- United States

- /

- Luxury

- /

- NYSE:ONON

On Holding (NYSE:ONON): Evaluating Valuation Following Upbeat Q3 Results and Raised Full-Year Outlook

Reviewed by Simply Wall St

On Holding (NYSE:ONON) shares surged after the company reported third quarter results that surpassed expectations and raised its full-year guidance. Sales growth accelerated, particularly in Asia and across multiple product categories.

See our latest analysis for On Holding.

After a tough year in the market, On Holding’s latest earnings beat and improved outlook have sparked real momentum. The past week saw a 21% jump in the share price, even as the year-to-date share price return remains down. While long-term investors are still benefiting from a 150% total shareholder return over three years, this fresh surge is a sign that investor sentiment could be turning more positive as growth accelerates and expectations for the holiday quarter rise.

If this rebound has you curious about what else is picking up speed, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains following upbeat results and raised guidance, investors are left to wonder: is On Holding’s recent surge just the beginning of an undervalued run, or is the company’s future growth already fully reflected in the price?

Most Popular Narrative: 31.9% Undervalued

With On Holding’s recent close at $42.40 and a widely-followed fair value estimation near $62, this narrative suggests substantial upside remains if projections play out. The next quote reveals one of the key pillars supporting this optimistic outlook.

The company's ability to launch and quickly scale new product franchises (nine now >5% of revenue), expand beyond running into tennis, trail, lifestyle, and fast-growing apparel, demonstrates successful product innovation and diversification, supporting both average selling price increases and higher future revenue per customer.

Curious what makes the numbers so bullish? The narrative’s fair value hinges on explosive top-line expansion, margin gains, and a confidence in future profit multiples that rivals the sector’s leaders. Want the specifics driving this price target? Open the narrative to see exactly how these bold projections stack up.

Result: Fair Value of $62.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as rising competition and an over-reliance on premium pricing could limit future growth. This may potentially shift the outlook for On Holding investors.

Find out about the key risks to this On Holding narrative.

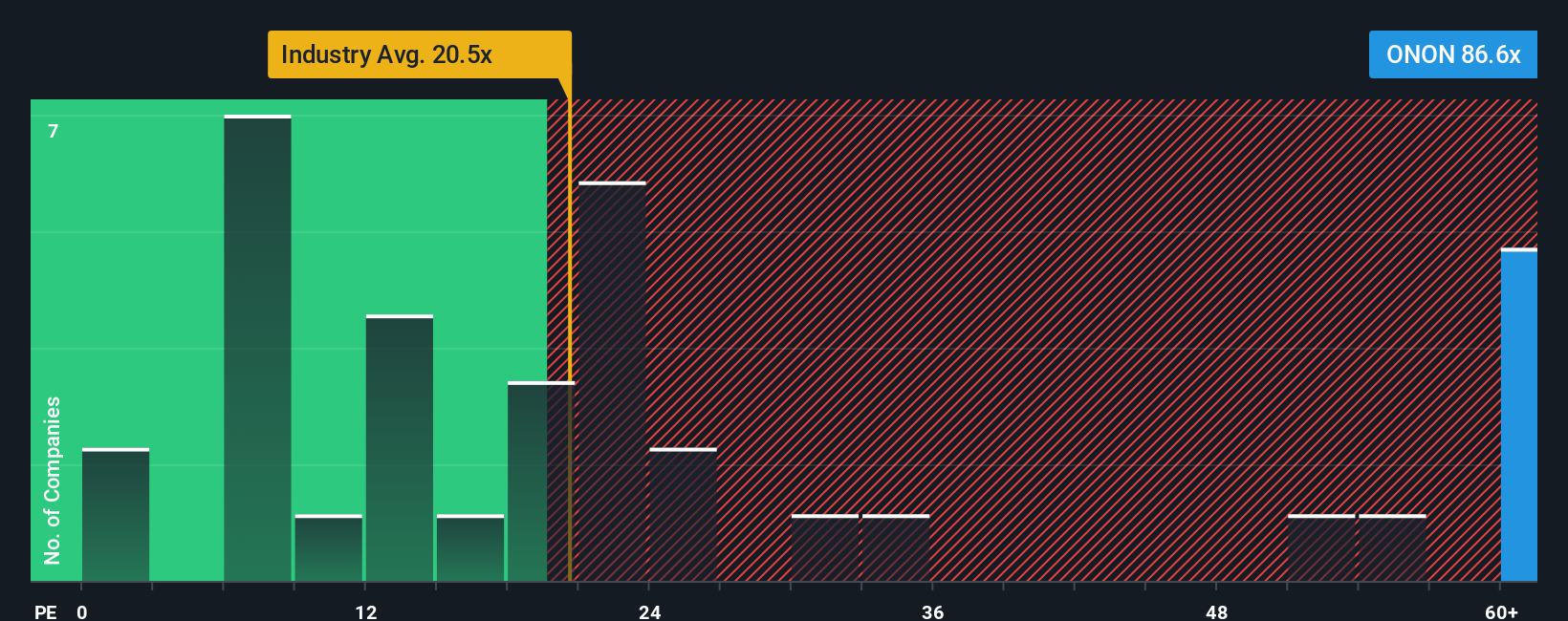

Another View: Market Multiples Raise Caution

While the fair value narrative paints On Holding as undervalued, a look at the price-to-earnings multiple tells a different story. Shares trade at 49 times earnings, which is well above the US Luxury industry’s 18.9x and the peer average of 25.8x. Even compared to a fair ratio of 29.7x, the premium is striking and signals possible valuation risk. Could the optimism be too far ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If you see the story unfolding differently or want to dig into the numbers on your own, you can shape your perspective quickly. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding On Holding.

Looking for More Investment Ideas?

Don’t limit your portfolio. Expand your horizons now with fresh investment opportunities handpicked for real growth seekers. Miss this, and you could miss the next big winner.

- Tap into future breakthroughs by checking out these 26 quantum computing stocks, featuring companies pioneering advances in computing power and new technologies.

- Capture income potential and long-term stability by reviewing these 15 dividend stocks with yields > 3%, where you’ll find businesses offering solid yields and dependable fundamentals.

- Step ahead of the crowd and see these 26 AI penny stocks, the early movers driving momentum in artificial intelligence and next-gen software innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives