- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Will Mortgage Rate Pressures on Peers Shift the Value Proposition for Champion Homes (SKY)?

Reviewed by Sasha Jovanovic

- Earlier this week, shares of Champion Homes fell after competitors NVR, Inc. and M/I Homes reported disappointing third-quarter results, highlighting persistent challenges in the homebuilding industry such as elevated mortgage rates and affordability pressures.

- This sector-wide reaction underscores how closely investors watch peer performance to gauge broader industry risks and sentiment, even for companies with distinct business models.

- We'll explore how increased concerns about mortgage rates and homebuyer affordability ripple through Champion Homes' investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Champion Homes Investment Narrative Recap

Owning Champion Homes centers on believing in the long-term opportunity for affordable, off-site construction and increased policy support for manufactured housing. Despite this week’s stock drop triggered by competitor results, persistent mortgage rate pressures and affordability concerns do not appear to materially alter the main short-term catalyst: expanded adoption of manufactured housing products. However, the biggest current risk, softening demand or order moderations in key community and retail channels, remains in focus, especially if sector sentiment weakens further.

Among recent company announcements, Champion’s Q1 2026 earnings release stands out, showcasing year-over-year gains in both revenue and net income despite broader industry challenges. This suggests the company is executing effectively on its growth initiatives, but investors continue to watch for shifting demand trends and any signals of slowing order rates, which may impact backlogs and future results.

By contrast, any signs of order moderation or demand softness should be on every investor’s radar because...

Read the full narrative on Champion Homes (it's free!)

Champion Homes' narrative projects $2.8 billion revenue and $228.5 million earnings by 2028. This requires 3.5% yearly revenue growth and a $11.2 million earnings increase from $217.3 million.

Uncover how Champion Homes' forecasts yield a $82.83 fair value, a 10% upside to its current price.

Exploring Other Perspectives

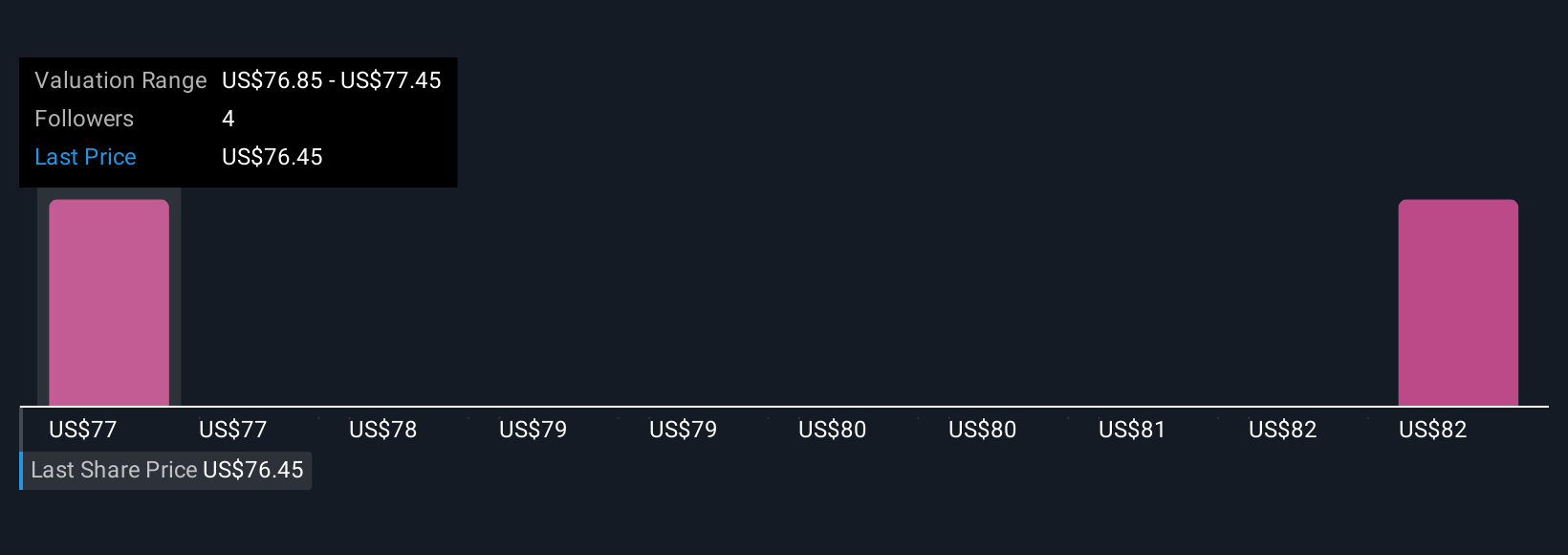

Simply Wall St Community members have set fair values between US$76.85 and US$82.83, based on two independent assessments. As investors weigh these views, it is clear that shifts in homebuyer affordability and sector demand could significantly influence the company’s future trajectory, explore more perspectives for deeper insight.

Explore 2 other fair value estimates on Champion Homes - why the stock might be worth as much as 10% more than the current price!

Build Your Own Champion Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Champion Homes research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Champion Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Champion Homes' overall financial health at a glance.

No Opportunity In Champion Homes?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives