- United States

- /

- Leisure

- /

- NYSE:PII

Will Polaris’ Premium 2026 Slingshot Lineup and RIDE COMMAND+ Push PII Deeper Into High-End Territory?

Reviewed by Sasha Jovanovic

- In early December 2025, Polaris Slingshot launched its 2026 model-year lineup, including a limited-edition Grand Touring trim, new premium iridescent paint schemes, upgraded wheel designs, and an optional subscription-based RIDE COMMAND+ connected services package.

- This refresh pushes Slingshot further into higher-end, feature-rich territory, potentially reinforcing Polaris’ premium positioning and deepening customer engagement through digital services.

- We’ll now examine how the premium-focused 2026 Slingshot lineup, including the limited Grand Touring model, could influence Polaris’s investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Polaris Investment Narrative Recap

To own Polaris, you need to believe the company can convert premium, enthusiast-focused powersports brands into durable cash generation despite tariffs, weak international sales, and interest rate pressure on big-ticket purchases. The 2026 Slingshot refresh, including the limited Grand Touring trim and subscription-based RIDE COMMAND+, reinforces the premium and digital angles but does not materially shift the near term tariff burden or macro-driven demand risk that still anchor the story.

The expanded Call of Duty collaboration, featuring Polaris vehicles inside Warzone and Black Ops 7 plus real-world giveaways, is the recent announcement that best complements the Slingshot news. Together, they highlight Polaris leaning into brand engagement and higher value products as key supports for its current catalysts around premium demand and new product innovation, even while broader powersports softness and tariff costs remain front of mind for shareholders.

Yet, while premium launches grab attention, investors should be very aware of how persistent tariff costs could...

Read the full narrative on Polaris (it's free!)

Polaris’ narrative projects $7.5 billion revenue and $224.6 million earnings by 2028.

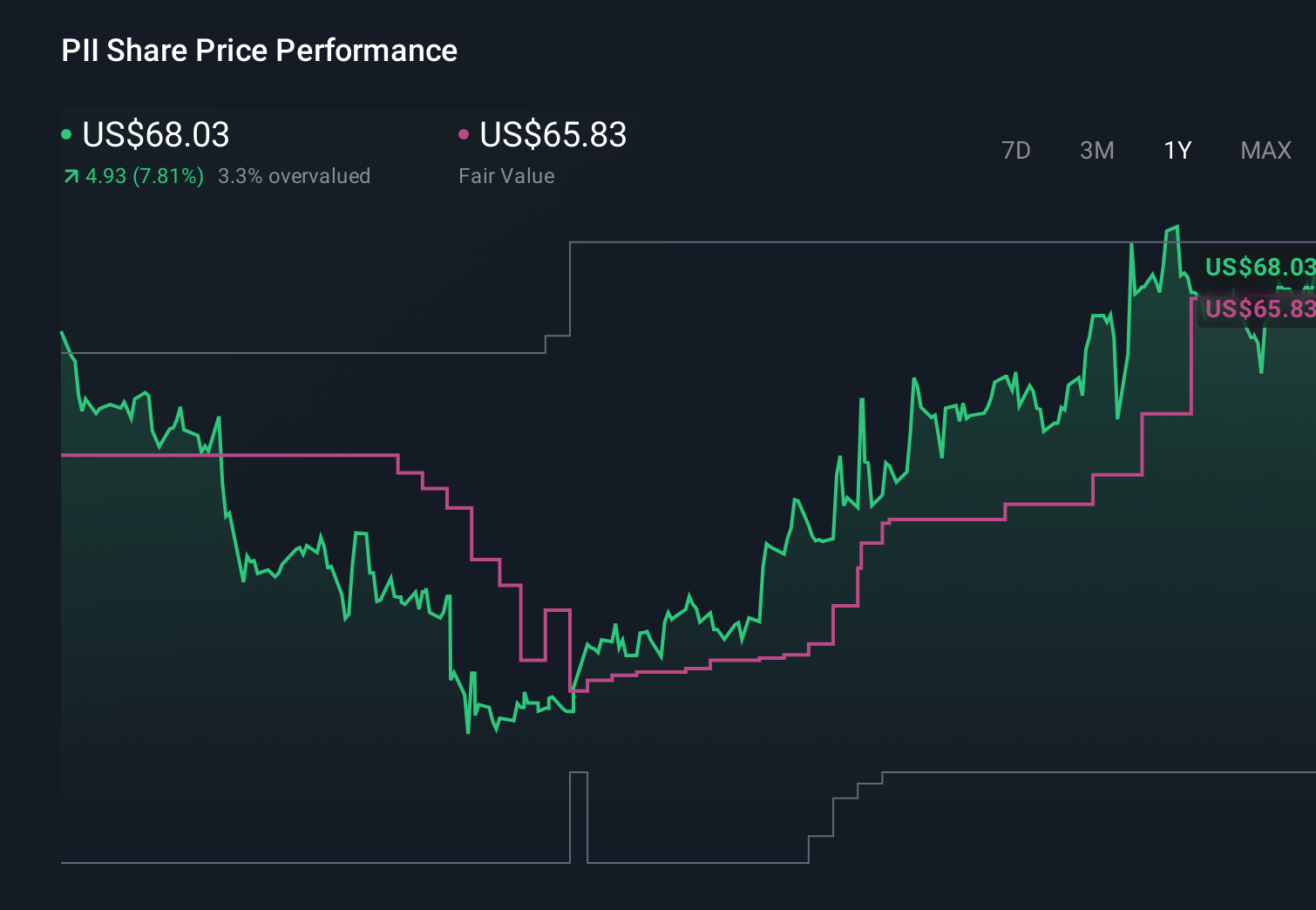

Uncover how Polaris' forecasts yield a $65.83 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$7 to US$70 per share, showing how far apart individual views can sit. You can set those opinions against the tariff cost overhang that still shapes expectations for Polaris’ margins and earnings, and then weigh several contrasting angles on what that might mean for the business over time.

Explore 6 other fair value estimates on Polaris - why the stock might be worth less than half the current price!

Build Your Own Polaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Polaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polaris' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026