- United States

- /

- Consumer Durables

- /

- NYSE:TPH

Tri Pointe Homes (TPH): Assessing Valuation Following PEOPLE® List Recognition and Coastal Carolinas Leadership Move

Reviewed by Simply Wall St

Most Popular Narrative: 8.2% Undervalued

According to community narrative, Tri Pointe Homes is currently viewed as undervalued, with a consensus price target that sits notably above the present share price.

Strategic discipline in land acquisition, strong liquidity ($1.4B), and active inventory management contribute to a robust lot pipeline. This provides flexibility to capitalize on growth opportunities, potentially supporting steady backlog conversion, reducing the risk of asset write-downs, and improving return on equity.

Curious how analysts justify this bullish valuation? The narrative is based on significant shifts in future earnings and profit margins, with aggressive share repurchases included as well. Interested in the hidden assumptions driving this optimistic price? The essential details are in the numbers analysts are betting on.

Result: Fair Value of $39.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent softness in core markets and reliance on affluent buyers could threaten Tri Pointe’s ability to maintain margins and protect long-term growth.

Find out about the key risks to this Tri Pointe Homes narrative.Another View: Discounted Cash Flow Analysis

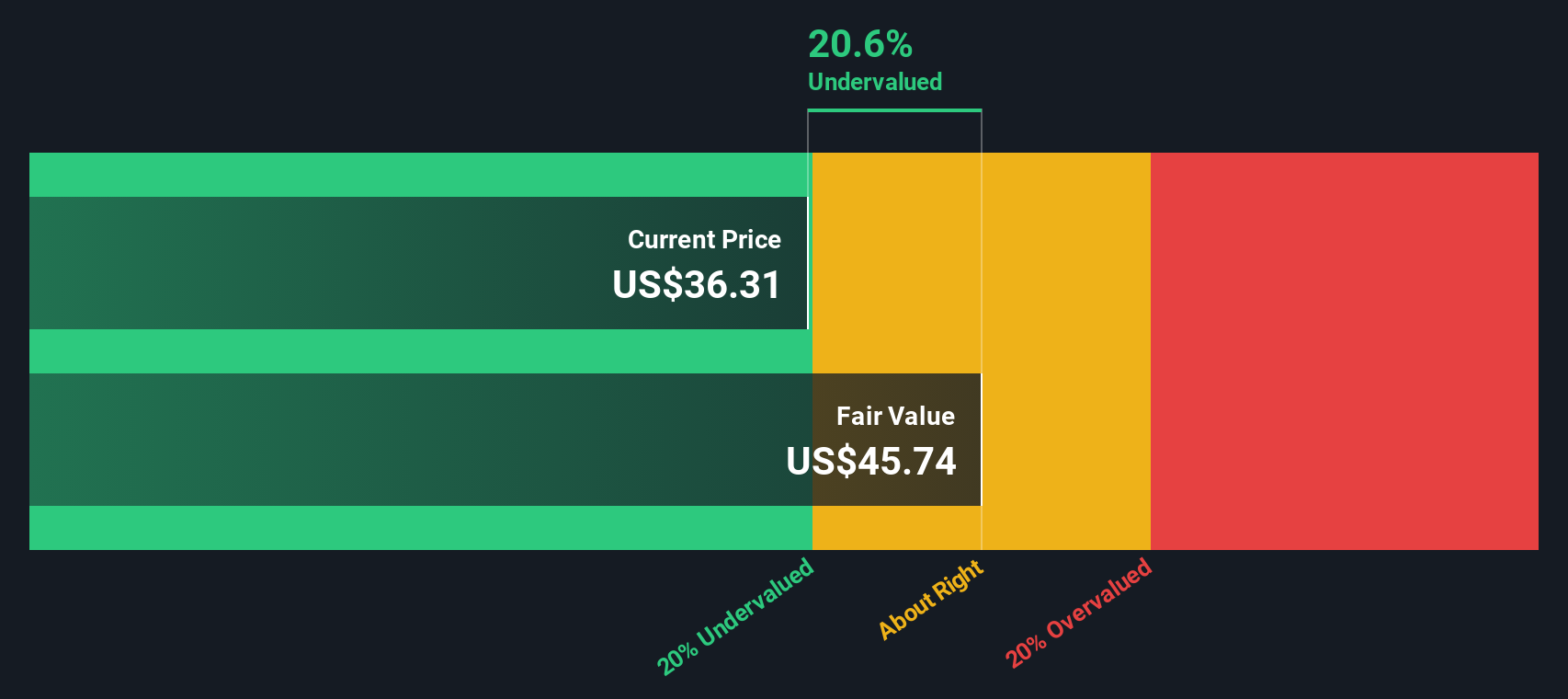

Taking a different angle, the SWS DCF model also suggests Tri Pointe Homes is undervalued. This supports the earlier narrative. However, how much trust can we place in these forecasts given current industry headwinds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tri Pointe Homes Narrative

If you see things differently or want to dig into the numbers yourself, crafting a custom narrative is quick and easy with do it your way.

A great starting point for your Tri Pointe Homes research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize the chance to stay ahead by tracking unique stock trends beyond Tri Pointe Homes. The market offers a wide range of standout opportunities, and having the right tools can make a significant difference. Explore these investment ideas using the Simply Wall Street Screener for a smarter approach:

- Discover which penny stocks with strong financials are surprising Wall Street with consistent earnings by using penny stocks with strong financials.

- Find reliable returns by identifying dividend stocks with yields above 3% that reward investors consistently, all thanks to dividend stocks with yields > 3%.

- Explore the future with AI penny stocks positioned for rapid innovation, easily located through AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tri Pointe Homes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPH

Tri Pointe Homes

Engages in the design, construction, and sale of single-family attached and detached homes in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives