- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Why Lennar (LEN) Is Down 5.1% After Seaton Creek Amenity Center Grand Opening and What’s Next

Reviewed by Simply Wall St

- Lennar recently celebrated the grand opening of its new amenity center at Seaton Creek, a master-planned community in Jacksonville, Florida, offering residents expanded amenities such as a resort-style pool, fitness center, and clubhouse.

- This addition aims to enhance community appeal and could attract more homebuyers seeking upgraded amenities and a connected lifestyle.

- We'll assess how this expanded community offering at Seaton Creek may influence Lennar's broader investment outlook and growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Lennar Investment Narrative Recap

To be a Lennar shareholder, you have to believe in the long-term resilience of the US housing market and the company’s ability to drive volume and efficiency through new community offerings. The grand opening of Seaton Creek’s amenity center supports Lennar’s appeal to lifestyle-focused buyers, but as mortgage rates and consumer confidence remain in focus, this news does not fundamentally shift the current main catalysts or the key risks around margin pressures and demand uncertainty.

Among Lennar's recent announcements, the ongoing share repurchase program is most relevant, reflecting confidence in cash flow generation even as the company expands community amenities. Maintaining capital returns while investing in new developments aligns with the objective to support shareholder value and reinforce demand despite sector-wide challenges.

However, what could catch investors off guard is the potential for higher mortgage rates to impact demand and margins more than expected…

Read the full narrative on Lennar (it's free!)

Lennar's forecast projects $40.4 billion in revenue and $2.7 billion in earnings by 2028. This outlook is based on a 4.1% annual revenue growth rate, but a $1.0 billion decrease in earnings from $3.7 billion today.

Uncover how Lennar's forecasts yield a $136.40 fair value, a 25% upside to its current price.

Exploring Other Perspectives

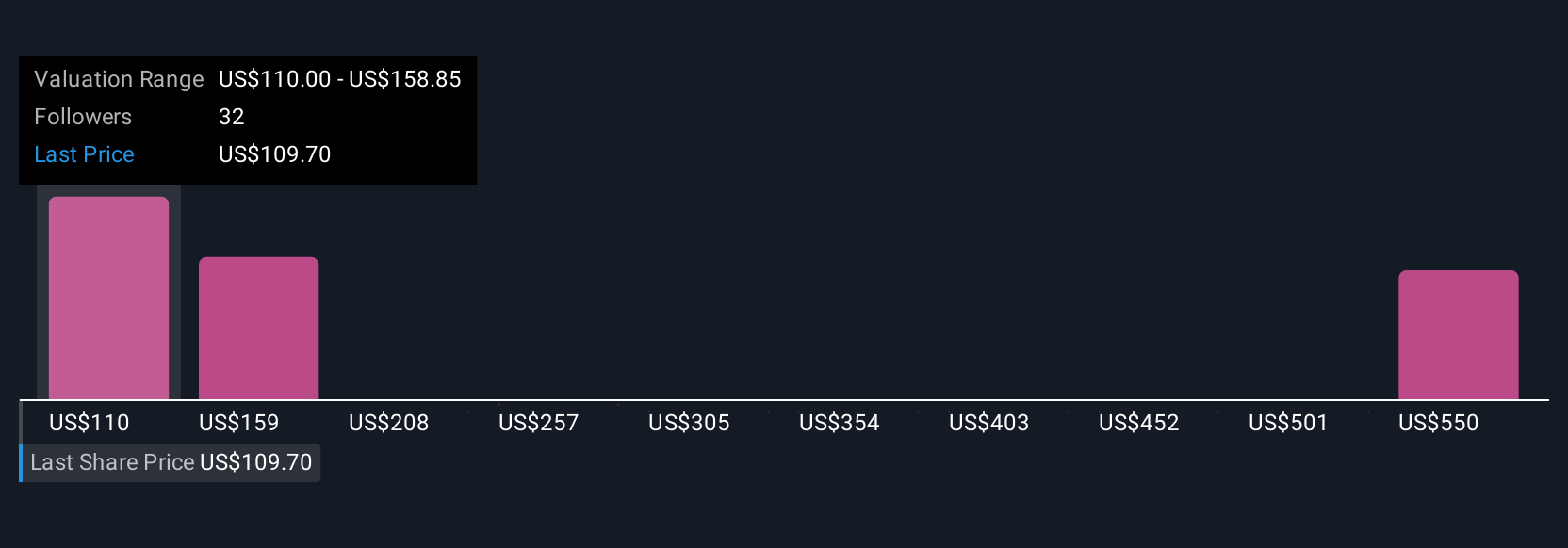

Seven members of the Simply Wall St Community estimate Lennar’s fair value between US$110 and US$598,320, highlighting an unusually wide spread of opinions. While some see the current focus on production efficiency as a reason for optimism, persistent risks around profitability could weigh on results ahead, so it pays to explore a range of viewpoints.

Explore 7 other fair value estimates on Lennar - why the stock might be worth just $110.00!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives