- United States

- /

- Luxury

- /

- NYSE:SKX

Is Now the Right Moment to Reassess Skechers After Shares Dip 6% Over the Year?

Reviewed by Simply Wall St

Thinking about what to do next with Skechers U.S.A stock? You are not alone. Over the past year, shares have drifted slightly lower, down 6.2%. The big picture, however, tells a more compelling story. Zoom out and you see hefty three- and five-year returns of 76% and 105%, showing real growth for long-term holders. Recent months have been quieter, with a 0.2% gain over the last 30 days and a minimal dip of 0.1% in the past week. The stock’s ability to bounce back in choppy markets has kept investors guessing if there is more upside ahead.

You might be wondering if now is the time to get in, hold on, or cash out. The valuation debate is heating up after the company scored an impressive 5 out of 6 on our value checklist. That high score suggests Skechers U.S.A looks undervalued by most measures, which is a rare spot for a recognizable, global brand.

But before you make any moves, it is crucial to dig into the different valuation approaches the market uses to assess Skechers U.S.A’s true worth. Even then, there is a smarter way to cut through the noise, which we will reveal at the end of this analysis.

Why Skechers U.S.A is lagging behind its peersApproach 1: Skechers U.S.A Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those amounts back to today’s dollars. Essentially, this approach answers the question, "What are all of Skechers U.S.A’s future cash flows worth, adjusted for risk and time?"

For Skechers U.S.A, the latest reported Free Cash Flow (FCF) stands at $175.04 million. Analysts have projected significant growth ahead, with annual FCF expected to reach $658 million by December 2027. The long-range outlook, which extends through 2035, points to further gains, with FCF crossing the $2.2 billion mark. It is important to note that projections beyond five years are extrapolations built on trends, not direct analyst estimates.

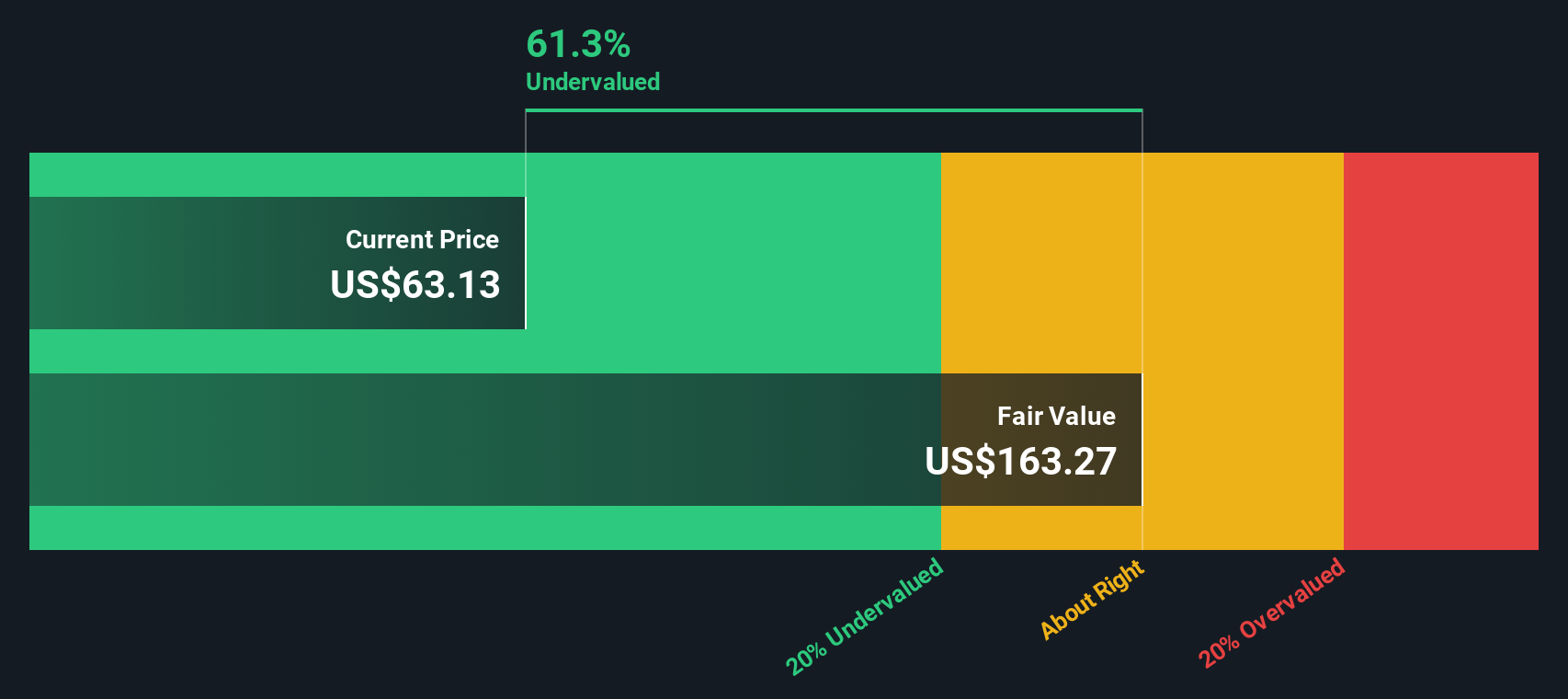

Based on these cash flow projections and using a 2 Stage Free Cash Flow to Equity model, the DCF calculation estimates Skechers U.S.A’s fair value at $163.27 per share. This represents a 61.3% increase over the current market price, suggesting that the stock is deeply undervalued based on its projected ability to generate future cash.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Skechers U.S.A.

Approach 2: Skechers U.S.A Price vs Earnings

The price-to-earnings (PE) ratio is a popular metric for valuing profitable companies like Skechers U.S.A because it compares the current share price to company earnings. This ratio helps investors gauge how much the market is willing to pay for each dollar of earnings, which can be particularly insightful for established brands with consistent profitability.

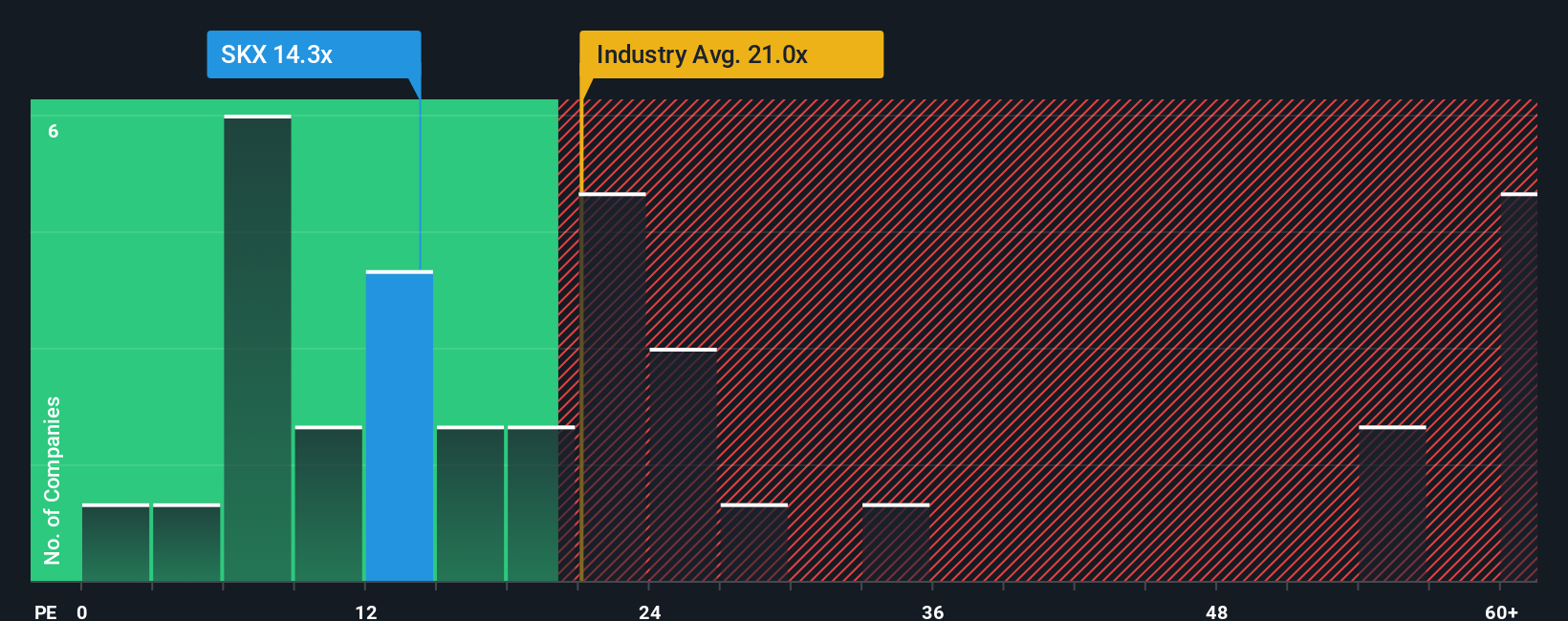

A "normal" or "fair" PE ratio should reflect expectations for future earnings growth and the risks associated with those earnings. Higher growth usually justifies a higher PE ratio, while more risk or lower growth warrants a lower multiple. Right now, Skechers U.S.A trades on a PE ratio of 14.3x, which is notably below both the peer average of 35.3x and the luxury industry average of 20.5x. This means the stock looks relatively cheap compared to similar companies and the broader industry.

However, comparing to just industry or peer averages does not tell the whole story. That is why Simply Wall St’s proprietary "Fair Ratio" offers a more tailored estimate by weighing factors such as earnings growth, profit margins, risk profile, size, and market backdrop to deliver a valuation that best fits Skechers U.S.A’s unique fundamentals. In this case, the Fair Ratio is 14.6x, just slightly above the current 14.3x multiple. This tight alignment suggests the stock’s valuation is in line with its actual prospects after considering all company-specific drivers.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Skechers U.S.A Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized investment story, where you connect what you believe about Skechers U.S.A’s future, such as its growth, risks, and business trends, directly to a financial forecast and an estimate of fair value.

Rather than relying only on ratios or analyst figures, Narratives let you link the company’s story to hard numbers. This makes your investment conviction clearer and more actionable. Using Simply Wall St’s Community page, millions of investors are now building and sharing their Narratives. It takes just a few clicks to select assumptions, like expected revenue growth or profit margins, see a fair value, and compare it to today’s price.

This approach helps you decide when to buy or sell, because you will see instantly whether your view suggests the shares are undervalued or overpriced. In addition, Narratives are dynamically updated. As new earnings or news arrive, your forecast and fair value automatically adjust so your decision making always stays relevant.

For Skechers U.S.A, different investors have Narratives that range from a bullish fair value of $163 per share, fueled by expectations of major international expansion, to a far more conservative estimate around $62, reflecting worries about margin pressure and global risks.

Do you think there's more to the story for Skechers U.S.A? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKX

Skechers U.S.A

Designs, develops, and markets footwear, apparel, and accessories worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives