- United States

- /

- Consumer Durables

- /

- NYSE:NVR

NVR (NVR) Margin Decline Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

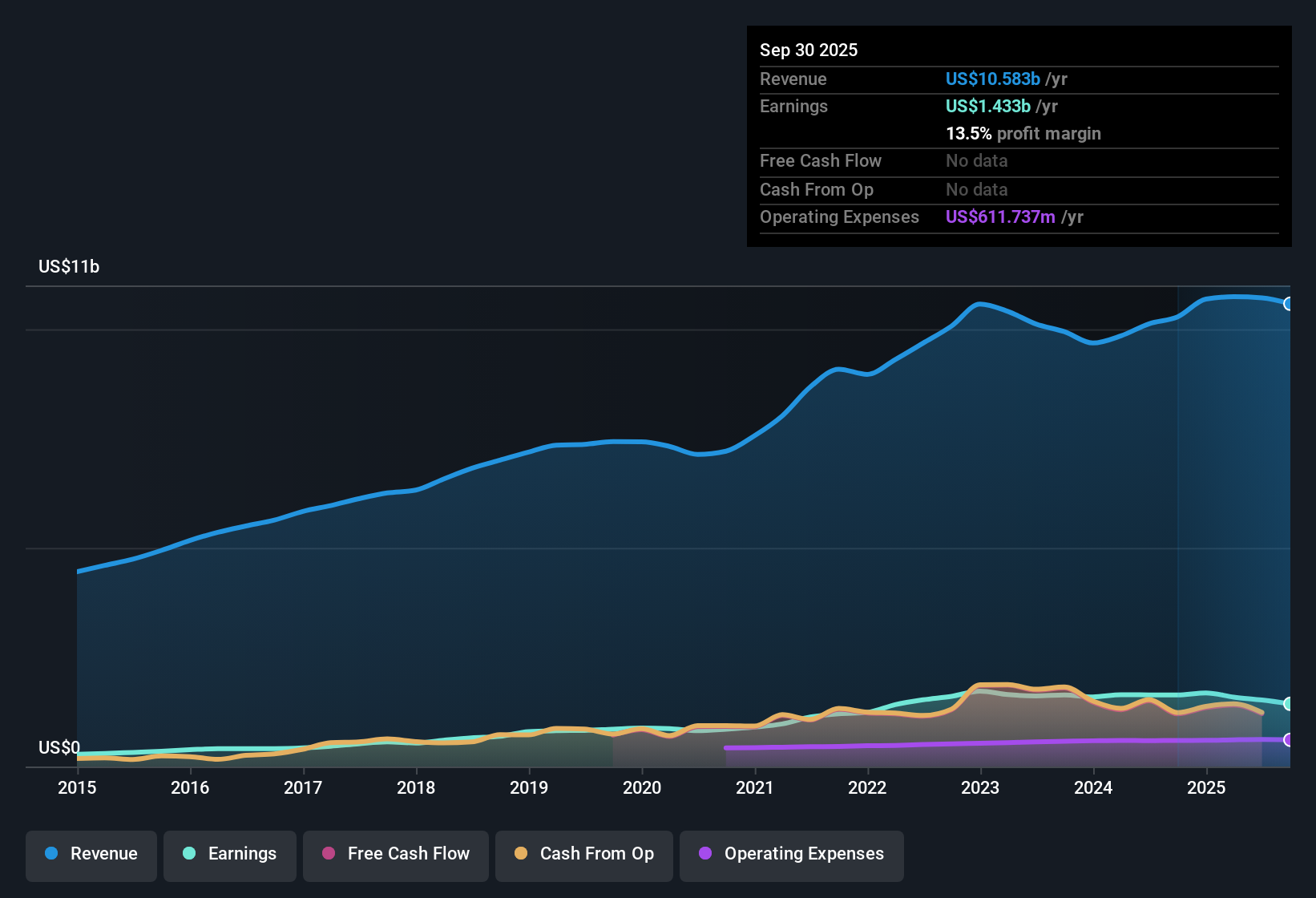

NVR (NVR) posted net profit margins of 14.2%, down from 16.2% last year, highlighting pressure on profitability even as annual earnings have grown 10.8% over the past five years. The most recent year saw negative earnings growth, and with a Price-To-Earnings ratio of 14.5x, which is well above industry and peer averages, the market is pricing the stock at $7,697.16, above the estimated fair value of $6,678.01. Despite earnings being described as high quality, investors may be weighing declining margins and a premium valuation against the company’s historical long-term growth.

See our full analysis for NVR.Next, we’ll see how these latest numbers stack up when held up against the most widely followed narratives around NVR. Some assumptions may be challenged, while others could be reinforced.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Drop to 14.2%

- NVR’s net profit margins have fallen to 14.2%, down two percentage points from 16.2% last year. This reflects a notable contraction in profitability beyond typical seasonal or market fluctuations.

- Market watchers highlight that despite the solid multi-year earnings growth, this margin compression introduces new doubts about how resilient NVR’s high quality label remains.

- Recent negative growth, paired with dipping margins, suggests that some of the historical advantages are being tested in the current housing market cycle.

- The prevailing view underscores how strong sector fundamentals and disciplined operations still anchor the investment case, even as near-term profitability softens.

Premium Price Tag Versus Industry

- The Price-To-Earnings ratio stands at 14.5x, exceeding the US Consumer Durables average of 10.5x and the peer median of 12.9x. This demonstrates that investors pay a sizable premium for NVR relative to its sector.

- Analysis often spotlights the contrast between investors’ willingness to pay up for perceived quality and the reality that recent margin and profit trends no longer fully justify such a stretch valuation.

- The share price of $7,697.16 trades well above the DCF fair value estimate of $6,678.01, putting the focus on whether the expected long-term stability justifies the extra cost.

- Some argue that a resilient business model supports this premium. However, the absence of accelerating growth makes it harder to maintain industry-leading multiples if conditions weaken further.

Long-Term Growth Outpaces Short-Term Drag

- Annual earnings have increased 10.8% over the last five years, even as the most recent year saw a decline, highlighting an impressive long-term growth track despite new headwinds.

- Market narratives draw out two competing interpretations. For some, that five-year track record heavily supports optimism about future rebound prospects.

- Historical compounding signals NVR’s underlying quality is not erased by a single tough year.

- Yet losing positive momentum means the company will need to prove it can return to those double-digit trends as the environment shifts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NVR's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NVR’s declining profit margins, premium valuation, and loss of earnings momentum leave investors exposed if the company cannot quickly reignite growth.

Looking for better value in today’s market? Discover these 871 undervalued stocks based on cash flows to find companies trading at attractive prices with solid fundamentals now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVR

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives