- United States

- /

- Luxury

- /

- NYSE:TPR

Here's Why We Think Tapestry, Inc.'s (NYSE:TPR) CEO Compensation Looks Fair for the time being

Key Insights

- Tapestry will host its Annual General Meeting on 2nd of November

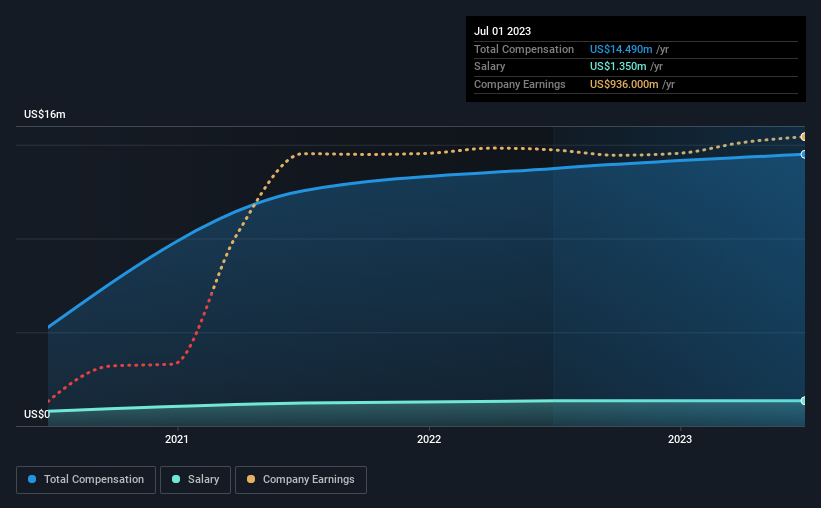

- CEO Joanne Crevoiserat's total compensation includes salary of US$1.35m

- Total compensation is similar to the industry average

- Tapestry's EPS grew by 71% over the past three years while total shareholder return over the past three years was 32%

CEO Joanne Crevoiserat has done a decent job of delivering relatively good performance at Tapestry, Inc. (NYSE:TPR) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 2nd of November. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Tapestry

Comparing Tapestry, Inc.'s CEO Compensation With The Industry

At the time of writing, our data shows that Tapestry, Inc. has a market capitalization of US$6.4b, and reported total annual CEO compensation of US$14m for the year to July 2023. That's a fairly small increase of 5.5% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.4m.

On comparing similar companies from the American Luxury industry with market caps ranging from US$4.0b to US$12b, we found that the median CEO total compensation was US$14m. This suggests that Tapestry remunerates its CEO largely in line with the industry average. Furthermore, Joanne Crevoiserat directly owns US$7.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.4m | US$1.3m | 9% |

| Other | US$13m | US$12m | 91% |

| Total Compensation | US$14m | US$14m | 100% |

Speaking on an industry level, nearly 24% of total compensation represents salary, while the remainder of 76% is other remuneration. In Tapestry's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Tapestry, Inc.'s Growth

Tapestry, Inc. has seen its earnings per share (EPS) increase by 71% a year over the past three years. Revenue was pretty flat on last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Tapestry, Inc. Been A Good Investment?

Tapestry, Inc. has served shareholders reasonably well, with a total return of 32% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for Tapestry that investors should be aware of in a dynamic business environment.

Switching gears from Tapestry, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPR

Tapestry

Provides luxury accessories and branded lifestyle products in North America, Greater China, rest of Asia, and internationally.

Adequate balance sheet average dividend payer.