Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see NIKE, Inc. (NYSE:NKE) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. In other words, investors can purchase NIKE's shares before the 1st of December in order to be eligible for the dividend, which will be paid on the 2nd of January.

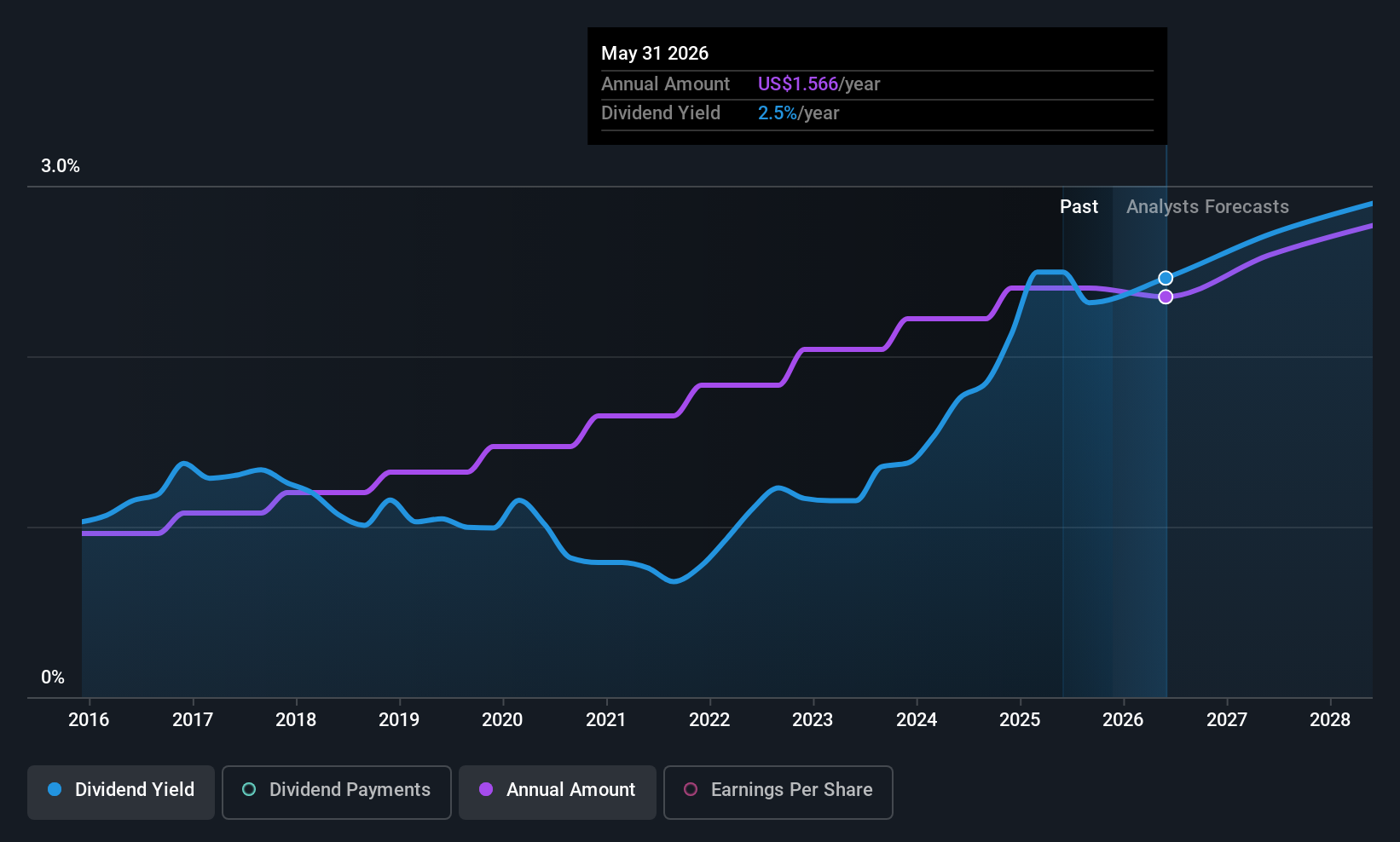

The company's next dividend payment will be US$0.41 per share, on the back of last year when the company paid a total of US$1.60 to shareholders. Last year's total dividend payments show that NIKE has a trailing yield of 2.5% on the current share price of US$63.68. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether NIKE can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. It paid out 82% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out more than three-quarters (78%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Check out our latest analysis for NIKE

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're encouraged by the steady growth at NIKE, with earnings per share up 3.8% on average over the last five years. A high payout ratio of 82% generally happens when a company can't find better uses for the cash. Combined with slim earnings growth in the past few years, NIKE could be signalling that its future growth prospects are thin.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, NIKE has lifted its dividend by approximately 11% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is NIKE an attractive dividend stock, or better left on the shelf? Earnings per share have been growing modestly and NIKE paid out a bit over half of its earnings and free cash flow last year. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

So if you want to do more digging on NIKE, you'll find it worthwhile knowing the risks that this stock faces. For example, we've found 1 warning sign for NIKE that we recommend you consider before investing in the business.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success