As the U.S. stock market experiences a surge, with major indices like the Dow Jones and S&P 500 closing sharply higher for consecutive days, investors are keenly observing economic indicators such as retail sales and interest rate forecasts. In this dynamic environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to navigate market fluctuations with a focus on steady returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.94% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.48% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.75% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.27% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.70% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.67% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.01% | ★★★★★★ |

| Ennis (EBF) | 5.76% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.07% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.57% | ★★★★★★ |

Click here to see the full list of 120 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

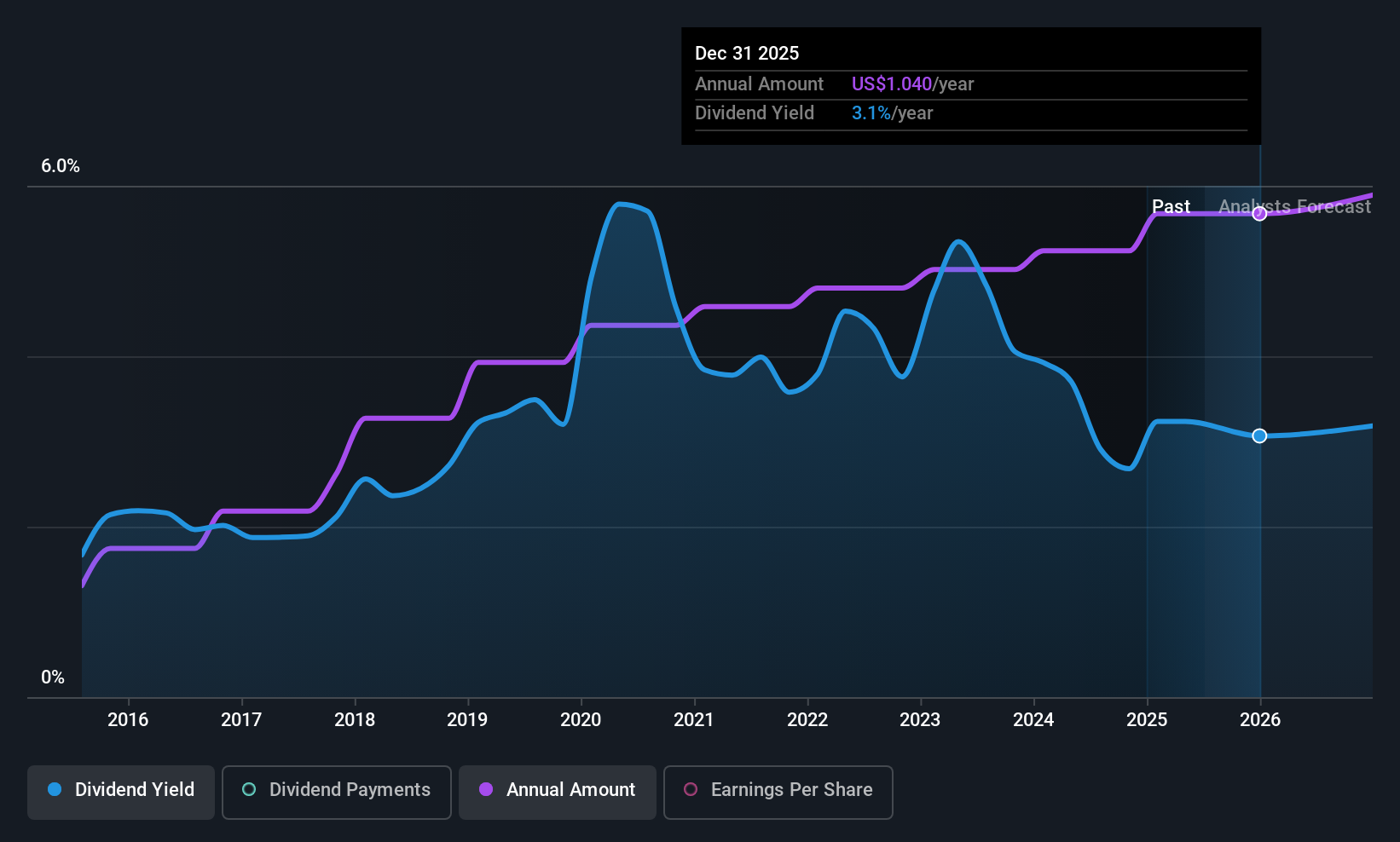

Independent Bank (IBCP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corporation operates as the bank holding company for Independent Bank, offering banking services in the United States with a market cap of $650.76 million.

Operations: Independent Bank Corporation generates revenue primarily through its banking services segment, with Independent Bank contributing $226.50 million.

Dividend Yield: 3.1%

Independent Bank Corporation's dividends have been stable and growing over the past decade, with a current yield of 3.15%, though lower than top-tier US dividend payers. The recent quarterly dividend of $0.26 per share reflects continued commitment to shareholders, supported by a low payout ratio of 31%. Recent earnings growth and share buybacks signal financial strength, with net income rising to $17.5 million in Q3 2025, enhancing the sustainability of future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Independent Bank.

- The valuation report we've compiled suggests that Independent Bank's current price could be quite moderate.

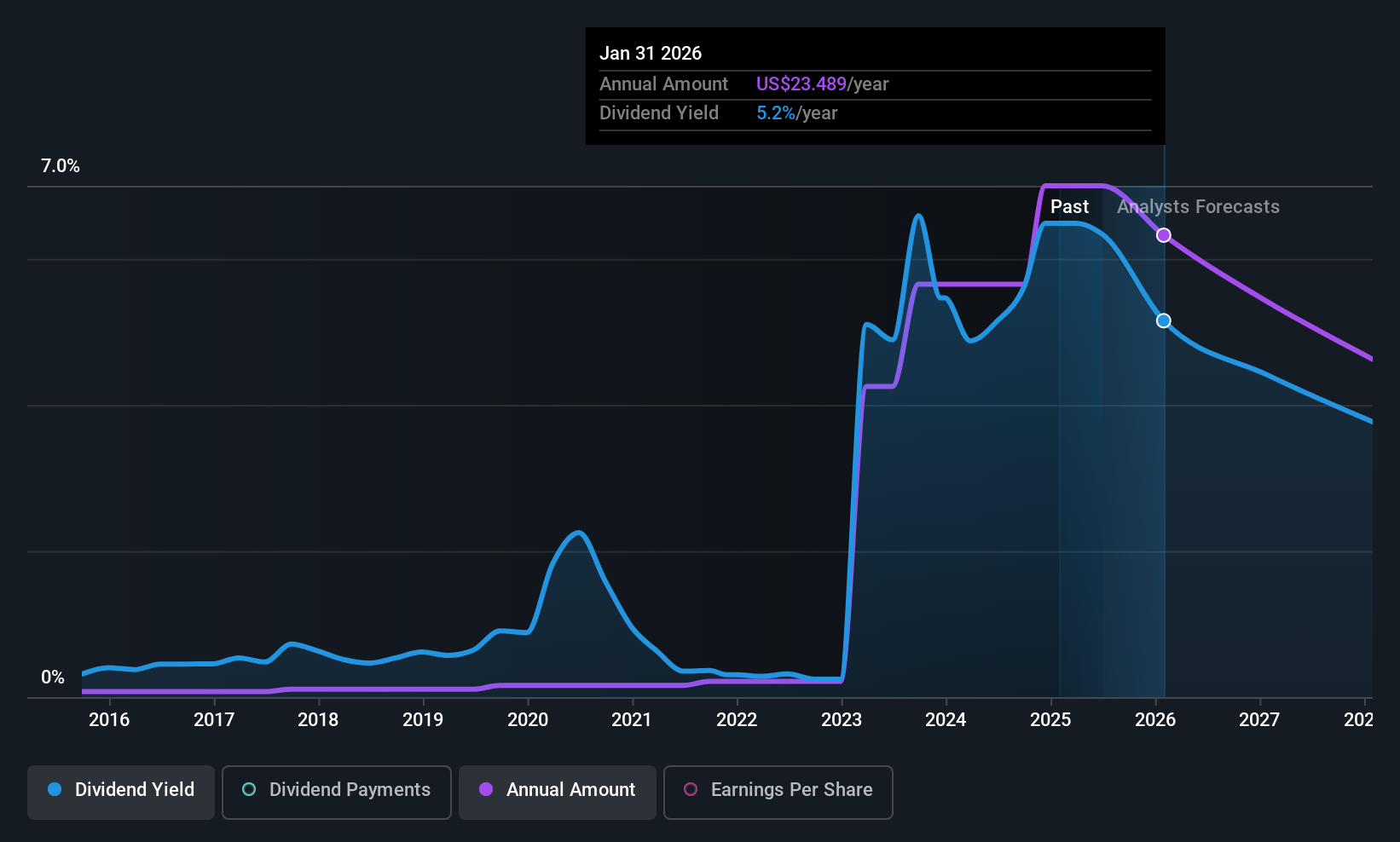

Dillard's (DDS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of $9.59 billion.

Operations: Dillard's generates revenue from its retail operations, amounting to $6.37 billion.

Dividend Yield: 3.9%

Dillard’s has affirmed its commitment to dividends with a recent quarterly dividend of US$0.30 per share and a special dividend of US$30.00 per share, both well-covered by earnings and cash flows, given a payout ratio of 0.7% and cash payout ratio of 52%. Despite stable dividends over the past decade, its yield at 3.9% is below top-tier payers in the US market. Recent insider selling may warrant attention for potential investors.

- Dive into the specifics of Dillard's here with our thorough dividend report.

- The valuation report we've compiled suggests that Dillard's current price could be inflated.

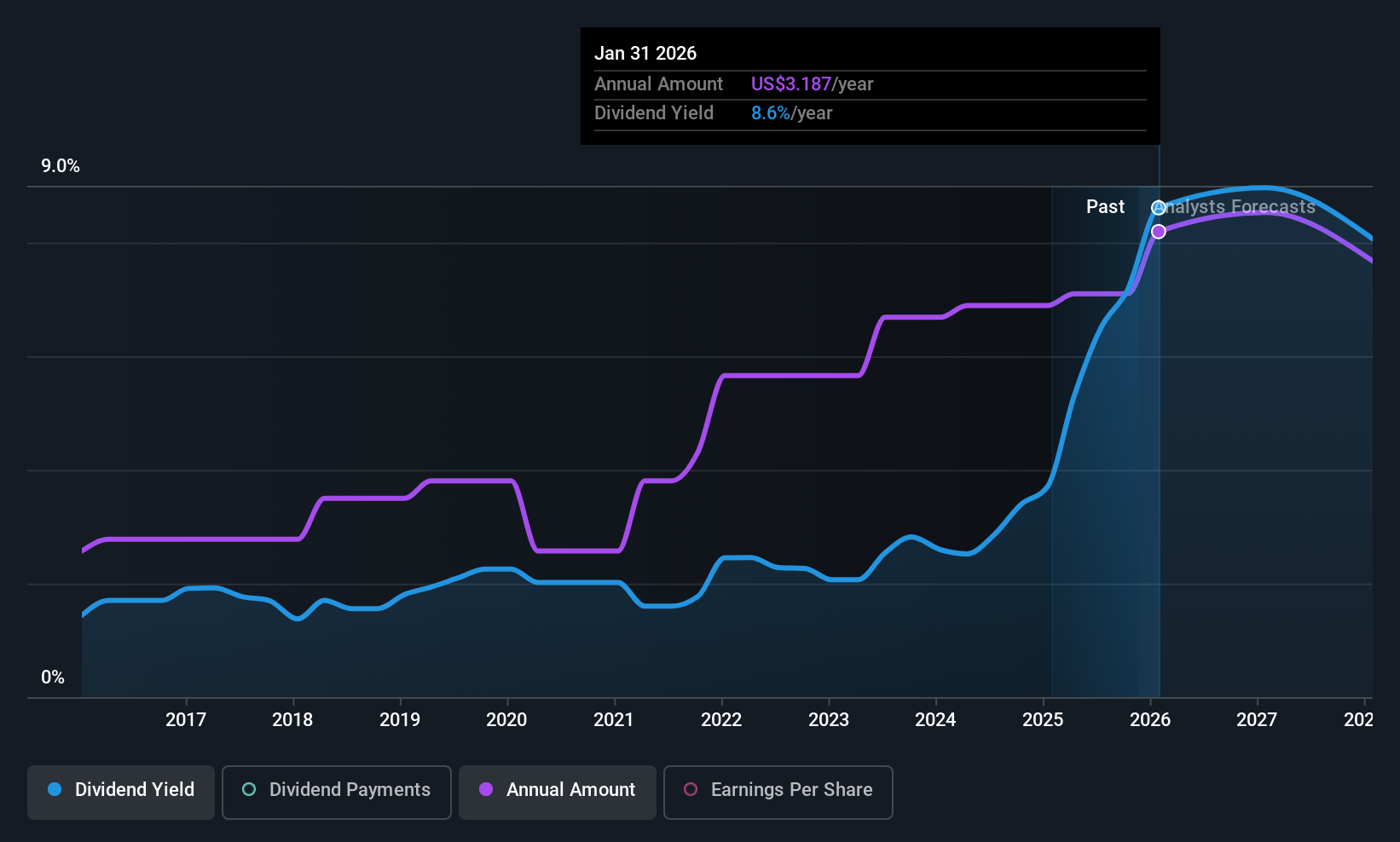

Oxford Industries (OXM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oxford Industries, Inc. is an apparel company that designs, sources, markets, and distributes lifestyle products globally with a market cap of $502.81 million.

Operations: Oxford Industries generates revenue through its distinct segments, including Johnny Was ($182.37 million), Tommy Bahama ($844.09 million), Lilly Pulitzer ($333.12 million), and Emerging Brands ($135.28 million).

Dividend Yield: 7.5%

Oxford Industries declared a quarterly dividend of US$0.69 per share, continuing its long history of payouts since 1960. Despite a high dividend yield of 7.46%, the sustainability is questionable as it isn't well covered by cash flows, with a cash payout ratio of 248.1%. The company's earnings have been volatile, impacting dividend reliability over the past decade, though dividends have grown during this period. Recent buybacks may signal confidence in future performance despite current challenges.

- Take a closer look at Oxford Industries' potential here in our dividend report.

- The analysis detailed in our Oxford Industries valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Discover the full array of 120 Top US Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DDS

Dillard's

Operates retail department stores in the southeastern, southwestern, and midwestern areas of the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success