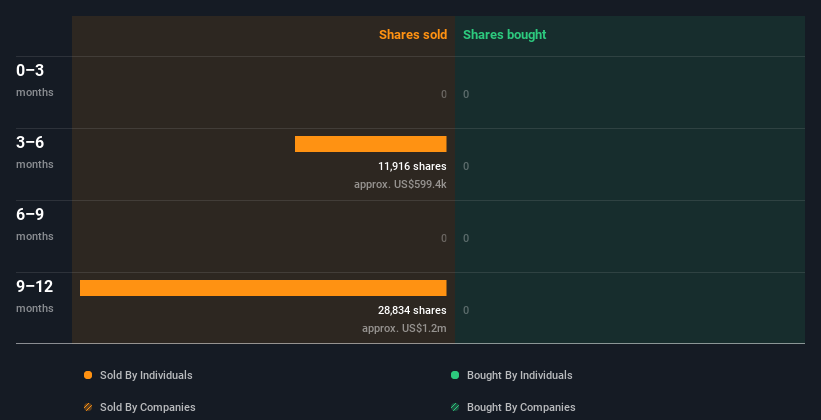

Over the last year, we can see that the biggest insider sale was by the Executive Vice President of International, Hansbart Wijnand, for US$1.2m worth of shares, at about US$42.51 per share. That means that even when the share price was below the current price of US$46.77, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was 65% of Hansbart Wijnand's holding. Hansbart Wijnand was the only individual insider to sell shares in the last twelve months.

Hansbart Wijnand ditched 40.75k shares over the year. The average price per share was US$44.79. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insider Ownership

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Tempur Sealy International insiders own 3.3% of the company, worth about US$264m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Tempur Sealy International Insider Transactions Indicate?

There haven't been any insider transactions in the last three months -- that doesn't mean much. While we feel good about high insider ownership of Tempur Sealy International, we can't say the same about the selling of shares. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we found 1 warning sign for Tempur Sealy International that deserve your attention before buying any shares.

But note: Tempur Sealy International may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Tempur Sealy International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPX

Tempur Sealy International

Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

Adequate balance sheet with acceptable track record.