- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Did Warren Buffett’s Billion-Dollar Bet and Texas Expansion Just Shift Lennar’s (LEN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, famed investor Warren Buffett made headlines by investing over US$1 billion in Lennar, while Lennar also began selling homes in the River Bridge Ranch community near downtown San Marcos, Texas, offering 28 distinct home designs with extensive amenities at starting prices in the mid US$200,000s.

- Buffett’s investment, timed with Lennar’s expansion into high-demand Texas markets, shines a spotlight on the company’s appeal to value-focused investors seeking steady sector exposure amid changing housing conditions.

- We’ll examine how Warren Buffett’s significant backing could influence Lennar’s long-term investment case and sector positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Lennar Investment Narrative Recap

To own Lennar shares, investors must believe in the ongoing demand for housing and the company's ability to grow market share in key regions despite higher mortgage rates and softer earnings. While Warren Buffett’s large investment and the River Bridge Ranch launch draw attention to Lennar’s appeal, these developments do not materially change the most important near-term catalyst: Lennar’s push for volume growth via its asset-light model. The biggest risk remains margin pressure from elevated sales incentives and constrained affordability.

Among recent company announcements, the start of sales at River Bridge Ranch in San Marcos, Texas, is particularly relevant. This expansion into affordable, amenity-rich communities highlights Lennar’s effort to drive volume and maintain a steady sales pace, which ties directly to its strategy to overcome headwinds from higher interest rates and affordability challenges.

However, while Lennar’s expansion shows promise, investors should also recognize that constrained consumer confidence and affordability issues...

Read the full narrative on Lennar (it's free!)

Lennar's outlook anticipates $40.2 billion in revenue and $2.5 billion in earnings by 2028. This is based on a 4.3% annual revenue growth rate, but represents a decrease of $0.7 billion in earnings from the current level of $3.2 billion.

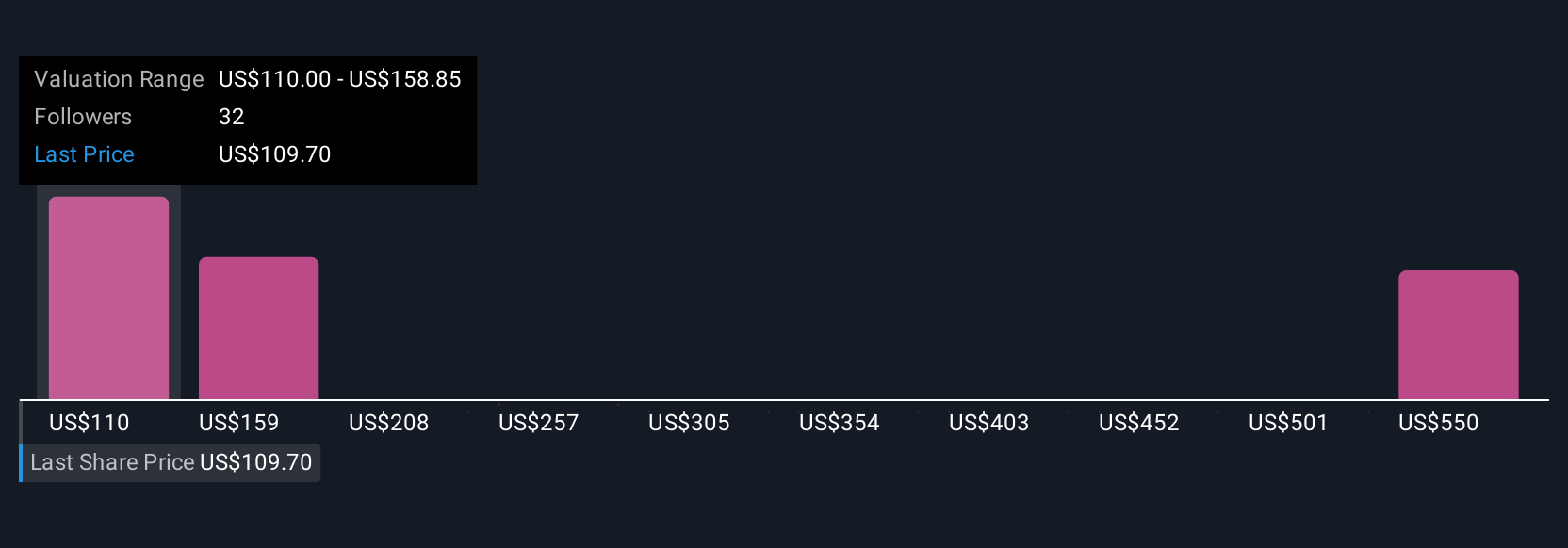

Uncover how Lennar's forecasts yield a $127.50 fair value, in line with its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community estimate Lennar’s fair value between US$81,664 and US$162,490, reflecting wide differences in growth expectations. Tight margins from elevated incentives are a key pressure point that could affect whether the company meets these forecasts, so consider all viewpoints when researching Lennar’s outlook.

Explore 7 other fair value estimates on Lennar - why the stock might be worth 36% less than the current price!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives