- United States

- /

- Luxury

- /

- NYSE:NKE

Did NIKE's (NKE) Dividend Increase Signal Stronger Board Confidence in Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- On November 20, 2025, NIKE, Inc.’s Board of Directors announced a 3 percent increase in its quarterly cash dividend to $0.41 per share, payable on January 2, 2026, to shareholders of record as of December 1, 2025.

- This dividend increase marks NIKE’s ongoing commitment to returning capital to shareholders, reflecting confidence in its cash generation and outlook.

- We’ll examine how NIKE’s decision to raise its dividend signals board confidence and impacts the company’s broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

NIKE Investment Narrative Recap

To be a NIKE shareholder today, you must believe the company can restore consistent growth despite recent earnings declines and margin pressures. While the 3 percent dividend increase highlights board confidence and ongoing cash generation, it does not materially shift focus from the near-term catalyst of revitalizing Nike’s product portfolio or the central risk: further revenue and margin challenges amid marketplace headwinds and digital sales declines.

A recent announcement that closely ties into the dividend increase is NIKE’s ongoing share buyback program, which saw over 1.8 million shares repurchased between June and August 2025. Both the dividend raise and buybacks reinforce the company’s intent to return capital to shareholders, but the biggest short-term catalyst continues to be progress in cleaning up inventory and improving margin trends.

By contrast, investors should also be aware of the risk that persists if Nike’s digital sales continue to decline or if margins do not recover as quickly as anticipated...

Read the full narrative on NIKE (it's free!)

NIKE's narrative projects $50.7 billion in revenue and $4.4 billion in earnings by 2028. This requires a 3.1% yearly revenue growth and an earnings increase of $1.2 billion from current earnings of $3.2 billion.

Uncover how NIKE's forecasts yield a $83.70 fair value, a 30% upside to its current price.

Exploring Other Perspectives

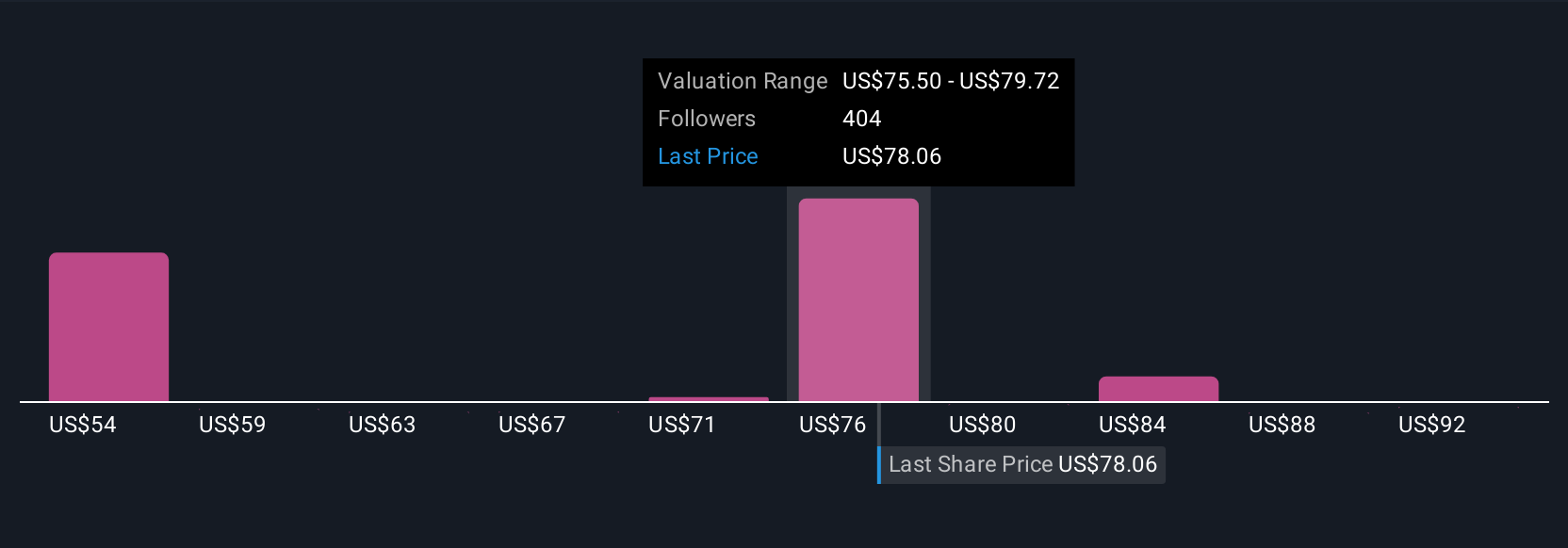

Forty fair value estimates from the Simply Wall St Community place NIKE’s worth between US$58.49 and US$96.60 per share. Paired with ongoing concerns around margin pressure and sales weakness, this range shows opinions can vary significantly and you are encouraged to review multiple viewpoints.

Explore 40 other fair value estimates on NIKE - why the stock might be worth 9% less than the current price!

Build Your Own NIKE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIKE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NIKE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIKE's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIKE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NKE

NIKE

Designs, develops, markets, and sells athletic and casual footwear, apparel, equipment, accessories, and services for men, women, and kids in North America, Europe, the Middle East, Africa, Greater China, the Asia Pacific, and Latin America.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success