- United States

- /

- Luxury

- /

- NYSE:NKE

Is Nike A Bargain After A 55% Five Year Slide In 2025?

Reviewed by Bailey Pemberton

- Wondering if NIKE at around $58 is a bargain or a value trap right now? You are not alone. Many long-term investors are asking the same question.

- Despite being a household brand, the stock has been under pressure, with shares down about 13% over the last week, 6.5% over the last month, and roughly 20.3% year to date, extending a multi-year slide of around 55.5% over five years.

- Recently, the conversation around NIKE has centered on shifting consumer demand, heightened competition from newer athletic brands, and the company recalibrating its direct-to-consumer strategy. Investors are weighing whether these strategic moves can reignite growth or if they signal a longer period of adjustment for the business.

- Right now, NIKE scores just 0/6 on our valuation checks. We will first look at what traditional valuation methods say about the stock, then explore a more holistic way to think about its long-term value.

NIKE scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIKE Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, using a required rate of return. For NIKE, the model uses its last twelve months Free Cash Flow of about $2.85 billion and analyst forecasts that see FCF rising to roughly $3.86 billion by 2028, with further growth extrapolated out to 2035 based on those trends.

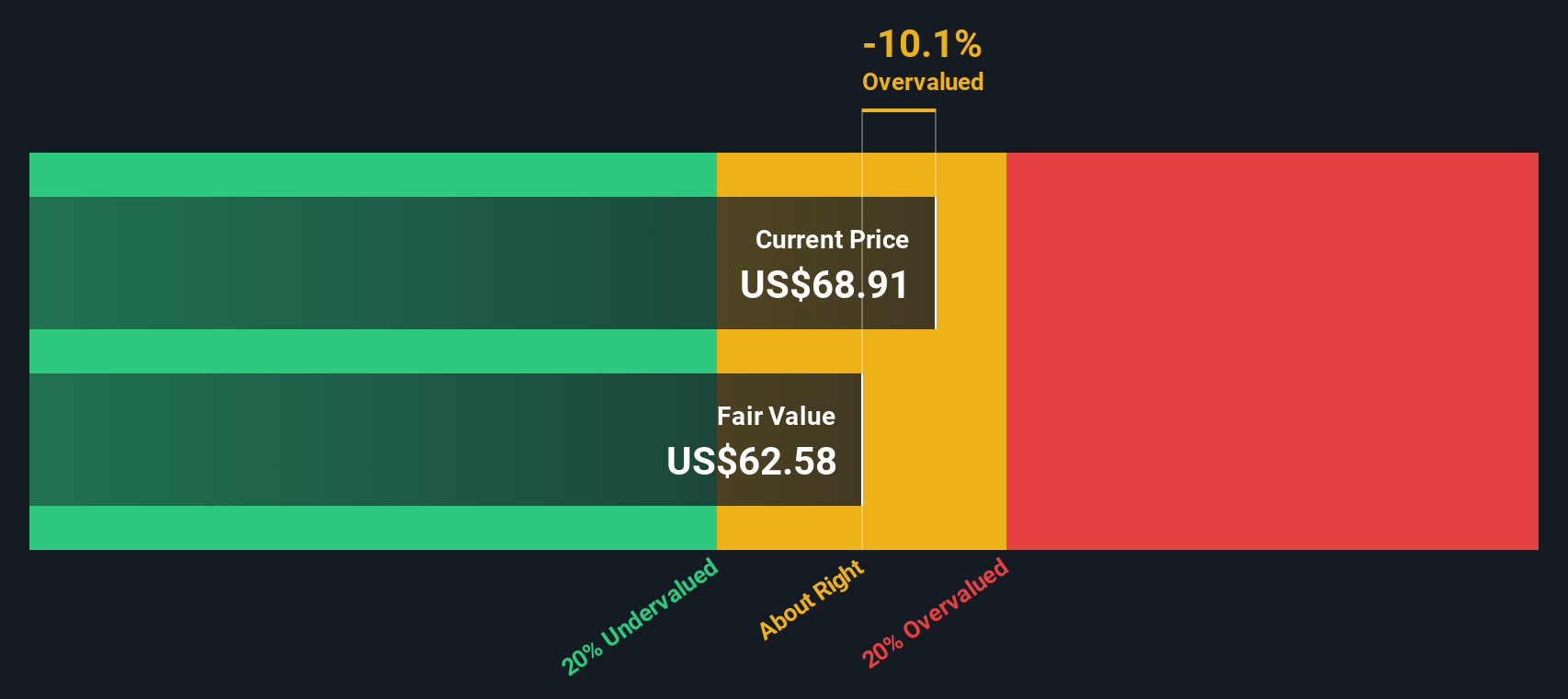

Using this 2 Stage Free Cash Flow to Equity approach, Simply Wall St arrives at an intrinsic value of about $52.18 per share. With NIKE currently trading around $58, the DCF suggests the stock is roughly 12.5% above its estimated fair value, implying it is modestly overvalued rather than a deep bargain.

In other words, the cash flow math does not indicate a cheap valuation; it points to a solid business at a slightly rich price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIKE may be overvalued by 12.5%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NIKE Price vs Earnings

For profitable, established companies like NIKE, the Price to Earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. It naturally connects today’s share price with the company’s ability to generate profits, which ultimately fund dividends, buybacks, and reinvestment.

What counts as a fair PE depends on how quickly earnings are expected to grow and how risky those earnings are. Higher growth and lower risk usually justify a higher multiple, while slower or more volatile growth tends to pull the PE down. NIKE currently trades on about 34.38x earnings. This is well above the Luxury industry average of around 20.17x, and also higher than its peer group average of roughly 29.09x.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what NIKE’s PE should be, given its specific earnings growth outlook, margins, size, industry, and risk profile. That produces a Fair Ratio of about 28.80x. Because this metric bakes in NIKE’s fundamentals rather than relying only on broad peer or industry averages, it is a more tailored benchmark. With the current PE of 34.38x sitting meaningfully above the Fair Ratio, the multiple suggests NIKE is trading at a premium that looks stretched.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIKE Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of NIKE’s story with a concrete financial forecast and Fair Value estimate. A Narrative on Simply Wall St lets you spell out what you believe about NIKE’s future, then translate that into assumptions for revenue growth, profit margins, and valuation multiples, so the story is tied directly to the numbers rather than floating above them. Narratives live inside the Community page used by millions of investors, and they are easy to create, compare, and adjust as new information like earnings results or major news is released, with Fair Values updating dynamically when the data changes. This can help you decide whether to buy, hold, or sell by continuously comparing your Narrative Fair Value to NIKE’s current share price in one place. For example, one NIKE Narrative on the platform might see fair value near $77 while another sees close to $97, reflecting very different but clearly quantified expectations about growth, margins, and potential upside.

Do you think there's more to the story for NIKE? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion