- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Lennar (LEN) Q4: Net Margin Drop to 6.1% Tests Asset‑Light Bull Case

Reviewed by Simply Wall St

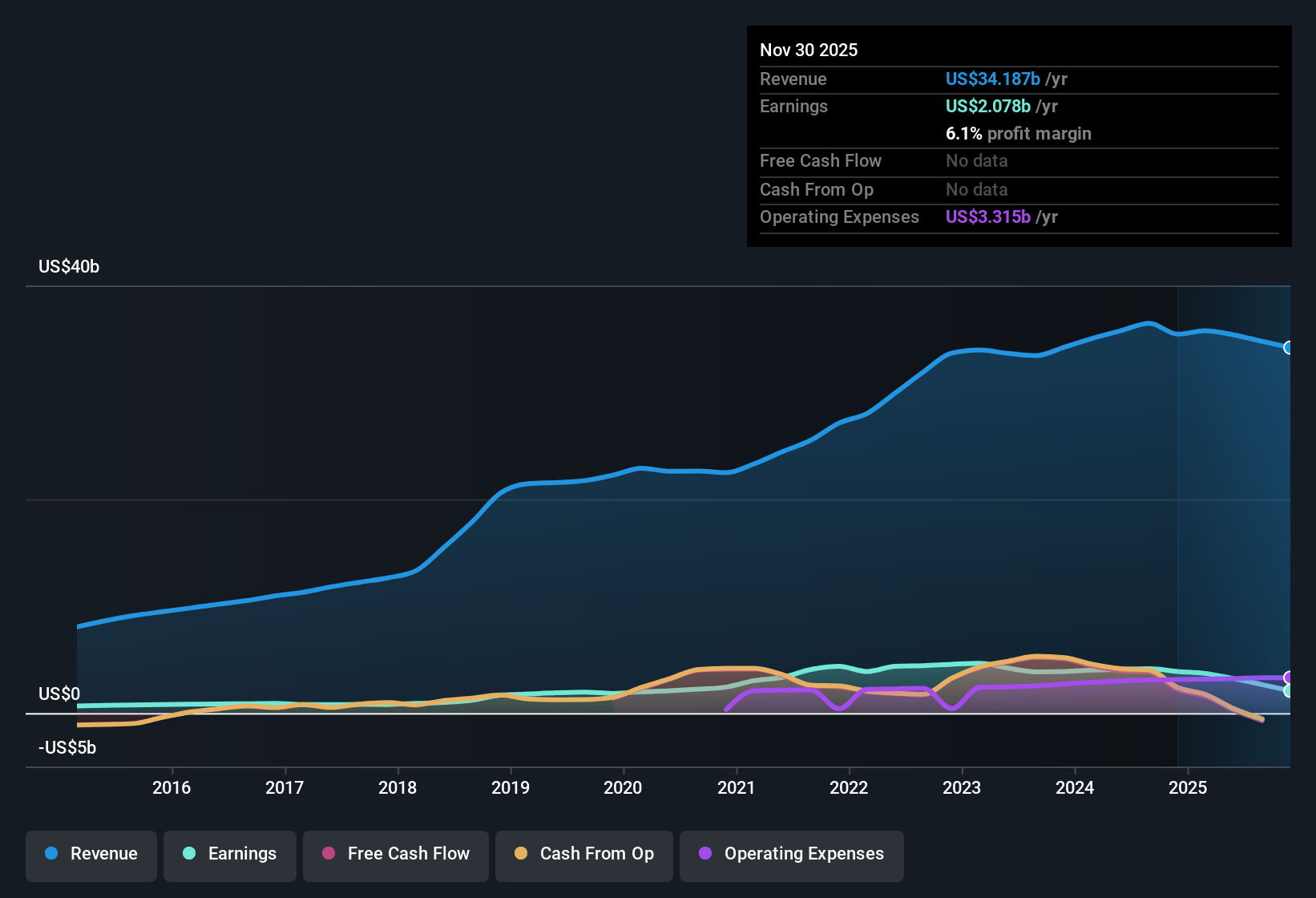

Lennar (LEN) has just wrapped up FY 2025 with fourth quarter revenue of about $9.4 billion and basic EPS of $1.94, setting the tone for a year in which trailing twelve month revenue came in at roughly $34.2 billion alongside EPS of $8.06. The company has seen quarterly revenue move from around $9.9 billion in Q4 2024 to $9.4 billion in Q4 2025, while basic EPS shifted from $4.06 to $1.94 over the same stretch, leaving investors focused on how much of that topline scale is now flowing through to the bottom line.

See our full analysis for Lennar.With the latest numbers on the table, the next step is to compare them with the major narratives around Lennar and determine which stories still hold up and where the conversation might need to shift as margins evolve.

See what the community is saying about Lennar

Net Margin Slides to 6.1%

- Trailing twelve month net income fell from about $3.9 billion to $2.1 billion as net margin narrowed from 11% to 6.1%, even though revenue only edged down from roughly $35.4 billion to $34.2 billion over the same window.

- Consensus narrative highlights Lennar’s push toward an asset light, land light model aimed at improving future margins. However, the current 6.1% net margin and the drop in trailing twelve month net income raise questions about how quickly those efficiency gains are appearing in the reported numbers.

- Analysts point to just in time production and better matching of build pace to sales as margin drivers, but the data so far still shows a multi percentage point margin compression versus last year.

- The strategy to keep volumes high with incentives is meant to protect future profitability. Even so, the present margin level underlines the trade off between sustaining sales and preserving per home profitability.

Revenue Growth Trails the Market

- Revenue is forecast to grow 6.4% per year, below both the US market revenue forecast of 10.5% and the company’s own recent twelve month revenue base of about $34.2 billion.

- Analysts’ consensus view that acquisitions and new market entries will support steady expansion is partly at odds with these mid single digit forecasts, which sit below broader market growth expectations.

- The acquisition of Rausch Coleman and added communities are expected to build volume. Even so, the 6.4% revenue growth outlook suggests a more measured climb than a high growth expansion story.

- Consensus also assumes constrained home supply should be a tailwind, but higher mortgage rates and softer consumer appetite highlighted in the narrative help explain why expected growth still lags the wider market.

Valuation Caught Between DCF and P/E

- At a share price of $112.23, Lennar trades below its DCF fair value of about $148.79, yet on 13.3 times earnings it still carries a higher P/E than both peers at 11.5 times and the broader US consumer durables industry at 10.7 times.

- Bulls argue that strong cash generation and capital returns justify a premium multiple, but the compressed 6.1% net margin and forecast 7.9% annual earnings growth leave a narrower foundation for paying more than peer and industry valuations.

- The gap between the $112.23 share price and the DCF fair value supports the bullish view that the market may be underpricing future cash flows despite softer recent profitability.

- At the same time, a 13.3 times P/E alongside weaker five year earnings trends than the market gives bears room to question whether Lennar should trade richer than its sector while margins are under pressure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lennar on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and think the story should shift? Turn that insight into a full narrative in minutes with Do it your way.

A great starting point for your Lennar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Lennar’s slipping net margins, slower forecast revenue growth than the broader market, and premium P/E versus peers suggest its risk reward profile is becoming less compelling.

If those trade offs give you pause, use our stable growth stocks screener (2094 results) to quickly focus on companies delivering steadier revenue growth and more consistent earnings momentum through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)