- United States

- /

- Consumer Durables

- /

- NYSE:TPH

Did Falling Backlog and Lower Guidance Just Shift Tri Pointe Homes' (TPH) Investment Narrative?

Reviewed by Sasha Jovanovic

- In late November 2025, Tri Pointe Homes reported that its average backlog had fallen 11.2% over the past two years, accompanied by projections of a 17.8% sales decline over the coming year and a 7.5% annual decrease in earnings per share during the same period.

- This combination of falling backlog, weakening demand projections, and declining profitability highlights operational headwinds likely impacting the company's ability to sustain sales momentum.

- We'll now explore how ongoing backlog declines could shape Tri Pointe Homes' broader investment narrative and future outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Tri Pointe Homes Investment Narrative Recap

To be a shareholder in Tri Pointe Homes today, you need to believe in the company’s ability to benefit from the long-term housing supply-demand imbalance and leverage its expansion into new growth markets. However, the recently reported 11.2% decline in backlog and anticipated double-digit declines in sales and earnings directly challenge the most important short-term catalyst, stabilizing order flows, and also heighten the biggest current risk of sustained margin and profitability pressure.

Among recent updates, Tri Pointe’s guidance to deliver 4,800 to 5,000 homes in 2025 at premium price points is highly relevant, as it provides a baseline for evaluating how backlog trends may affect near-term revenue and margin targets. This outlook is particularly important since ongoing backlog declines make it more difficult to maintain volumes without resorting to greater incentives or price adjustments.

On the flip side, investors should be aware that this combination of backlog deterioration and slowing demand could leave Tri Pointe especially vulnerable if...

Read the full narrative on Tri Pointe Homes (it's free!)

Tri Pointe Homes is projected to reach $3.2 billion in revenue and $193.6 million in earnings by 2028. This outlook assumes a 7.5% annual revenue decline and a $172.2 million decrease in earnings from the current $365.8 million.

Uncover how Tri Pointe Homes' forecasts yield a $38.60 fair value, a 13% upside to its current price.

Exploring Other Perspectives

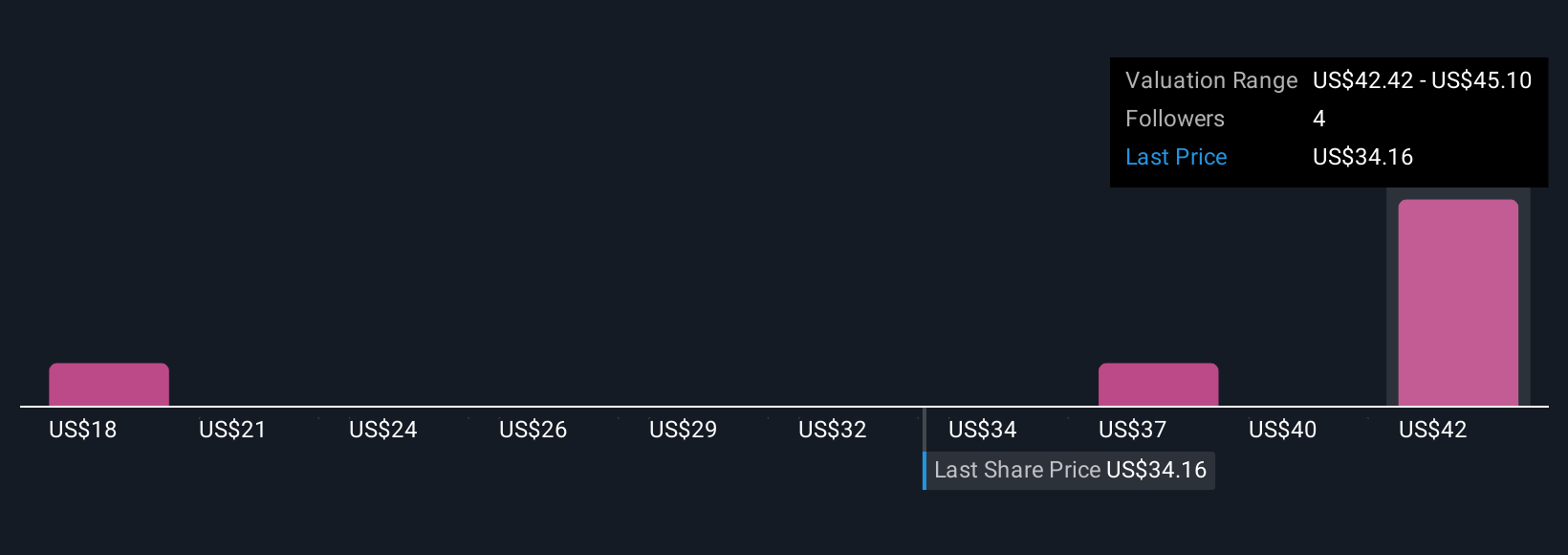

Fair value estimates from the Simply Wall St Community range widely, from US$18.35 to US$41.64, based on three individual valuations. Many participants remain cautious given the ongoing backlog declines, encouraging you to consider several viewpoints when weighing the company's performance outlook.

Explore 3 other fair value estimates on Tri Pointe Homes - why the stock might be worth as much as 22% more than the current price!

Build Your Own Tri Pointe Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tri Pointe Homes research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tri Pointe Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tri Pointe Homes' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tri Pointe Homes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPH

Tri Pointe Homes

Engages in the design, construction, and sale of single-family attached and detached homes in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)