- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Lennar (LEN): Evaluating Fair Value as Investors Eye Shifting Housing Market Dynamics

Reviewed by Kshitija Bhandaru

See our latest analysis for Lennar.

Lennar’s share price has been treading water this year, reflecting uncertainty around housing demand and shifting mortgage rates. Meanwhile, muted 1-year total shareholder return highlights a wait-and-see approach from investors despite the company’s scale and market position.

If you’re interested in the broader landscape, now could be a great moment to expand your search and discover fast growing stocks with high insider ownership

With Lennar’s fundamentals mixed and its recent performance lagging peers, the big question now is whether the stock is trading at a bargain or if the market is already pricing in all the growth ahead.

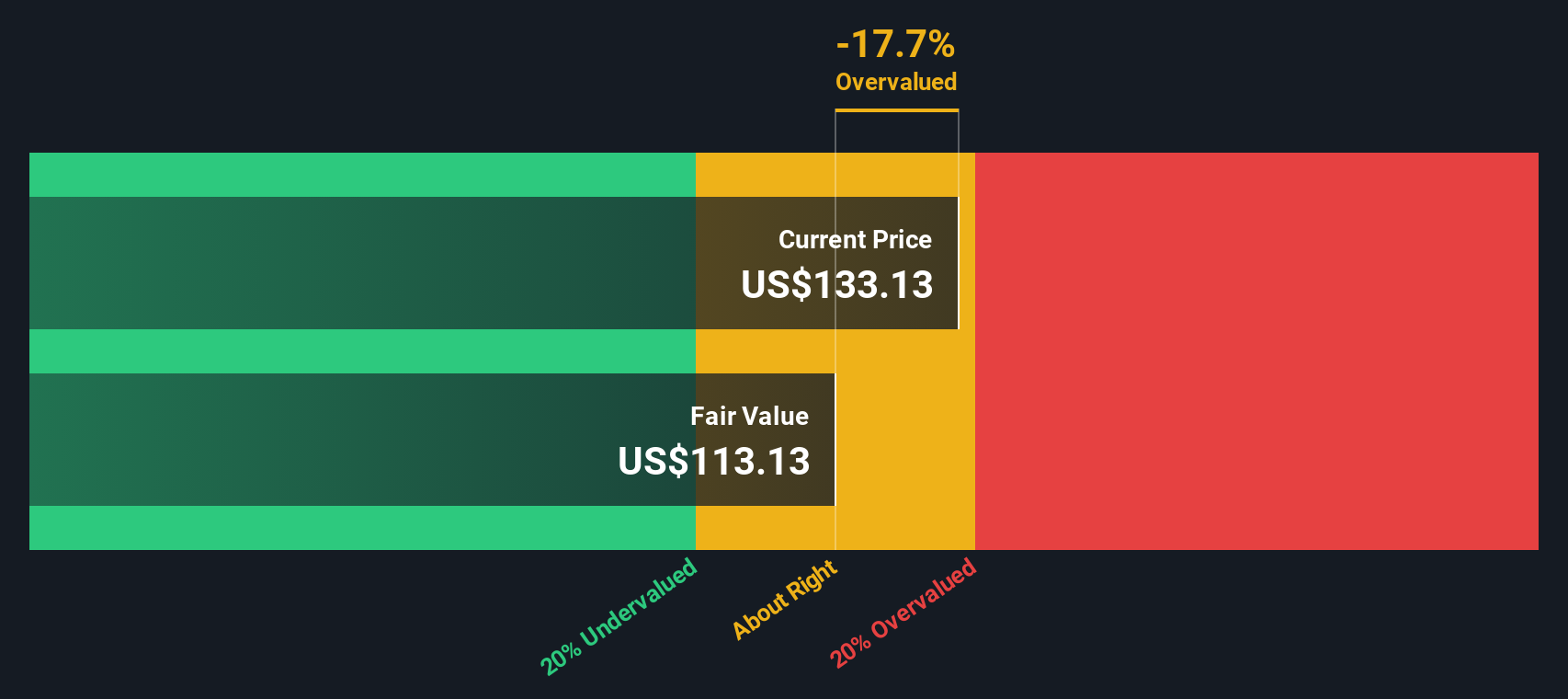

Most Popular Narrative: 2.3% Overvalued

The most followed narrative puts Lennar’s fair value slightly below its last close of $128.33. This suggests the stock may be priced a bit rich for its growth prospects given current analyst assumptions.

Analysts have a consensus price target of $124.0 for Lennar, based on their expectations regarding its future earnings growth, profit margins, and other risk factors. There is some disagreement among analysts, with the most bullish reporting a price target of $159.0 and the most bearish reporting a price target of just $95.0.

Want to know what really drives this valuation? There is a financial forecast at the heart of this narrative, focusing on where profits and revenue will land three years from now. Curious about the crucial assumptions analysts are including? Unlock the narrative to reveal the surprising leap of faith behind their price target.

Result: Fair Value of $125.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher mortgage rates or a prolonged dip in consumer confidence could challenge these optimistic forecasts and put additional pressure on Lennar's margins.

Find out about the key risks to this Lennar narrative.

Another View: Discounted Cash Flow Puts Lennar in a Different Light

While many analysts see Lennar as slightly overvalued, our SWS DCF model paints a more optimistic picture. Based on projected future cash flows, the model suggests Lennar is trading 16.3% below its fair value. This could indicate hidden potential that the market may have overlooked. Could this gap signal opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lennar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lennar Narrative

If the consensus does not fit your perspective, dive into the numbers yourself and build your own view of Lennar’s story in just minutes. Do it your way

A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip by while you wait on Lennar. Expand your horizons and zero in on top prospects from other fast-changing sectors and themes right now using these handpicked stock ideas:

- Unlock the potential of portfolio growth by seizing these 909 undervalued stocks based on cash flows with promising cash flows that might be flying under the market’s radar.

- Capitalize on the AI revolution by targeting these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and rapid innovation.

- Cement your passive income stream with these 19 dividend stocks with yields > 3%, offering attractive yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives