- United States

- /

- Consumer Durables

- /

- NYSE:SN

Assessing SharkNinja (SN) Valuation After Shark EveryMess Launch and Renewed International Expansion Push

Reviewed by Simply Wall St

SharkNinja (SN) just rolled out its Shark EveryMess three-in-one cleaner, and the timing matters for investors. The launch lands as management leans harder into international expansion while U.S. growth starts to cool.

See our latest analysis for SharkNinja.

The Shark EveryMess launch has arrived just as investors have pushed SharkNinja’s share price to $107.44, with a strong 1 month share price return of 26.86 percent, partly reversing a softer 90 day share price return of negative 8.31 percent. Momentum is tentatively rebuilding even though the 1 year total shareholder return of 5.68 percent still looks modest versus the company’s growth ambitions.

If this kind of product driven story has your attention, it might be a good time to explore other consumer facing names using fast growing stocks with high insider ownership.

With growth still solid, a double digit discount to analyst targets, and the new EveryMess launch reinforcing the product engine, is SharkNinja quietly undervalued here? Or is the market already baking in its next leg of expansion?

Most Popular Narrative: 19.6% Undervalued

With SharkNinja last closing at $107.44 against a narrative fair value of $133.60, the story implies meaningful upside if its growth plan delivers.

Ongoing international market penetration, especially in underpenetrated regions like Continental Europe and Latin America, where product introductions remain in early stages, unlocks significant future revenue runway as urbanization and middle-class growth drive demand for modern home products.

Curious how this expansion thesis translates into today’s valuation? The narrative leans on faster growth, fatter margins and a richer future earnings multiple. Want to see the exact assumptions driving that upside case?

Result: Fair Value of $133.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising manufacturing and tariff costs in Asia, alongside reliance on viral hit products, could quickly pressure margins and challenge the bullish valuation narrative.

Find out about the key risks to this SharkNinja narrative.

Another Lens on Value

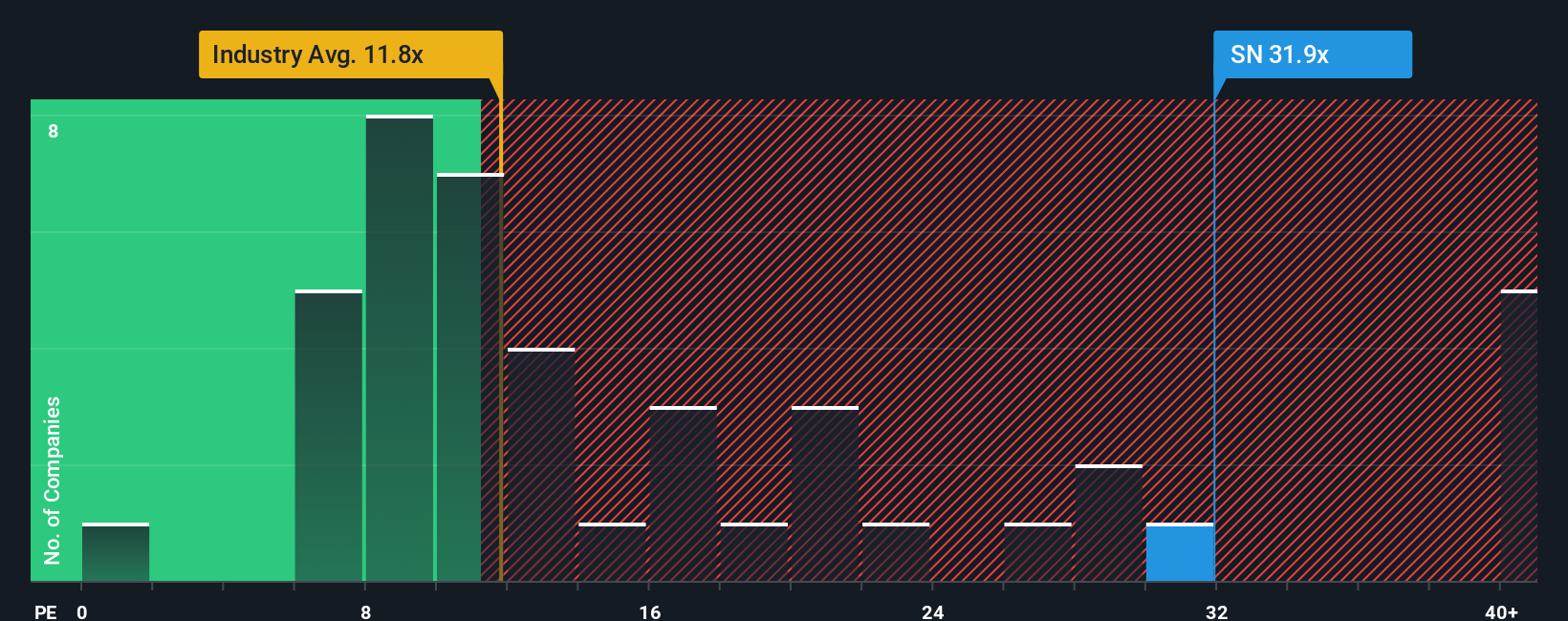

On raw valuation, SharkNinja looks less obvious. Its 26.4x price to earnings multiple sits well above the US Consumer Durables average of 12.1x and above its own fair ratio of 22x, suggesting investors are already paying up for execution. Is the growth story strong enough to keep that premium intact?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If you see the story differently, or would rather lean on your own homework and assumptions, you can build a fresh one in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SharkNinja.

Looking for more investment ideas?

Smart opportunities rarely wait around, so now is the moment to broaden your watchlist with targeted ideas that match your strategy on Simply Wall St’s Screener.

- Capture stronger potential returns by using these 916 undervalued stocks based on cash flows that trade below their estimated intrinsic value before the rest of the market catches on.

- Position yourself at the forefront of innovation by screening these 25 AI penny stocks reshaping industries with automation, data intelligence, and rapid adoption curves.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can support consistent cash flow alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026