- United States

- /

- Consumer Durables

- /

- NYSE:MTH

Meritage Homes (MTH): Assessing Valuation After Recent Share Price Uptick and Ongoing Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Meritage Homes.

Meritage Homes’ share price has stumbled in 2024, with a 30-day decline of nearly 10% weighing on sentiment. However, the longer-term picture stays impressive thanks to a massive 118% total shareholder return over the past three years. This suggests that the momentum which once fueled its rise is now in a cooling phase.

If you’re curious what else is out there, this is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With Meritage Homes now trading well below its recent highs and sitting at a notable discount to analysts’ price targets, the key question is whether there is hidden value waiting to be unlocked or if the current price already reflects all future growth potential.

Most Popular Narrative: 17.1% Undervalued

Compared to its last close of $69.62, the narrative’s fair value estimate of $84 suggests sizable upside remains. The stage is set for a closer look at the convictions supporting this positive valuation.

Meritage's significant and accelerating growth in community count, including double-digit expansion for both 2025 and 2026, directly addresses the persistent undersupply of housing in the U.S. This positions the company to capture increased new-home demand and drive future revenue and earnings growth as macro headwinds abate.

Curious about the math behind this bullish price? The key is a blend of aggressive growth ambitions, shifting market demographics, and a projected profit profile that breaks the industry mold. Unlock the full narrative to see exactly which hidden market forces and analyst forecasts are steering this valuation.

Result: Fair Value of $84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued affordability challenges or sudden shifts in buyer demand could quickly undermine the current optimism around Meritage Homes’ growth prospects.

Find out about the key risks to this Meritage Homes narrative.

Another View: What Does Our DCF Model Suggest?

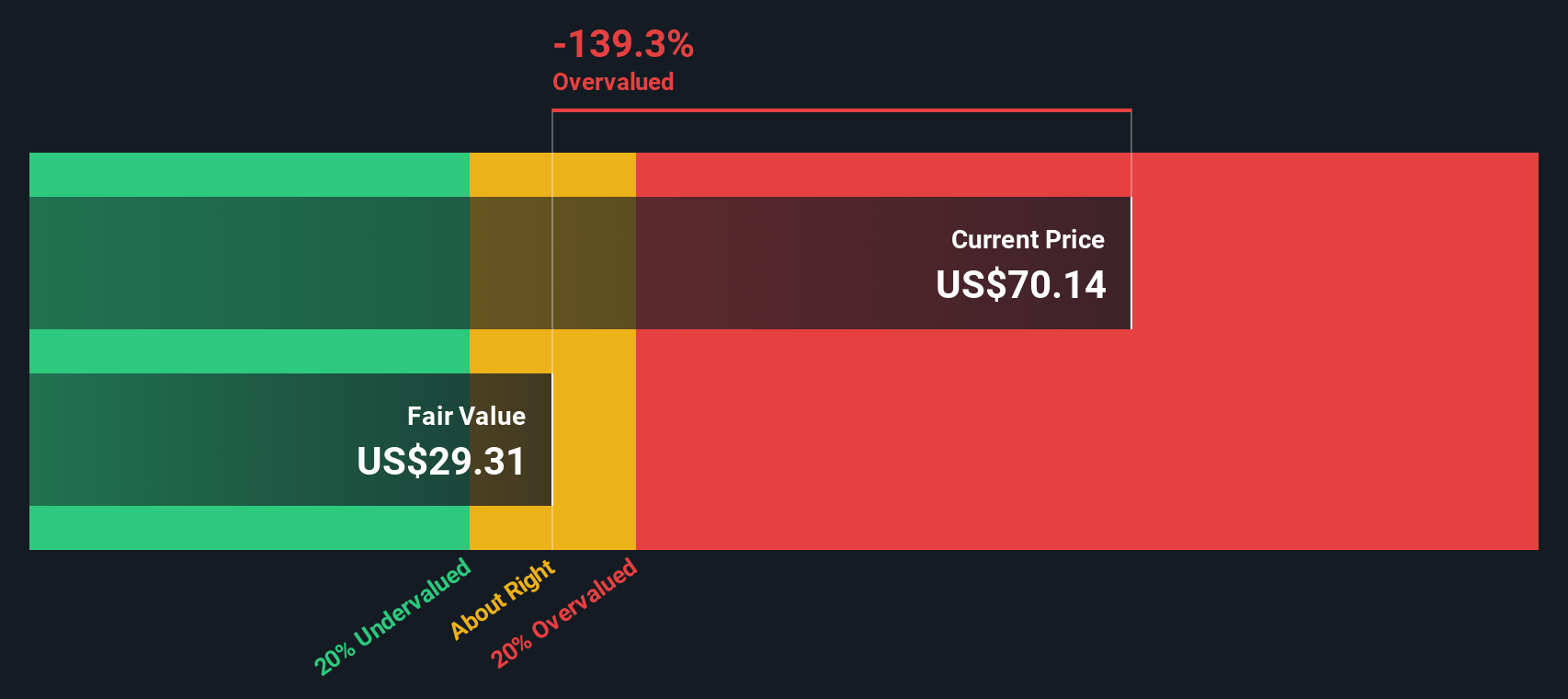

While the market sees Meritage Homes as undervalued based on analyst forecasts and price targets, our SWS DCF model takes a more conservative approach. According to our calculations, the current share price is actually well above what the discounted cash flow model suggests is fair value. This creates a tension between whether analysts are being too optimistic about future growth or if the DCF is missing something about the company’s potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meritage Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meritage Homes Narrative

If you see things differently or want to explore the numbers for yourself, you can build your own view using our easy tools in just a few minutes. Do it your way

A great starting point for your Meritage Homes research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t let your research stop here. Simply Wall Street’s powerful screeners reveal standout stocks you might otherwise overlook. Go beyond Meritage Homes and seize the potential in today’s market.

- Unearth bargain opportunities with these 875 undervalued stocks based on cash flows based on rigorous cash flow analysis, and take your portfolio to new heights before the crowd catches on.

- Capture passive income streams instantly by tapping into these 18 dividend stocks with yields > 3% offering strong yield and stability for long-term growth.

- Step into the future of innovation with these 24 AI penny stocks reshaping industries through artificial intelligence breakthroughs and relentless growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTH

Meritage Homes

Designs and builds single-family attached and detached homes in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives