- United States

- /

- Consumer Durables

- /

- NYSE:TPH

How Expanded Credit and a Positive S&P Outlook at Tri Pointe Homes (TPH) Has Changed Its Investment Story

Reviewed by Simply Wall St

- On September 18, 2025, Tri Pointe Homes entered into a modified credit agreement, increasing its term loan facility to US$450 million, splitting it into two tranches, and securing maturity extensions and additional flexibility.

- This update coincided with S&P Global Ratings revising its outlook for the company to positive, based on strong credit metrics and a resilient balance sheet.

- We'll examine how this expanded credit facility and improved outlook may shape Tri Pointe Homes' investment narrative going forward.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tri Pointe Homes Investment Narrative Recap

To be a Tri Pointe Homes shareholder, you need to believe that the company can rebound from recent home order weakness and capitalize on long-term housing demand despite ongoing affordability pressures and margin risks. The expanded credit facility announced on September 18, 2025, adds financial flexibility but does not fundamentally change the immediate catalyst, which remains a stabilization or improvement in home orders and absorption rates, nor does it alter concerns around local market softness and future inventory impairments.

Of the recent headlines, Tri Pointe's ongoing expansions in high-growth Sun Belt and Southeastern markets stand out as most relevant, as these initiatives directly address one of the biggest business catalysts, broadening the company’s footprint to offset regional demand softness and tap into favorable demographic shifts. This regional diversification may offer some buffer against concentration risks and margin volatility if demand conditions worsen in core Western markets.

By contrast, investors should be aware that persistent order weakness compared to competitors continues to raise questions about...

Read the full narrative on Tri Pointe Homes (it's free!)

Tri Pointe Homes is projected to generate $3.2 billion in revenue and $193.6 million in earnings by 2028. This forecast reflects a 7.5% annual decline in revenue and a $172.2 million decrease in earnings from current earnings of $365.8 million.

Uncover how Tri Pointe Homes' forecasts yield a $39.40 fair value, a 18% upside to its current price.

Exploring Other Perspectives

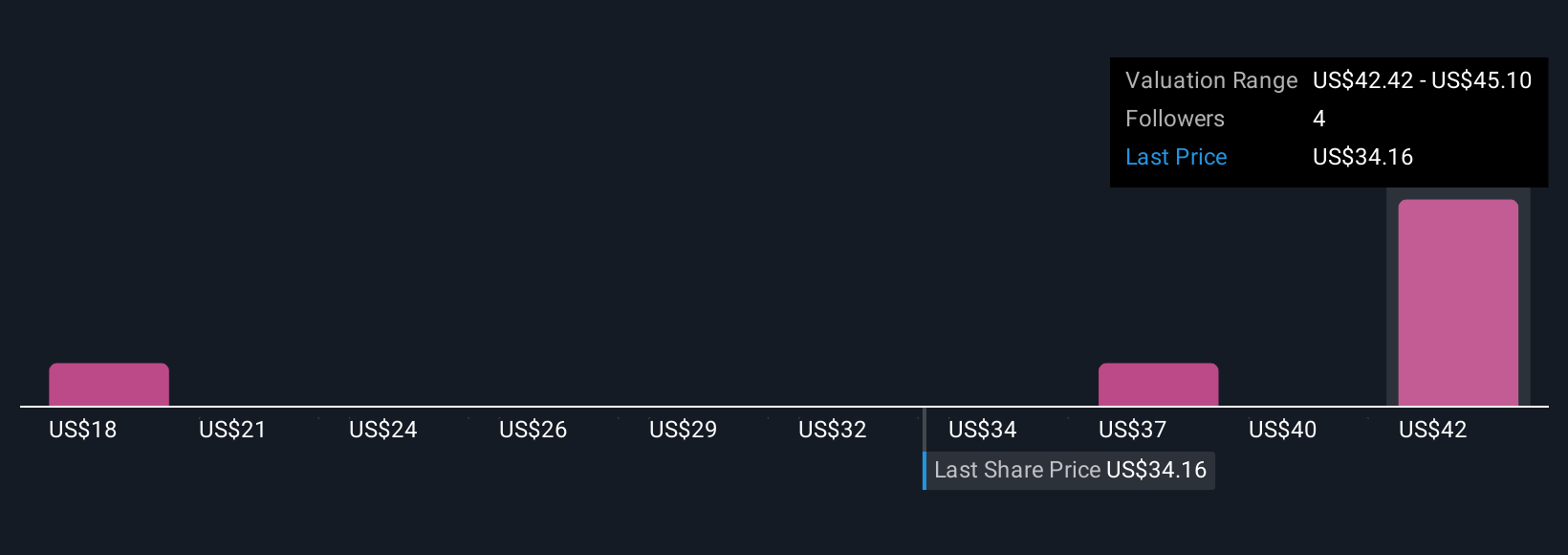

Three fair value estimates from the Simply Wall St Community range from US$18.35 to US$45.10, revealing broad differences in company outlooks. While many see upside in geographic expansion, you should also consider how continued home order declines versus peers could influence future revenue and margins, explore how others evaluate these shifting risks and expectations.

Explore 3 other fair value estimates on Tri Pointe Homes - why the stock might be worth 45% less than the current price!

Build Your Own Tri Pointe Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tri Pointe Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tri Pointe Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tri Pointe Homes' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tri Pointe Homes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPH

Tri Pointe Homes

Engages in the design, construction, and sale of single-family attached and detached homes in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives