- United States

- /

- Consumer Durables

- /

- NYSE:MHK

A Fresh Look at Mohawk Industries (MHK) Valuation After Outperforming Revenue and Operational Gains

Reviewed by Simply Wall St

If you own or are eyeing Mohawk Industries (MHK), the latest quarterly update brought a mix of headlines that could shape your next move. The company outperformed on revenue, surprising the market with a 2.2% beat over what analysts expected for the quarter. At the same time, earnings guidance for next quarter fell short of forecasts. Company leadership pointed to tighter cost controls and ongoing operational initiatives as key drivers. Management also acknowledged market headwinds that are still in play. Amidst this push and pull, Mohawk emerged with the most significant analyst beat among its peer set, making the post-earnings action tough to ignore.

The combination of exceeding revenue estimates and addressing operational challenges seemed to fuel renewed investor optimism, with Mohawk’s stock price climbing 16.7% since the report. That single event marks one of the strongest positive moves for the company this year, even against a volatile backdrop that saw shares dip by nearly 6% over the past twelve months. This momentum is a stark contrast to prior quarters and suggests that some investors are seeing the recent gains as signs of execution and recovery starting to materialize.

But after such a strong bounce, is Mohawk Industries undervalued or has the recent run priced in all the good news and growth potential already?

Most Popular Narrative: 2.6% Overvalued

According to the most widely followed narrative, Mohawk Industries is currently viewed as slightly overvalued, with its fair value estimated just below the current trading price.

"Strategic investments in sustainability, including product circularity, material optimization, and green energy, are positioning Mohawk to capture premium pricing and expanded margins as more customers seek environmentally friendly flooring solutions. Ongoing digital and operational transformation through technology upgrades, automation, and supply chain optimization is projected to improve operational efficiency and drive net margin enhancement over the long term."

Curious how bold bets on greener products, tech upgrades, and global expansion are factored into this valuation? This popular narrative is built on ambitious financial projections and a future profit ratio that challenges industry norms. What is the real formula behind the target price, and does the current price mirror the narrative’s optimism?

Result: Fair Value of $135.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pricing pressure and persistent softness in remodeling demand could challenge Mohawk’s ability to achieve these optimistic growth targets.

Find out about the key risks to this Mohawk Industries narrative.Another View: Discounted Cash Flow Analysis

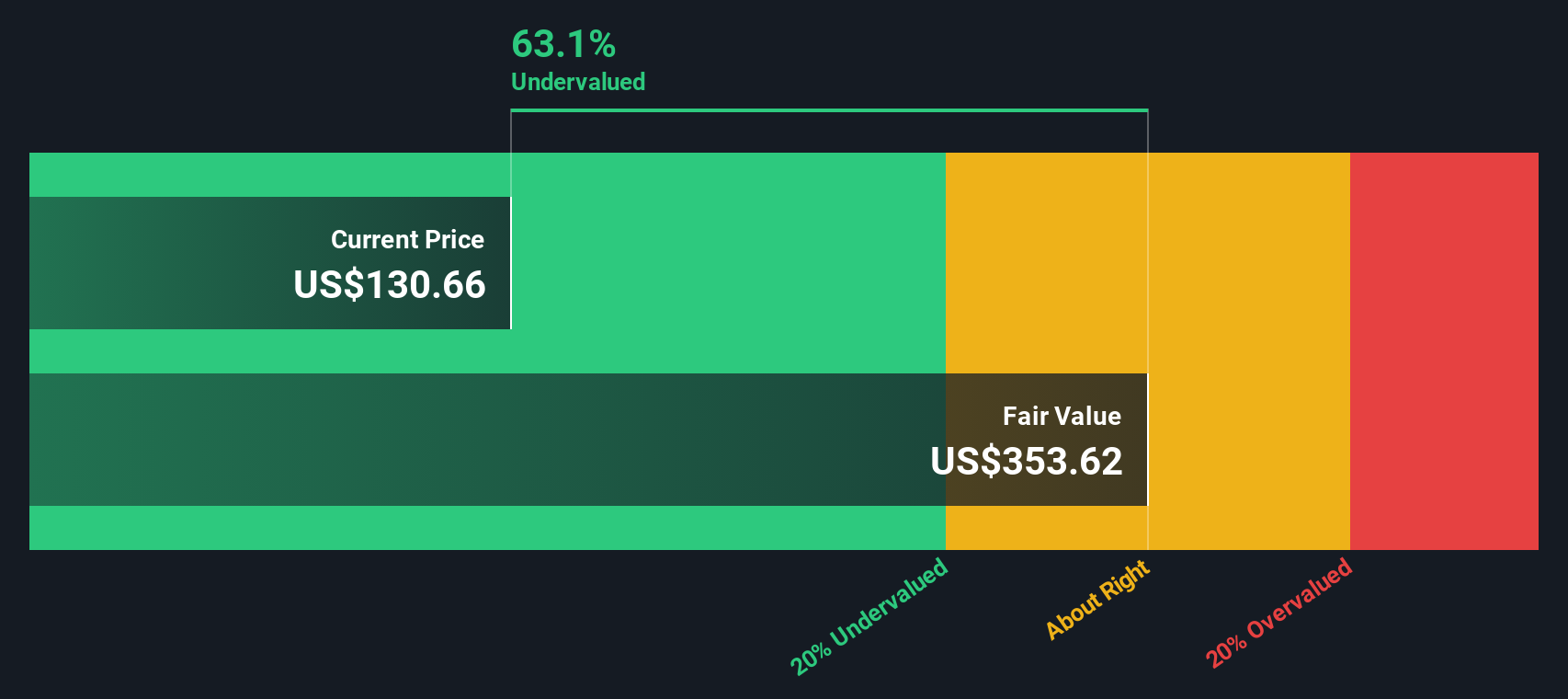

While analysts call Mohawk Industries slightly overvalued based on their profit expectations, our DCF model presents a sharply different picture and suggests shares trade well below their estimated fair value. Which perspective better captures today’s reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mohawk Industries Narrative

If you are looking to reach your own conclusions or want to see the numbers for yourself, building a personalized narrative takes just a few minutes. Do it your way.

A great starting point for your Mohawk Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let the best investing ideas pass you by when you can quickly spot unique opportunities that fit your goals and style. The Simply Wall Street Screener helps you act with confidence and uncover stocks making headlines for all the right reasons.

- Tap into generational wealth potential with promising up-and-comers. See which companies are setting the pace with penny stocks with strong financials.

- Catch the wave of innovation shaping healthcare with standouts in medical technology and artificial intelligence through healthcare AI stocks.

- Unlock hidden gems trading at attractive prices by using the power of undervalued stocks based on cash flows to reshape your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MHK

Mohawk Industries

Designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)