- United States

- /

- Consumer Durables

- /

- NYSE:TOL

What Toll Brothers (TOL)'s New Oakbend Wellen Park Launch Reveals About Its Florida Growth Strategy

Reviewed by Sasha Jovanovic

- Toll Brothers, Inc. recently celebrated the grand opening and sales launch of Oakbend Wellen Park, a gated luxury home community in Venice, Florida, featuring expansive home designs and resort-style amenities.

- This development highlights Toll Brothers' ongoing expansion in high-demand markets and its emphasis on offering homebuyers extensive personalization options through its Design Studio.

- We'll explore how the launch of Oakbend Wellen Park influences Toll Brothers' investment narrative, especially its growth in attractive Florida luxury markets.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Toll Brothers Investment Narrative Recap

To be a Toll Brothers shareholder, you need to believe in the long-term demand for luxury homes in key markets, robust profit margins, and the company's ability to weather interest rate and affordability pressures. The grand opening of Oakbend Wellen Park expands presence in a prime Florida market, but this event alone does not materially alter the biggest near-term catalyst, community count growth, or the most immediate risk, which remains exposure to higher levels of speculative home construction in a moderating housing market.

The announcement of final home opportunities at Reflections at Seabrook in Ponte Vedra, Florida, is especially relevant as it confirms Toll Brothers’ consistent progress in high-demand luxury regions. This context makes it clear why expansion in Florida markets is central to driving volume and capturing pent-up demand, but also why the reliance on speculative inventory could leave results exposed if buyer sentiment shifts.

But in contrast, investors should keep in mind that the increasing share of spec homes now represents a risk for future...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers' narrative projects $13.1 billion revenue and $1.7 billion earnings by 2028. This requires 6.3% yearly revenue growth and a $0.3 billion increase in earnings from $1.4 billion currently.

Uncover how Toll Brothers' forecasts yield a $149.94 fair value, a 8% upside to its current price.

Exploring Other Perspectives

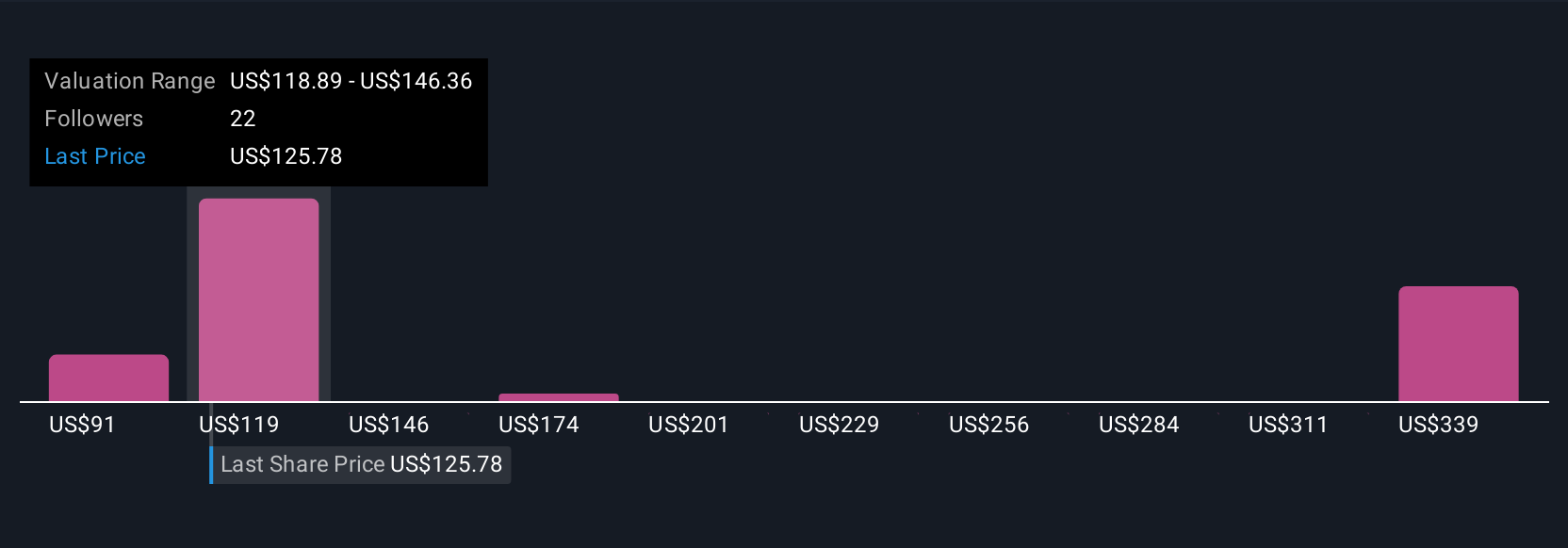

Nine individual fair value estimates from the Simply Wall St Community span US$91.41 to US$193.73, reflecting a broad range of outlooks. With current product launches targeting affluent buyers, consider how growing inventory of speculative homes could influence business performance over time and explore a variety of market viewpoints.

Explore 9 other fair value estimates on Toll Brothers - why the stock might be worth as much as 40% more than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOL

Toll Brothers

Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives