- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes, Inc.'s (NYSE:SKY) 27% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the Champion Homes, Inc. (NYSE:SKY) share price has dived 27% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 8.2% in the last year.

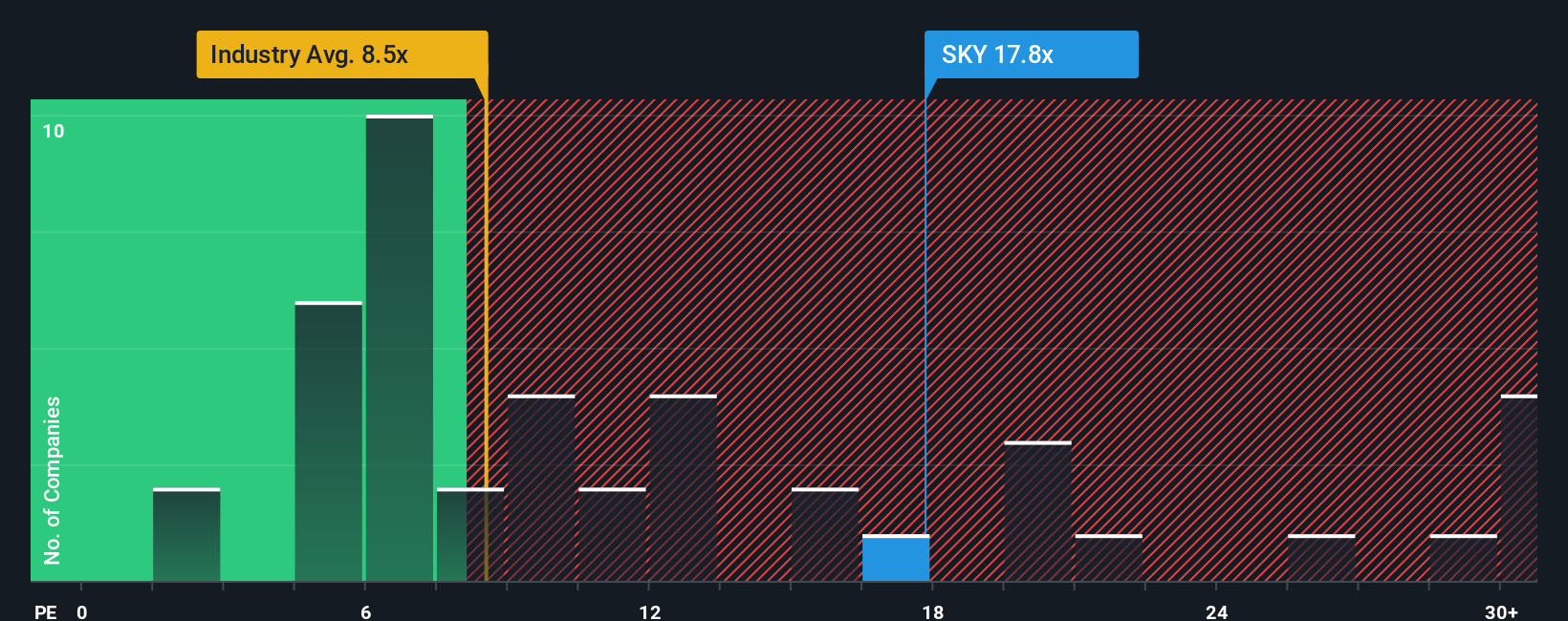

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Champion Homes' P/E ratio of 17.8x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Champion Homes as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Champion Homes

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Champion Homes' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 21% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings growth is heading into negative territory, declining 1.6% over the next year. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we find it concerning that Champion Homes is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Champion Homes' P/E

Champion Homes' plummeting stock price has brought its P/E right back to the rest of the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Champion Homes' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Champion Homes with six simple checks.

You might be able to find a better investment than Champion Homes. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives